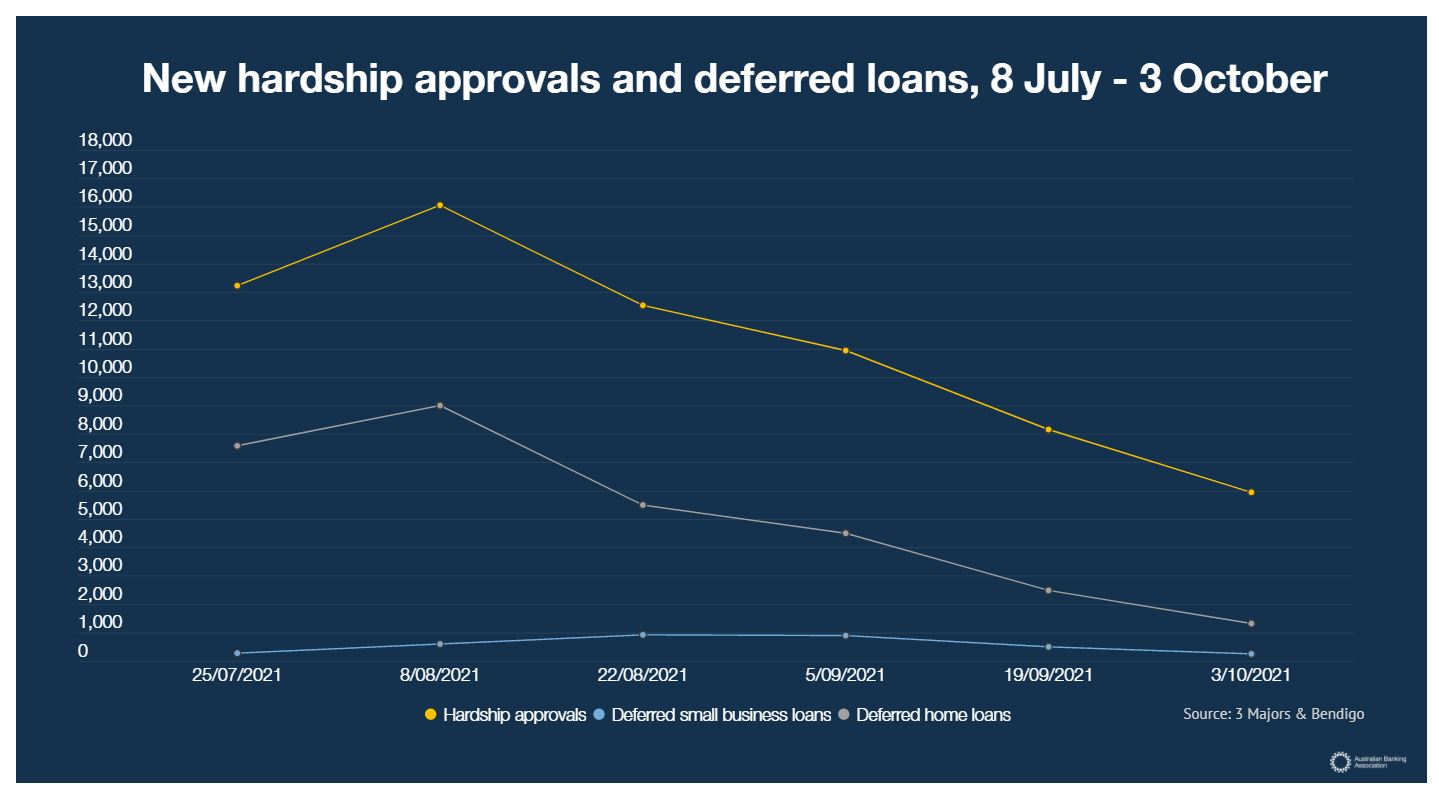

Almost 69,000 Aussies have received hardship assistance since 8 July this year, including more than 27,000 home loan deferrals and more than 4,000 business loan deferrals.

Comparatively, this is just 12,000 more hardship assistance approvals since last month, the smallest increase since the banking industry announced a second COVID-19 package of assistance in July this year.

ABA data was collected from three major banks as well as Bendigo Bank.

This comes as welcome news after APRA data showed there was $11.9 billion worth of loans deferred at the end of August - up from $5.6 billion in July.

However, this pales in comparison to mid-2020 when upwards of one in ten residential home loans were deferred, amounting to $195 billion.

Source: ABA

ABA chief Anna Bligh said while the data shows people still require assistance, it is reassuring to see people are getting back on their feet.

"Banks have been on-hand to assist their customers throughout the pandemic, however it’s heartening to see the need for assistance declining as many States and Territories come out of lockdown and as borders begin to open," Ms Bligh said.

"The majority of hardship approvals came from customers in NSW and Victoria, which is obviously no surprise given the recent lockdowns, however we did see thousands of customers across the rest of Australia seek support and talk to their bank."

Outstanding hardship and deferred loans.

| Hardship approvals | Deferred business loans | Deferred home loans | |

| ACT | 1,085 | 59 | 372 |

| NSW | 35,972 | 2,859 | 17,993 |

| NT | 309 | 6 | 36 |

| QLD | 7,937 | 231 | 1,511 |

| SA | 2,503 | 47 | 515 |

| TAS | 703 | 27 | 46 |

| VIC | 15,907 | 995 | 6,560 |

| WA | 3,122 | 38 | 228 |

| TOTAL | 68,981 | 4,285 | 27,439 |

Source: ABA

High LVR a trigger for deferrals

According to APRA data, loans with a loan to value ratio (LVR) of 90% or higher represent 5% of the total market.

However they represent 8% of deferred home loans.

Across the ditch, New Zealand has already tightened high-LVR lending.

RBNZ, which also acts as prudential regulator, tightened macroprudential lending standards further at the start of October, limiting 80%+ LVR loans to 10% of the owner occupier market.

New APRA rule effective from today

From today, APRA's new serviceability buffer comes into effect, jumping from 2.5% to 3.0%, explained further here.

A number of banks and lenders have responded by already adhering to the guidelines, while also hiking home loan interest rates.

On a home loan with an advertised interest rate 2.00% for example, banks will now use a serviceability rate of 5.00% (2.00% plus 3.00% buffer) to assess a borrower's capacity to repay the home loan.

Non-banks aren't subject to the rule, and instead will continue to use ASIC's mandated 2.50% buffer.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Matthew Waring via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Rachel Horan

Rachel Horan