Domain’s First-Home Buyers report released Wednesday revealed Australian couples aged 25-34 are having to stash away their cash for an extra 11 months to reach the 20% deposit milestone for an entry-priced house across capital cities.

The report highlights over the past decade house prices across the combined capitals increased by 101%, and unit prices by 52%.

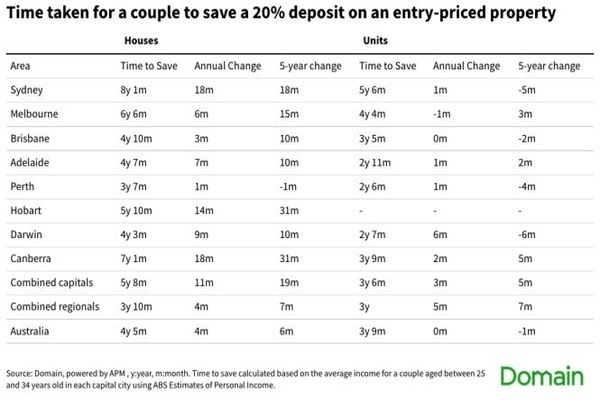

To meet this sharp rise in house prices, it now takes young couples an average of five years and eight months to save a 20% deposit across all capitals.

For Sydneysiders, the median prices for a house sits at a record $1.6 million - it's $800,000 for units.

As a result, Sydney continues its reign as the city with the longest period to save an entry priced house deposit at eight years and one month.

The report highlights Perth remains as the city with the quickest savings period of three years and seven months for an entry-house - less than half of the time taken in Sydney.

Domain’s Chief of Research and Economics Dr Nicola Powell said first home buyers are facing a growing financial hurdle when it comes to saving a deposit.

“This is becoming more daunting in the context of rising living costs, low wage growth, weak saving rates and the rapid rise in property prices,” Dr Powell said.

“Government incentives such as the First Home Loan Deposit Scheme or the First Home Super Saver Scheme, which allows prospective first-home buyers to make additional superannuation contributions that are later accessible for a first home deposit, can be advantageous to shave years off the time it takes to save for an entry-priced deposit.”

Gap between house and unit deposits widens

The difference between saving for an entry-house or unit is continuing to widen, with the report noting across capital cities purchasing a unit may result in buying a first home two years and two months earlier than a house.

Canberra topped the list, resulting in an additional three years and four months to save for an entry-level house as opposed to an entry-level unit.

Further, Sydney and Melbourne rounded out the top three, with an additional two years and seven months and two years and two months respectively.

Recently, CoreLogic revealed the divide between Australia's house and unit prices reached a record high of 28.3% in January.

Could super be the solution to first home deposit woes?

On Friday, a House of Representatives Inquiry into housing affordability and supply put forward the recommendation of utilising super as security to overcome deposit hurdles.

Chair of the Inquiry Jason Falinski MP said inquiry after inquiry has found ownership of your home to be the single biggest factor in determining financial security.

"Thee biggest impediment to gaining entry into the housing market is the deposit, and using superannuation as collateral could ease that pressure," Mr Falinski told Savings.com.au.

CoreLogic Research Director Tim Lawless said superannuation savings for individuals over 30 years old are on average upwards of $35,000 with the amount of savings rising with age.

"Although that amount wouldn’t come close to covering a 20% deposit in most cities, it would provide some first home buyers with a substantial head start in accessing the market," Mr Lawless said.

"The risk here is that access to superannuation would boost demand, driving prices higher and doing little to combat the underlying issue of housing affordability, unless the scheme was accompanied by a commensurate addition to housing supply – which is a key principal of the inquiry’s recommendation."

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by This is Zun via Pexels

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Alex Brewster

Alex Brewster

Emma Duffy

Emma Duffy