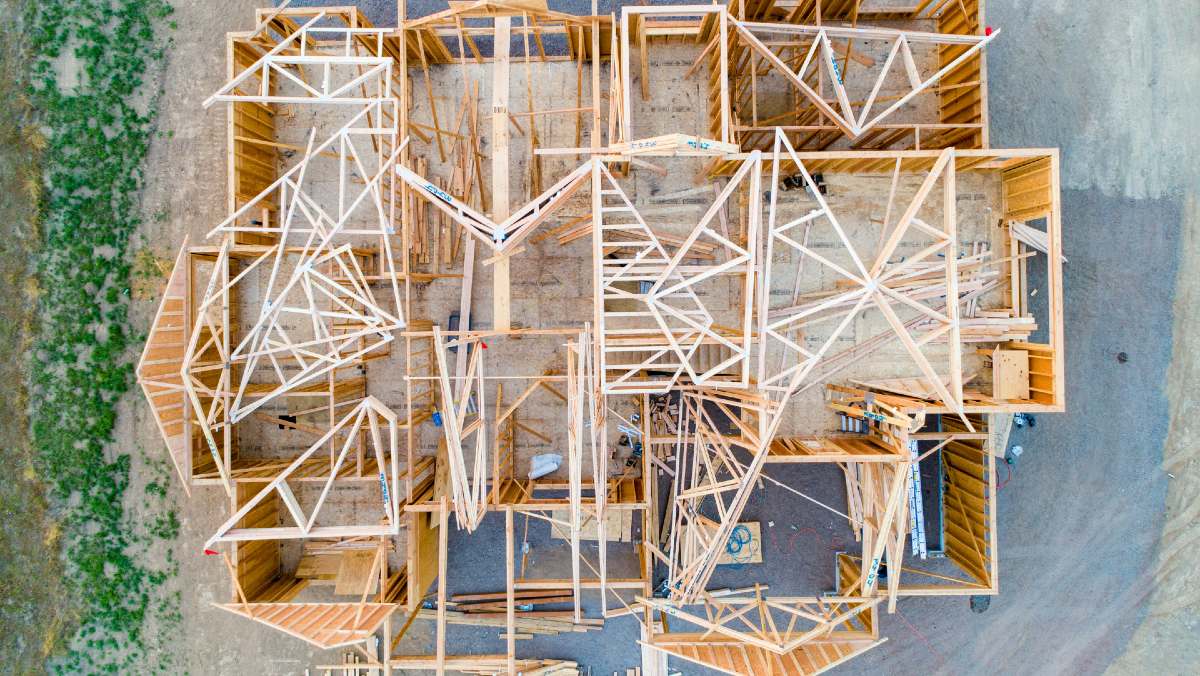

The most generous new home grants in Australia launch on Tuesday, as part of the new government’s bid to boost the NT economy and support population growth.

First home buyers who build or buy a new home will be eligible for $50,000, with no cap on home values.

First home buyers who purchase an established home will get $10,000.

In an Australian first, the NT’s HomeGrown Territory grants scheme also includes $30,000 for existing homeowners to build or buy a new home.

The initiative is open to Australian citizens and permanent residents who must live in their homes for a minimum of 12 months.

Build and they will come

Northern Territory chief minister Lia Finocchiaro said Territorians have been eagerly awaiting the launch of the program - a key election promise of the Country Liberal Party who won government last month.

“HomeGrown Territory will help attract and retain our key workers and families by breaking down financial barriers to entering the housing market,” she said.

The program is being billed as the most generous home building scheme in Australia.

It will take the title from the Queensland government’s First Home Owners Grant that provides $30,000 to eligible first home buyers building or purchasing new homes worth less than $750,000.

The NT scheme has no caps on property values.

“This is about encouraging Territorians to put down roots and build a life in the Territory,” Ms Finocchiaro said.

“It also signals to the rest of Australia that if you want to build your dream home, come to the Northern Territory.”

The grants will be available for 12 months from Tuesday 1 October.

See Also: State First Home Owner Grants Compared

No cap on grants available

The NT government has committed $20 million to the scheme but has assured potential applicants it will allocate more funds to ensure eligible people who apply don’t miss out.

The government is hoping the grants will help people get out of the rental cycle and into home ownership.

To be eligible, homebuyers must:

- sign a contract to buy or build a home in the NT between 1 October 2024 and 30 September 2025 (it must not replace other contracts signed before 1 October 2024)

- be a person, not a company or trustee

- have at least one person over the age of 18

- have one applicant who is an Australian citizen or permanent resident

- live in the home for at least 12 months after taken possession once construction is complete

- lodge their application by 31 December 2025

The program will begin taking applications on Tuesday 1 October. See the Northern Territory government website for more details.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Avel Chuklanov on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward