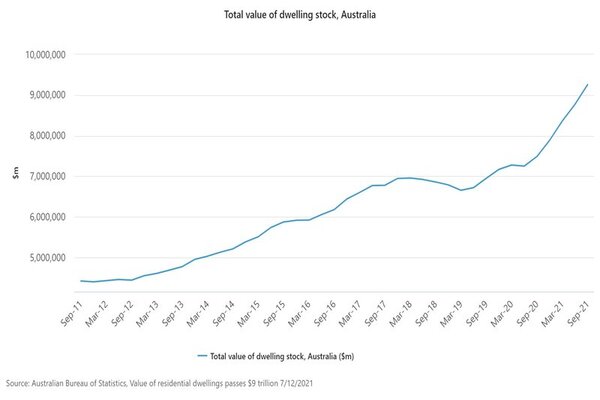

Aussie homeowners are reaping the rewards of a hot property market, with Australia’s 10.7 million residential dwellings rising $487.0 billion in value to $9,259.2 trillion according to figures released today by the Australian Bureau of Statistics (ABS).

New South Wales accounted for 40%, or $3.7 trillion of Australia's total value of dwellings with the average price of residential dwellings in NSW rising to a record level of $1.1 million.

The data released by the ABS covering the September quarter for 2021, highlighted the mean price of residential dwellings in Australia has risen to $863,700, up from $821,700 in the June quarter.

Head of Prices Statistics at the ABS, Michelle Marquardt, said the value of Australia's dwelling stock has risen by nearly $1 trillion in the past six months.

"By comparison, the previous increase of just over $1 trillion took 15 months, rising from $7.2 trillion in the December quarter 2019 to $8.4 trillion in the March quarter 2021," Ms Marquardt said.

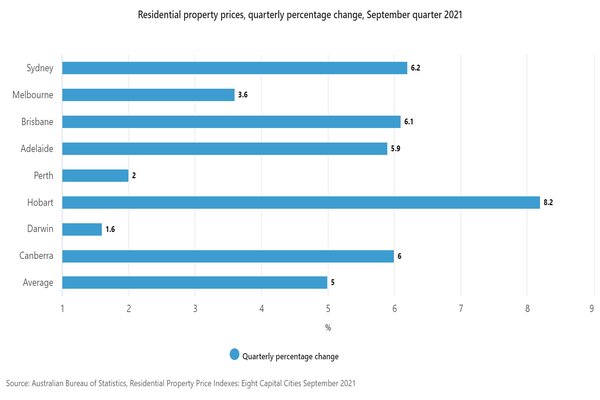

Annually, ABS data highlights residential property prices rose 21.7% - the strongest annual growth since the Residential Property Price Index series commenced in the September quarter 2003.

Further, ABS noted rises in residential property prices across all capital cities over the past 12 months to the September quarter 2021:

- Hobart (+25.7%), Sydney (+25.4%) and Canberra (+25.2%) each had their largest annual rise since the series commenced.

- Perth (+15.7%) had the largest annual rise since the March quarter 2007.

- Brisbane (+19.7%) and Adelaide (+19.0%) each had their largest annual rise since the March quarter 2008.

- Darwin (+13.7%) had the largest annual rise since the March quarter 2010.

- Melbourne (+19.5%) had the largest annual rise since the June quarter 2010.

Ms Marquardt said the September quarter results were consistent with housing market conditions.

"Continued solid growth in residential property prices was supported by record low interest rates, strong demand and low levels of stock on the market," Ms Marquardt said.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Ralph Kelly via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Alex Brewster

Alex Brewster

Harrison Astbury

Harrison Astbury