Getting a HECS/HELP loan to attend university could mean you can't afford food, medical treatment and might still owe tens of thousands of dollars in your sixties.

That's according to a report by Futurity Investment Group, entitled The Financial and Social Impact of the Cost of University Education.

Based on a survey of over 1,000 people who have attended university, the report laid bare how the cost of university is holding back Australians.

A majority (59%) believe their student debt has impacted their ability to purchase a home, while 49% say the same about a car.

The report also showed that HECS related pressure has seen a number of people are foregoing the most basic of necessities, with 18% cutting back on food and 16% saying they were unable to afford medical or dental treatment.

It's perhaps unsurprising then that an estimated 68% of people are uncomfortable with their level of student debt, while 23% of women and 13% of men do not feel in control of their financial situation.

The ATO has reported that it takes 9.4 years on average to repay HECS/HELP debt, compared to 8.2 in 2012, and that Australia currently has nearly $66.4 billion worth of student debt.

Just over half, 58%, of respondents agreed with the statement "the benefits of pursuing my higher education outweigh the costs of HECS/HELP debt acquired at university".

Student debt is indexed to inflation, meaning the amount owed increases yearly.

It's a situation that could be exacerbated later this year when outstanding student debt will indexed to the inflation figures for preceding two years, which could mean debts increase by 7% or more.

The more it's indexed to inflation, the less time in the next financial year students dedicate to paying off their initial principal amount.

How much student debt does Australia have?

According to the report, the average HECS/HELP balance is $22,636.

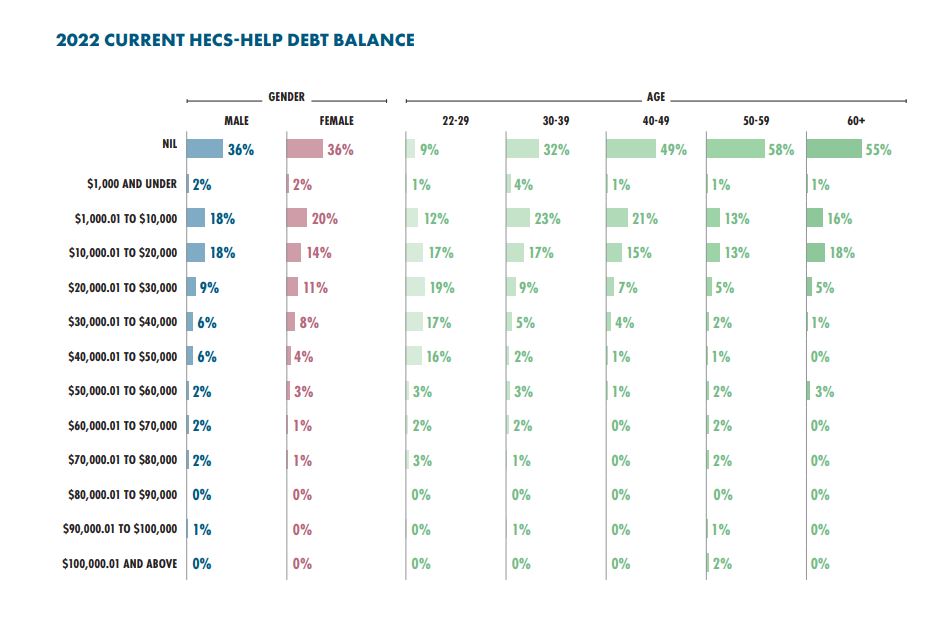

Three out of every five respondents aged between 22 and 29 had a debt that exceeded $20,000, while 51% of those between 40 and 49 still had outstanding debt.

According to the ATO, there are currently 1,487,351 Australians with a debt over $20,000, 293,201 whose debt exceeds $50,000, while 35,481 people currently owe over $100,000.

Nearly half (45%) of respondents over 60 years old owed at least some outstanding repayments, although it's worth remembering some of these people will have attended university later in life.

The ATO has reported that 155,370 Australians aged over 60 collectively have nearly $1.7 billion worth of HECS/HELP debt.

How students are held back

How students are held back

A majority of respondents reported that their student debt has had some effect on their ability to purchase a home, while 49% said the same about buying a car.

A further third (33%) of respondents said that their ability to start a business had been impacted by HECS-HELP debt.

Marriage was also affected, with 28% of men and 14% of women saying that their debts had hindered their ability to get married.

What are the solutions?

The report contained no recommendations, but included a series of suggestions from those who have experienced HECS/HELP debt for how the system could be improved.

1. The salary threshold should be raised

Until the borrower is earning above $48,361, they are not required to make any HECS/HELP repayments.

As their salary increases, a higher percentage of their earnings goes towards their debts.

2. Incentives to make voluntary payments

The above rates are mandatory for those with student debts.

Many though choose to make voluntary contributions to bring down the amount they owe.

Even small contributions can be hugely beneficial, since indexation means that amount would have likely grown each year it remained outstanding.

Some respondents believe that more incentives, like students being able to get some money back after making voluntary payments, would be a good way to alleviate pressure down the track.

3. Better education about the HECS-HELP system

A common theme among the respondents' comments was calls for potential students to be better informed about the implications of their loan.

Many who start at university will be unfamiliar with how indexation works, when they will be required to repay their loan and the importance of voluntary contributions.

Many respondents also wished they were advised more on trades and vocational skills.

Picture by Brett Jordan on Unsplash

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan