Established only a few months ago, Unloan is backed by Commonwealth Bank's 'x15' venture capital arm, is completely digital and promotes itself on fast application times.

Speaking to Savings.com.au, Mr Oertli (pictured above) said borrowers looking to refinance can complete the process in as little as 10 minutes with the new digital lender.

"The earlier you get a great deal, the better. You really want to look at your home loan and it's for two reasons," he said.

"One is the savings in your pocket now. Make sure you find a product that isn't offering a honeymoon rate or a fixed rate that reverts to a higher interest rate; you really want to be on a persistently low rate product.

Mr Oertli said the second reason is to avoid becoming a mortgage prisoner - the risk of which can grow the longer borrowers neglect their home loan in a rising rate environment.

"There could be increasing numbers of people - what we call mortgage prisoners - who can comfortably service their current rates, and would indeed save more money by switching to a cheaper rate, but can't because when being assessed for that cheaper rate, the new lender has to factor in the ability to pay at a much higher interest rate than today," Mr Oertli said.

Essentially a 'mortgage prisoner' is a borrower that's unable to refinance and get out of their expensive mortgage because the serviceability rate is higher than what they could previously afford.

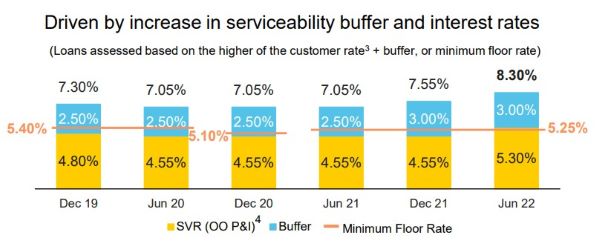

For reference, Commonwealth Bank's serviceability rates - the higher of the 5.25% floor rate, or the advertised interest rate plus a 300 basis point buffer - have experienced a significant jump over the past year.

Source: CBA Full Financial Year Results, 2022

The serviceability buffer has been a point of contention lately, and England's central bank recently relaxed its mandatory buffer from 3% to 1%.

Pete Wargent, co-founder of buyers agents BuyersBuyers, encouraged Australia's regulators to follow suit.

"Many of our clients and other borrowers are finding it impossibly difficult to refinance when lending standards are so tight, leaving them stuck with unattractive mortgage rates or on challenging repayment terms," Mr Wargent said.

"Realistically the cash rate target is extremely unlikely to increase to anywhere near the implied 5.35% in the current monetary tightening cycle.

"Assessing borrowers at such extreme outcomes would thus be unnecessary, at a time when Australia is close to experiencing full employment, and rental vacancy rates are tracking at near 20-year lows."

The economics of refinancing

Mr Oertli said refinancing could be one of the simplest and quickest ways to save tens of thousands - over the life of the loan anyway.

For example, Unloan offers a variable home loan for owner occupiers at 3.14% p.a. (3.06% p.a. comparison rate*).

On the average home loan size of $610,000, refinancing away from a 30-year mortgage rate of 4.00% p.a. for example would save $294 per month, or $3,528 per year.

"There's not many things you can do in around 10 minutes that will put about tens of thousands of dollars back into your pocket. So have a serious look. Do your research," Mr Oertli said.

However, refinancing isn't a free lunch and could cost hundreds or thousands of dollars upfront, which would negate some savings in the first year.

For example, a new lender will typically require the borrower to re-pay valuation fees, establishment fees or other costs. However some lenders such as Unloan now waive a bulk of these fees.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Rachel Horan

Rachel Horan