In its Best of the Best report CoreLogic said it is likely property value growth and sales activity have already peaked.

"Affordability constraints have worsened, vendor activity has surged toward the end of the year, and the housing finance space is currently showing signs of tightening and slowing," CoreLogic said.

The accumulated force of these individual headwinds have led many of the major banks to forecast softer growth outcomes for 2022, while also expecting tighter lending conditions for borrowers.

In October, CBA and ANZ predicted tighter macro prudential policies were coming in the near future.

However CoreLogic's report said, "a slowdown in buyer and seller activity also mean a slowdown in debt accrual for Australian households."

"This may also mitigate the need for further interventions around risk in housing lending, following the increase to serviceability assessment buffers for borrowers by APRA in October. "

Despite the stellar growth in 2021, CoreLogic also highlighted a slowdown in borrowing in the second half of 2021.

"In the three months to October, ABS housing finance data showed total values secured for the purchase of property fell -6.3% compared to the previous quarter, led by a decline in housing finance secured by owner-occupiers (both first home buyer, and non-first home buyer owner-occupier finance fell)," the report said.

2021 in review

Nationally, dwelling values recorded an annual appreciation of 22.2%, the highest increase since 1989 according to CoreLogic data.

In addition, sales volumes climbed to an estimated 614,635 in the past 12 months, the highest level in almost 18 years.

Ms Owen said the estimated value of Australia’s residential real estate had gone from $7.2 trillion at the end of November 2020, to reach a record high of $9.4 trillion in just 12 months.

“Strong housing market performance over the year was driven by multiple factors, including low interest rates, fiscal and institutional support for households, high household savings and relatively low levels of advertised stock,” she said.

“Rates of housing turnover had also been relatively low for some years before these factors boosted housing demand, which may also explain the elevated volume of sales in the past 12 months, which at November was 32.6% above the decade annual average.”

Change in Dwelling Values

| Month | Quarter | Annual | Median Value | |

| Sydney | 0.9% | 4.3% | 25.8% | $1,090,276 |

| Melbourne | 0.6% | 2.4% | 16.3% | $788,484 |

| Brisbane | 2.9% | 7.4% | 25.1% | $662,199 |

| Adelaide | 2.5% | 6.5% | 21.4% | $558,540 |

| Perth | 0.2% | 0.4% | 14.5% | $528,540 |

| Hobart | 1.1% | 5.5% | 27.7% | $676,595 |

| Darwin | -0.4% | 0.2% | 16.7% | $493,047 |

| Canberra | 1.1% | 5.0% | 24.5% | $882,519 |

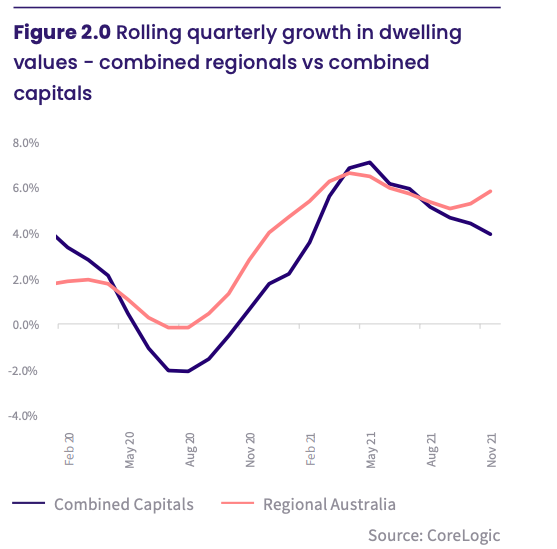

| Combined Capitals | 1.1% | 4.0% | 21.3% | $783,557 |

| Combined Regional | 2.2% | 5.9% | 25.2% | 527,322 |

| National | 1.3% | 4.4% | 22.2% | $698,170 |

Source: CoreLogic

Brisbane finishes the year as Australia's fastest growing property market

Core Logic data shows Brisbane dwelling values rose 2.9% over November and 7.4% over the quarter, its highest rate of quarterly growth since 2002.

While Sydney and Melbourne have experienced a plateau to end the year, Brisbane ploughed full steam ahead according to Core Logic’s Best of the Best report.

Brisbane’s annual growth now sits at 25.1%, just below Sydney’s growth of 25.8% and well above Melbourne’s annual growth of 16.3%.

Highest total value of sales Brisbane

| Suburb | Region | Number sold (12m) Sept 2021 | Total value (12m) Sept 2021 | Median value Nov 2021 | |

| 1 | Cleveland | Brisbane - East | 356 | $367,635,171 | $883,170 |

| 2 | Camp Hill | Brisbane - South | 282 | $362,757,747 | $1,359,254 |

| 3 | North Lakes | Moreton Bay - South | 585 | $350,374,750 | $675,413 |

| 4 | Redland Bay | Brisbane - East | 475 | $337,318,885 | $749,275 |

| 5 | Thornlands | Brisbane - East | 430 | $337,173,349 | $785,774 |

Source: CoreLogic

Highest 12 month change in values

| Suburb | Region | Annual Change | Median Value | |

| 1 | Indooroopilly | Brisbane- West | 41.8% | $1,386,937 |

| 2 | Newmarket | Inner City | 40.5% | $1,314,552 |

| 3 | Teneriffe | Inner City | 40.5% | $2,379,902 |

| 4 | Sherwood | Brisbane - West | 38.7% | $1,386,670 |

| 5 | Hawthorne | Inner City | 38.5% | $1,858,992 |

| 6 | Taringa | Brisbane - West | 38.3% | $1,421,929 |

| 7 | Everton Hills | Moreton Bay - South | 37.6% | $862,509 |

| 8 | Carindale | Brisbane - South | 37.2% | $1,299,519 |

| 9 | Hamilton | Inner City | 37.1% | $2,106,348 |

| 10 | Corinda | Brisbane - West | 36.8% | $1,137,752 |

Source: CoreLogic

Also read: Brisbane suburbs to watch in 2022

Image by Robert Ruggiero via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Brooke Cooper

Brooke Cooper

Denise Raward

Denise Raward