Via the CommBank app and Netbank, customers can check their personal credit score free of charge from November 2022.

The bank has partnered with Credit Savvy and Experian to offer eligible digitally active CommBank customers access to the feature.

The purpose of the credit score hub is to help customers improve their financial wellbeing and provide further transparency.

This comes as new CommBank data revealed only one-in-five Aussies have checked their personal credit score in the past six months.

A third of the respondents were unsure what a credit score even was or have never heard the term before.

Marcos Meneguzzo, CBA’s Executive General Manager Consumer Finance, said the credit score is a timely feature helping customers understand their credit profile.

“The new credit score hub makes it easy for customers to monitor their credit file and understand the drivers impacting their score, quickly and easily from the palm of their hand,” Mr Meneguzzo said.

“It’s another tool we’re adding into the CommBank app and NetBank that customers can use to help improve their financial wellbeing and make smarter financial decisions.”

Key features of the CommBank credit score hub:

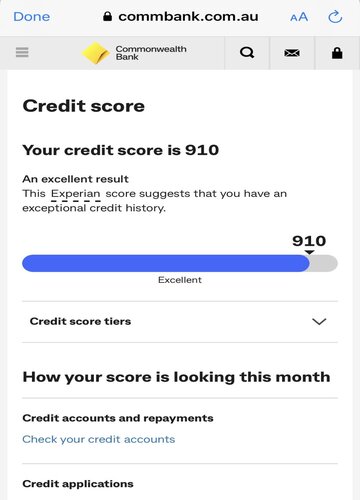

- Provides customers with their individual credit score and tier

- Reports negative credit events

- Provides customers with information about credit applications

- Notifies customers about credit accounts and repayments over the last 12 months

Mr Meneguzzo said he wants to reassure customers that checking your score does not impact it negatively.

“In fact, knowing your credit score can better empower customers to understand their overall credit worthiness and take steps to improve it,” he said.

“In addition, they can monitor their score and credit applications to protect themselves from fraud and scams.”

Read More: Tips to improve your credit score

Image by Dylan Gillis via Unsplash

Denise Raward

Denise Raward

Harrison Astbury

Harrison Astbury

Emma Duffy

Emma Duffy