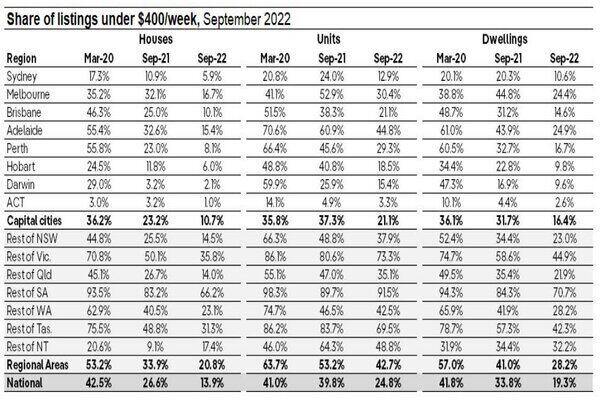

In September 2022, the share of properties listed for rent on realestate.com.au for less than $400 per week fell to a record low of 19.3% of listings - declining from 41.8% in March 2020.

Rental listings under $400 per week in capital cities also reported a decline, down from 36.1% in March 2020 to 16.4% in September 2022.

Regional areas didn't escape the trend - the share fell to 28.2% from 57% in the same time period.

Not one capital city market had more than a quarter of available listings below $400 per week in September 2022.

The lowest percentage share was reported in the ACT, Hobart and Darwin - with less than 10% of all listings in each city under $400 per week.

Adelaide (15.4%) and Melbourne (16.7%) had the highest share amongst all capital cities.

Source: PropTrack

A year ago, one in five rentals in Sydney were advertised under $400 per week, falling significantly to just one in 10 in September.

Over the past year, Melbourne (-20.4%), Adelaide (-19%) and Brisbane (-16.6%) have seen the biggest percentage point decline in the share of listings available to rent under $400/week.

While the ongoing shortage of rental stock across Australia impacts all renters, the dwindling number of rentals under $400 per week means the most significant impact is being seen on lower income households the most.

Since the start of the pandemic, the total number of properties available for rent is 31.4% lower, with the number of properties available for rent under $400/week also tightening even further - falling 68.2% to sit at a record low.

PropTrack predicts the supply of affordable rental listings under $400 per week will reduce even further over the coming months, as supply continues to tighten and competition for stock heats up, in preparation for a migration increase.

This comes after SQM Research data showed capital city rents had risen 21.8% over the past 12 months.

Number crunching from Property Club also showed the pension was the same as weekly rent in Sydney in 1973.

By 2050 however rent is predicted to rise 484% in Sydney, wages 425%, and the pension 100.8%.

The PropTrack Market Insight report also comes off the back of recent data by Muval - an online removalist booking platform - that was released earlier in the month.

Muval's Index Report found that as the financial squeeze has become so extreme in recent months, 40% of Australians said they would be prompted to consider moving house if their rent increased by $50 a week.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Karolina Grabowska via Pexels.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Emma Duffy

Emma Duffy

Dominic Beattie

Dominic Beattie