The number of bank branches scattered across the nation declined 11% over the year to 30 June 2023, according to new figures from the Australian Prudential Regulation Authority (APRA).

A total of 424 branches shut over that period, 122 of which were regional or remote.

There are now 2,027 bank branches in Australia’s major cities and 1,561 in its regional and remote areas.

Those figures are down from 3,335 and 2,359 respectively in 2017, marking a nationwide decline of 37% over the last five years.

A Senate inquiry into regional bank closures kicked off earlier this year, with a report expected by early December.

The leaders of each of the big four banks fronted the inquiry last month, all agreeing the way Australians conduct their banking business has shifted significantly in recent years.

The Australian Banking Association’s (ABA) 2023 member survey, which collected data from banks in May, found 98.9% of transactions through major banks are now made online or through an app.

Only 0.7% of transactions are made in branch while 0.4% are made over the phone or via chatbot.

“Once online, many customers have found the accessibility and the 24/7 availability of digital banking a very convenient way to bank,” ABA CEO Anna Bligh said.

“These digital shifts have also contributed to a dramatic reduction in the use of bank branches and a significant move to digital transactions.”

ABA’s most recent annual report also found customers affected by 98% of bank closures since 2017 have access to an alternative branch or a Bank@Post outlet within three kilometres of their original branch.

However, advocates for regional bank branches believe they should be declared an essential service.

“We know that the decisions on branch closures are made based on artificially low transaction numbers based only on over-the-counter transactions and they don’t count interactions that aren’t deposit or withdrawal transactions,” Finance Sector Union national secretary Julia Angrisano said.

“Unfortunately, these transactions are the ones that cannot be done anywhere but at a bank branch.”

“They range from identity checks to cries for help from the most vulnerable in the community impacted by violence or misadventure.

“It includes loan applications, opening new accounts for children, or community organisations.”

Shift to a cashless society ‘already well underway’

Meanwhile, RMIT associate professor of finance Dr Angel Zhong has declared that Australia is on track to ditch cash altogether.

“The shift towards a cashless society in Australia isn’t just a possibility, it’s already well underway,” she said via The Conversation.

Cash was used as payment in just 13% of transactions in 2022, compared to 70% in 2007, and the value of the nation’s ATM withdrawals has also fallen in recent years, the ABA found.

Additionally, online purchases now make up 81% of retail sales and the value of payments made through digital wallets has soared 12,300% since 2018 to more than $90 billion.

The Albanese Government moved to update legislation regulating payment systems to address the shifting environment last week.

The suggested updates include an expansion of the definition of ‘payment systems’ and ‘participants’ to include the likes of digital wallet and buy now, pay later (BNPL) providers.

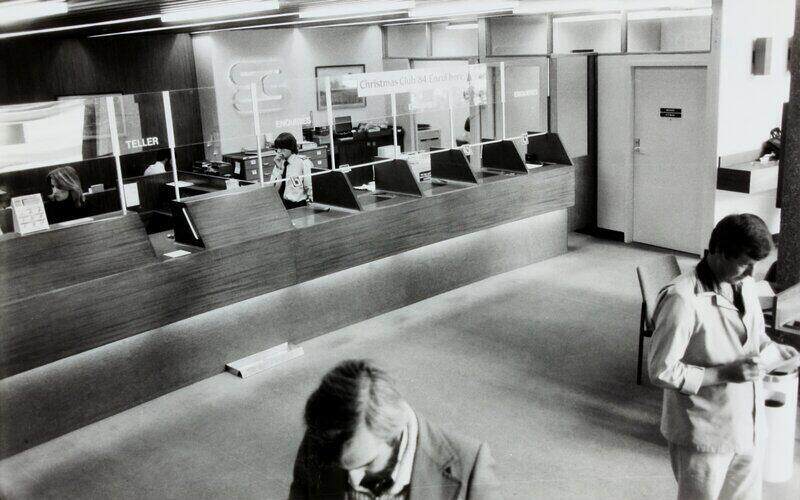

Image by Museums Victoria on Unsplash.

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy