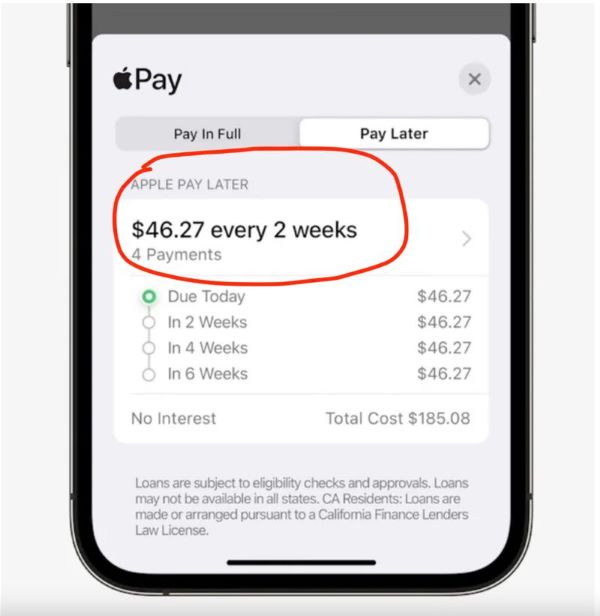

Like other providers, Apply Pay Later will allow customers to split payments into four interest free instalments over six weeks.

When customers make an Apple Pay purchase, they'll get the option to split the cost, with payment information being available in the Apple Wallet.

Apple Pay Later will be available on any purchases made using Apple Pay in stores and online.

The news comes two weeks after NAB became the last of the big four banks to offer its own BNPL service.

Grant Halverson, payments expert and former Diners Club and Citi executive, said delivery through a mobile wallet is very easy and persuasive for Apple customers.

"This is a fintech BNPL app's worst nightmare. It will cut off spending on standalone apps," Mr Halverson told Savings.com.au.

"These start-ups face a powerful new competitor in Apple with over 500 million mobile wallets globally."

The rise of big players in the industry means fintechs such as Zip could struggle in the space.

"Zip - Australia's leading BNPL - was once a unicorn valued at $7.7 billion [market cap]; today it's half a unicorn worth $470 million - the stock market is sending a very clear message," he said.

"Zip shares are trading as low as 67 cents, not seen since 2018."

Mr Halverson also said looming regulations could trouble the challengers rather than the incumbents.

"It's a total myth that ... BNPL is somehow a totally new industry - it's not; it's simply a regulatory arbitrage which has now attracted big competitors," he said.

"Australia has six fully regulated BNPL providers who can withstand Apple - banks know who uses BNPL in their customer bases and can target them.

"Australia has nine BNPL public ASX stocks, 18 non public start-ups and 14 copycat executions taking advantage of a legal loophole."

The regulated players include ANZ's Visa instalments option, CBA's StepPay, NAB's new offer, Citibank's SpotPay (acquired by NAB), LatitudePay, Paypal Pay in 4, and Suncorp's Visa instalments option.

Apple instalments option, via Grant Halverson

Advertisement

In the market for a personal loan? The table below features unsecured personal loans with some of the lowest interest rates on the market.

| Lender | Car Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Interest Type | Secured Type | Early Exit Fee | Ongoing Fee | Upfront Fee | Total Repayment | Early Repayment | Instant Approval | Online Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.28% p.a. | 6.28% p.a. | $389 | Fixed | Unsecured | – | $0 | $0 | $23,356 |

| Promoted | Disclosure | ||||||||

5.76% p.a. | 5.76% p.a. | $384 | Fixed | Unsecured | $0 | $0 | $275 | $23,066 |

| Promoted | Disclosure | ||||||||

6.45% p.a. | 6.45% p.a. | $391 | Fixed | Unsecured | $0 | $0 | $0 | $23,451 |

Image by Bangyu Wang via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper

Jacob Cocciolone

Jacob Cocciolone