The neobank has introduced a new 85% Loan to Value Ratio (LVR) tier for owner occupiers making principal and interest repayments, and waived Lenders Mortgage Insurance (LMI).

Typically, borrowers have to pay LMI if they have a deposit of less than 20%, which can add thousands to the upfront cost of buying a home.

Interest rates for the 85% LVR loans start from 2.04% p.a. for a one year fixed rate for the 'Own' home loan (comparison rate 2.96% p.a.*) and 2.54% p.a. for the 'Neat' variable rate home loan (comparison rate 2.55% p.a.*).

The main difference is that the 'Own' line comes with an offset account, as well as some other features.

UBank also has a 'no LMI' feature for its 85% LVR home loans, with both brands being NAB subsidiaries.

Borrowers can now also apply directly for an 86 400 home loan, rather than through a mortgage broker.

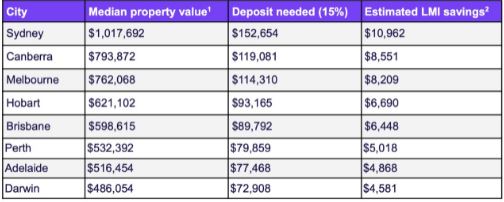

The table below shows how much 86 400 customers could save by not paying LMI if they had a 15% deposit, when purchasing a median value property in each capital city.

Source: 86 400

The lender also dropped rates on a range of its owner occupier and investment home loans by up to 25 basis points.

Some of the changes include:

- The 'Own' three-year fixed-rate home loan rate was reduced by 14 basis points to 1.85% p.a. (comparison rate 2.55% p.a.*) for borrowers with an LVR of 80%.

- The 'Neat' variable home loan rate was reduced by 10 basis points to 2.09% p.a. (2.10% p.a. comparison rate*) for borrowers with an LVR of 60%.

Travis Tyler, Chief Product & Marketing Officer at 86 400, said waiving LMI could shave thousands of dollars off the potential cost of a property.

"We know how tough it can be to break into the housing market and get ahead on your loan, so we’re helping home buyers get on the financial fast-track with smaller deposits or equity and very competitive rates," Mr Tyler said.

The new 86 400 can be used in conjunction with its $2,000 cashback offer, available for purchases and refinances of at least $250,000 until 30 September.

Touting itself as "Australia's first smartbank", 86 400 states borrowers can apply online in as little as 15 minutes and get approval in 24 hours.

The lender first launched home loans in November 2019 and currently has $775 million in mortgages settled and awaiting settlement.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury

Rachel Horan

Rachel Horan