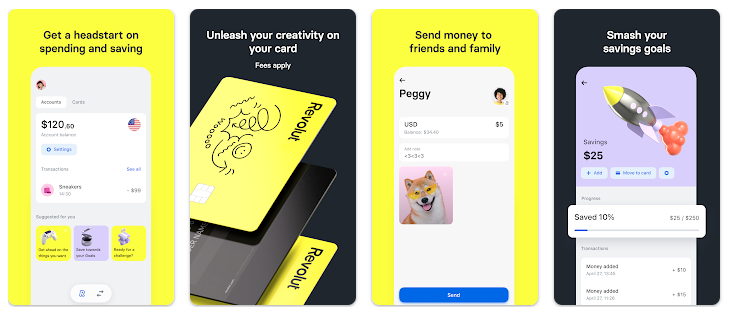

Since landing on Australian shores in 2020, Revolut has become an all-in-one platform for over 100,000 Aussie adults looking to make payments, exchange currency and invest in stocks, crypto and commodities. Fast-forward three years, Revolut <18 (previously Revolut Junior) aims to place generation-next on a path to achieve financial success.

Revolut <18 at a glance

- Revolut <18 comes with its ‘own’ digital money account and card.

- Available for young Aussies aged 6-17, managed and controlled by parents or legal guardians.

- Parents can monitor their child’s activity, set limits on transaction amounts, receive real-time notifications and even block their child’s card.

- Revolut <18 ‘Standard’ plan is free, ‘Premium’ costs $9.99 per month and ‘Metal’ costs $24.99 per month.

What is Revolut <18?

Speaking to Savings.com.au, Charlie Short, Head of Growth for Revolut APAC said Revolut <18 teaches children how to achieve financial success in a safe and controlled environment.

“The product enables children aged 6-17 (although they can use it until they turn 19) to have their 'own' digital money account and card, which can be managed and controlled by their parents or legal guardians,” Mr Short said.

“With a Revolut <18 account, children can learn how to manage, save and spend their money, while parents can monitor their activity and set limits on their transaction amounts.”

To keep an eye on their child’s spending habits and avoid one-too-many after school Maccas trips, Mr Short said parents can elect to receive real-time notifications of their child’s transactions and can block their child’s card if necessary.

For more on Revolut and Revolut <18, head to Revolut’s website here.

How does Revolut <18 work?

Setting up

Like most financial products for children, a parent or legal guardian is required to set up the account for their child. However, the parent must also be a Revolut customer in order to open a Revolut <18 account.

“The parent or legal guardian can create a Revolut <18 account for their child using their own Revolut app,” Mr Short said.

“They will need to provide some basic information about their child, such as their name and date of birth, and will need to verify their own identity. All information shared is protected by Revolut.”

Managing the account

From there, Mr Short notes parents or legal guardians can manage the child’s account.

“The parent or legal guardian has ultimate control over the child's account and can manage it from their own Revolut app,” he said.

“They can set up allowances, view their child's transactions, and block the child's card if necessary.”

Revolut <18 allows parents or legal guardians to enable or disable swipe payments, contactless payments, online transactions and ATM withdrawals with children unable to change these settings from within the Revolut <18 app.

Given each family has different circumstances, Revolut allows the ‘lead’ parent in charge of the initial set-up and management of the account to add a co-parent to coordinate managing the <18 account together.

To assign a co-parent, open the Revolut app, head to the ‘<18 Tab’ and select the account you want to add a co-parent to (if you have more than one linked <18 account). Scroll down to the ‘Parents’ section and select the option to ‘Add a Co-parent’.

Co-parents can be removed at any time under the ‘Parents’ section of the Revolut <18 account by selecting the ‘Remove’ option.

Revolut notes only one co-parent can be assigned at a time, up to maximum of three times per calendar year.

Using the Revolut <18 card

Mr Short said once a child receives their own Revolut <18 card, they can use this card to make payments or withdraw cash.

“The card can be used anywhere that accepts Mastercard or Visa, subject to any spending limits or restrictions set by the parent or legal guardian,” he said.

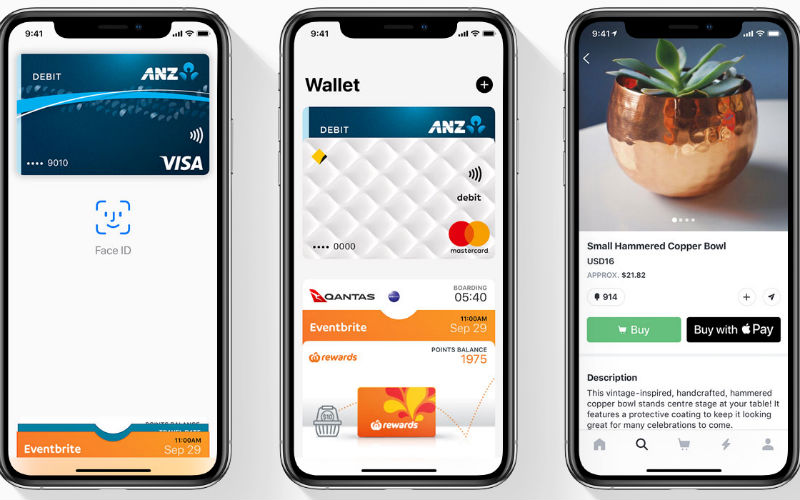

The Revolut <18 card can be linked to both Apple Pay on Apple devices and Google Pay on Google and Android devices.

Activation of the Revolut <18 card can be completed through a PIN transaction in a shop or at an ATM.

Once completed, this will automatically activate contactless and online payment for the Revolut <18 card.

Monitoring spending

“The parent or legal guardian can view their child's transactions in real-time and receive notifications whenever their child makes a purchase,” Mr Short said.

“This allows them to monitor their child's spending and help them learn how to manage their money responsibly.

“It also enables them to instantly block the card or account if ever there is an urgent need.”

Why open a Revolut <18 account for your child?

Mr Short said Revolut <18’s strongest advantage is its safety and security features, user-experience, digital-first approach and the low associated usage and sign up fees.

“Revolut <18 is a tool that enables parents to teach their children about financial management while giving them a level of independence,” he said.

“There are few other financial institutions in Australia that offer money products specifically for under 18s. For example, traditional banks may offer kids savings accounts, but these are often limited in terms of features and accessibility.

“Other neobanks in Australia may offer features for children, but may not have the same level of parental control and oversight that Revolut <18 provides.

“Revolut <18 app also provides educational tools and resources that can help children learn about financial literacy and money management skills, which can give them a strong foundation for financial success later in life.

“Additionally, Revolut's global reach and low fees for international transactions are perfect for any parents with children on exchange or visiting relatives overseas.”

Revolut <18 fees and features

Sign-up

To take advantage of Revolut <18, there is no sign-up or set-up fee, yet the Revolut <18 account needs to be linked to an existing Revolut retail account.

Revolut notes financial goals and challenges are only available to you if your parent or guardian is a Premium or Metal subscriber.

|

Feature |

Standard (Free) |

Premium ($9.99 per month) |

Metal ($24.99 per month) |

|---|---|---|---|

|

Number of accounts |

1 |

2 |

5 |

|

Card delivery |

First card free, then $8.99 per card |

First and second card free, then $24.99 per card |

First and second card free, then $24.99 per card |

|

Features available |

Basic account features |

Weekly allowance measuring Financial goals Challenges |

Weekly allowance measuring Financial goals Challenges |

Transaction Fees

Mr Short notes the use of Revolut <18 is subject to the same fees as standard Revolut retail accounts, other than the following exceptions:

-

Revolut <18 Card Exchange Allowance: For Revolut <18 Card transactions made in a currency other than AUD, the allowance is A$450 per monthly billing cycle (the Revolut <18 Card Exchange Allowance). For transactions that exceed the Revolut <18 Card Exchange Allowance, a 0.5% fee will apply.

-

ATM withdrawals: Free on each individual Revolut <18 card up to A$70 per rolling month. After that, a 2% fee applies.

-

Top-up limit: Standard users also have a monthly top up limit applied, currently set at $7,000.

Revolut <18 account eligibility

To open a Revolut <18 account for a child aged 14 or under, a parent or guardian will need to create an account from within their Revolut app.

Teens aged 15 and above can create an account on their own with parent or guardian approval.

Further, Mr Short noted both payments and referrals to and from customers on Revolut <18 are only available to teens aged 15 and over.

Savings.com.au’s two cents

Revolut <18 offers a unique solution for Revolut customers looking to help their children make the best start to their financial future. Not only can parents or guardians manage their child’s account, they have the ability to set up allowances, view their child's transactions, and block the child's card if spending becomes excessive or problems arise.

It’s important to note Revolut <18 is a transaction account product, meaning no savings rate is offered for Revolut customers looking to potentially store savings away for their child. Some savings account products for children currently offer a rate of 5% or higher, meaning the flexibility of Revolut’s <18 product must be weighed against the potential for returns from other banks. Revolut is also not a bank, however the electronic money in your Revolut and Revolut <18 account is protected by a bank guarantee. This means that in the event that Revolut is found to be in breach of any obligation, your money is protected. As with all financial products, do your research before determining whether Revolut’s <18 product is the right start to your child’s financial future.

Images supplied

William Jolly

William Jolly

Denise Raward

Denise Raward