New research conducted by buyers agency InvestorKit has revealed a link between renewable construction projects and strong property market performance in local communities.

By analysing major renewable energy projects across Australia and their economic impact, InvestorKit found five markets that will benefit from the renewable energy boom.

Those include: Rockhampton, Toowoomba, Tamworth-Armidale, Dubbo, and Latrobe Valley.

Founder and head of research at InvestorKit Arjun Paliwal said regional economies and property markets will see positive flow-on effects during the renewable construction phase and also in the long run.

“As more projects and zones [renewable] are created in regional Australia, communities will see the benefits through new opportunities created for their local economies,” Mr Paliwal said.

“Each renewable energy project creates hundreds, and even thousands of jobs, particularly in its construction phase.

“This will see increased demand for housing in regional areas, a revitalisation of regional surrounding towns as new ‘locals’ bring money to hospitality and retail businesses, and an overall strengthening of its property market.

“Those looking to buy in areas where the renewable energy boom is earmarked to take place can see property prices rise and benefit from long-term capital growth.”

The report also found renewable projects increase demand for rental supply as workers migrate for jobs.

A breakdown of the five regions tipped to boom

Toowoomba, QLD

Toowoomba is surrounded by $30 billion of in-progress and potential renewable energy projects, particularly in Western Downs.

The top three projects in the area are expected to create more than 1,000 jobs.

For those looking to invest in the region, the median house price is $490,000 and has been growing steadily in the past two years.

Rockhampton, QLD

Along with Gladstone and Bundaberg, Rockhampton is one of the major cities in the Central Queensland Renewable Energy Zone and has 67 registered interest projects, representing more than $39 billion in renewable energy investment.

The top three projects in the area are expected to create more than 6,000 jobs.

The median house price is $370,000 with further room to grow.

The current rental vacancy rate is sitting at 0.3%.

Tamworth-Armidale, NSW

The region is expected to deliver up to $10.07 billion in private sector investment and is expected to support over 830 operational jobs and 1,250 construction jobs.

The median house prices in Tamworth and Armidale are $437,000 and $450,000 respectively.

Mr Paliwal expects the local job market and economy to grow as construction begins in the region.

Dubbo, NSW

Dubbo’s accessibility to Sydney and the business and investment opportunities the community offers makes it an attractive area for buyers to invest in.

The renewable projects in the area are expected to support just under 4,000 construction jobs.

Dubbo’s median house price is $420,000 with sale days on market continuously declining for more than a year.

According to Mr Paliwal, this suggests Dubbo has high market pressure.

Latrobe Valley, VIC

Latrobe Valley has two proposed billion-dollar projects set to create well over 6,000 new jobs.

The median house price is $393,000 with rental vacancy rates sitting at 0.9%.

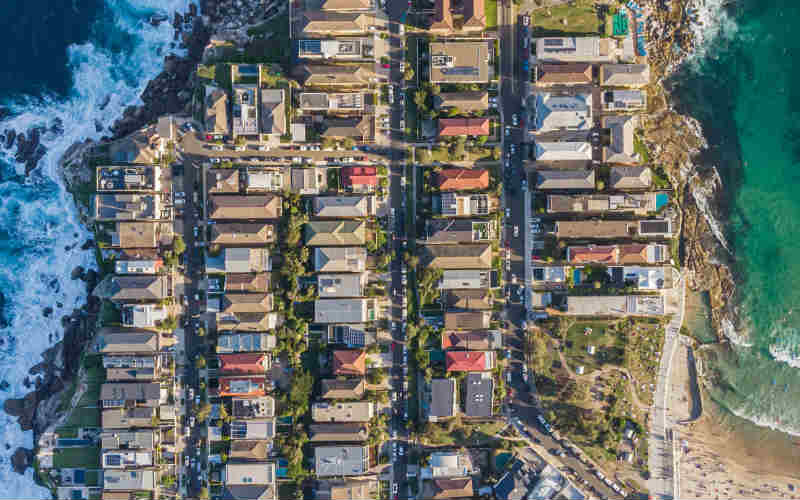

Image by Pixabay via Pexels

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury