A colleague said to me the media hype around Wednesday's news is probably going to cause a bigger stir in the property market than the actual APRA announcement itself.

Indeed, the bump in what's called the 'serviceability buffer' from 2.5% to 3.0% hardly seems like a big deal, but the prudential regulator estimates it will reduce borrowing capacity for the average borrower by about 5%.

So, let's set a few things straight.

What on earth is a serviceability buffer?

A bank will look at not only payslips, bank statements, savings and your existing debts - it will also do some 'quick maths' to see if you can still afford to make your home loan repayments should interest rates rise significantly.

Banks make this assessment using a 'serviceability rate', which is essentially a hypothetical higher interest rate banks use when judging your ability to meet the repayments.

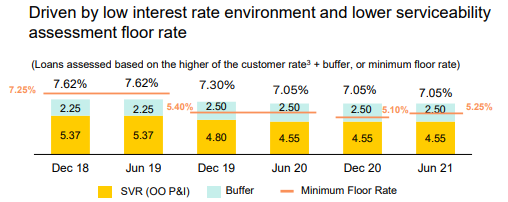

A serviceability rate could be one of two things - the bank's minimum 'floor' rate or its advertised home loan interest rate plus a 'buffer'. Whichever is higher will generally be used as the serviceability rate.

Since 2019, banks can set their own floors - typically around 5% - while APRA's new recommended buffer is 3.0% above the advertised rate.

The buffer is to ensure you can afford not only the advertised interest rate, but withstand any potential rate rises as well.

If we look at the Commonwealth Bank example below, its 'minimum floor' in June 21 (5.25% p.a.) is actually lower than its standard variable rate (4.55%) plus APRA's previous 2.5% buffer.

In this case, a customer applying for a Commbank loan at the standard variable rate of 4.55% p.a. would be assessed at a serviceability rate of 7.05% (4.55% + 2.5% buffer), because it is higher than the 5.25% floor rate.

Under APRA's bigger buffer of 3%, this serviceability rate would be even higher at 7.55%.

Source: CBA

What does it mean for the average home loan?

For new loans, it will probably mean you can borrow less money.

APRA estimates it will drop borrowing power by 5%. On a $400,000 home loan under the old rules, that could drop your borrowing power to $380,000.

Say you have a 2.00% home loan - the new buffer of 3.0% means banks could assess your ability to repay based on a 5.00% interest rate.

On a $400,000 home loan over 30 years, that would result in a monthly payment of $2,147 per month.

Frankly that repayment sounds pretty high, especially in today's low interest environment.

Does it affect existing home loans?

Once you've got your foot in the door of the nightclub and past the thick-necked bouncer, you're pretty much free to enjoy a drink.

Existing home loans are likely to be less affected or even unaffected by the changes, because the bank has already assessed your ability to pay off the home loan satisfactorily.

However, where existing home owners could run into a bit of strife is when it comes to refinancing.

Any refinancing will likely be assessed with the new buffer in mind.

Though with the way house prices have performed, many home owners would have likely experienced strong capital growth, and hence built up sizeable equity, which takes some of the sting out of refinancing.

What if I'm a first home buyer?

First home buyers may now have a harder time borrowing as much as they might have done in the past, or satisfying the bank they can even get a home loan.

As a first home buyer you're the young ruffian in the nightclub queue who wore trainers to a fancy club.

"No trainers!" the bouncer says.

Your deposit may get you less than it did before.

However, if lending, wages, and debt-to-income data is anything to go by, most home buyers don't totally over-leverage themselves, so the 50 basis point rise in the buffer might not totally be the end of the world.

You might just have to temper your expectations a touch, especially if you're in Sydney or Melbourne with super-high home prices.

Would this actually help with housing affordability?

In the grand scheme of things, this is a fairly minor adjustment. Thinking back to what my colleague said yesterday, the hype around the announcement is probably more influential than the change itself.

However, APRA has said it is reviewing other levers it can pull to promote financial stability, which could collectively cool the housing market.

The main criticism however is that this lever doesn't really promote 'affordability', but rather disintegrates 'accessibility', especially for first home buyers who naturally borrow more the first go around to get into the market.

Investors and owner occupiers already in the market will be less affected because they can use the equity from their existing home to help fuel any subsequent home purchases.

While APRA said the latest change is designed to cool investment lending and promote financial stability, the majority of the surge in lending in 2021 has been to first home buyers and owner occupiers.

However, there has been a slight pullback in loans to these demographics as a natural reaction to home prices increasing strongly.

An amusing anecdote to end

New Zealand has generally gone much harder in addressing housing affordability.

Prior to its Reserve Bank tightening investment lending in March this year, CoreLogic NZ figures from January show 30% of all new lending in that month went to investors - a 15-year high.

Investors piled in before the changes took effect.

It appears any looming legislation could pull forward demand before it spooks the market.

Affordability, or at least accessibility, for first home buyers could get worse before it gets 'better' - if it does at all.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Bailey Rytenskild on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury

Brooke Cooper

Brooke Cooper