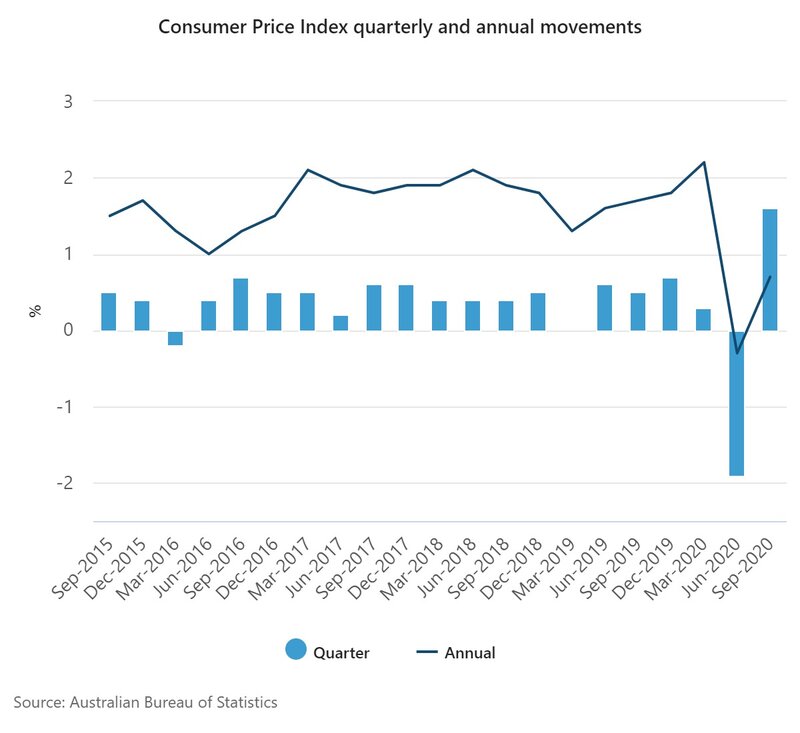

The figures from the Australian Bureau of Statistics (ABS) come in just shy of the predicted 1.9% rise from economists.

It follows the record 1.9% fall in CPI in the June quarter, the biggest quarterly drop on record, which took the annual rate of inflation to -0.3%, only the third time it had been negative.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest non-introductory interest rates on the market.

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

Head of Prices Statistics at the ABS Andrew Tomadini said the end to free childcare was the biggest driver of the rise in the CPI.

"In the September quarter child care fees returned to their pre-COVID-19 rate having been free during the June quarter," Mr Tomadini said.

"This was the largest contributor to the CPI rise in the September quarter. Excluding the impact of child care, the CPI would have risen 0.7%.

"Significant rises were also recorded in the September quarter for automotive fuel (9.4%) following a rebound in world oil prices, and pre-school and primary education (11.1%), with before and after school care no longer being free."

Annual inflation returned to positive territory, rising 0.7% in the September quarter.

Other notable increases included furniture (6.4%), major appliances (5.3%) and small appliances (5.8%).

"Strong demand and supply shortages led to price rises and less discounting for many household durable goods," Mr Tomadini said.

RBA forecasts country is out of recession

Speaking to Senate estimates yesterday, RBA Deputy Governor Guy Debelle forecast that the country was technically out of a recession, despite the difficult conditions in Victoria.

"At the moment it looks like the September quarter for the country probably recorded positive growth rather than slightly negative," Dr Debelle said.

"The growth elsewhere in the country was more than the drag from Victoria and the drag from Victoria was possibly a little less than what we guessed back in August."

A technical recession is defined as two consecutive quarters of economic contraction, which occurred when gross domestic product (GDP) contracted 0.3% in the March quarter and a record 7.0% in the June quarter.

Although technically out of recession, many people would argue the economy will be in dire straits for some time, with the national effective unemployment rate around 9-9.5% nationally and 14% in Victoria.

Despite the forecast, Dr Debelle said current conditions made accurate predictions incredibly difficult.

"The range of uncertainty around the numbers at the moment is as large as it has been in my career," he said.

"We are having a lot of trouble trying to understand where we are let alone where we are going."

The RBA deputy remained tight-lipped on whether we would see a November cash rate cut on Melbourne Cup day.

"We have a policy decision next Tuesday which is pretty market sensitive so I don't want to provide too much commentary around whether or not that will go ahead."

Economists are widely predicting the central bank will cut the rate by 15 basis points and take it to a new record low of 0.10%, as well as expanding its quantitative easing program.

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Aaron Bell

Aaron Bell

Harrison Astbury

Harrison Astbury