The Poverty in Australia 2022 report is based off ABS data from the 2019-20 financial year, and was released by the Australian Council of Social Service (ACOSS) and UNSW Sydney.

It showed as many as 13.4% of the population (or 3.3 million people) and 16.6% of children (or 761,000 kids) were living below the poverty line in the first year of the pandemic (2019-20).

The data also revealed people in poverty are falling further behind the rest of society, with their average weekly incomes dropping to $304 below the poverty line.

Temporary income supports, like the Coronavirus Supplement and Economic Support Payment, that were introduced during COVID lockdowns in 2020 were responsible for pulling 646,000 people, including 245,000 children, back above the poverty line.

At the time, JobSeeker payments were doubled.

In the first three months of 2020, Australia's poverty rate increased to 14.6% as large parts of the economy were shut down by Covid restrictions and thousands were put out of work.

However, over the next three months the poverty rate dropped to a 17-year-low of 12%, as boosted income support payments were announced in April that year.

The boosted payments also reduced the child poverty rate from 19% in the March quarter of 2020 to a 20-year low of 13.7% in the June quarter of 2020 - lifting 245,000 children above the poverty line.

As a result of the extra income, single adults receiving social security payments went from being $134 a week below the poverty line in March to $146 above it in June 2020.

Couples with two children also went from being $187 below the poverty line to $361 above it at the same time.

However, by April 2021, the Coronavirus Supplement (initially $275 a week) was abolished and in its place Jobseeker and other related payments were increased by $25 a week.

As a result of Australian Government borrowings during the pandemic, gross Australian debt grew to more than $900 billion.

A salary earner whose tax bill is $20,000 paid more than $600 towards paying off government interest on debt last financial year, up from the high-$500s the year before.

This was more than unemployment payments, and paying for federal police.

It's expected with interest rates rising, that debt interest bill will be higher.

Professor Carla Treloar, Director of the Social Policy Research Centre at UNSW Sydney, said the report highlights the unacceptable levels of poverty in our nation.

"Australia is one of the wealthiest countries in the world, yet we have one in eight people and one in six children living below the poverty line," Ms Treloar said.

"There are 3.3 million people in Australia desperately struggling to pay the bills and put food on the table, there are 761,000 children who are denied a good start to life."

ACOSS CEO Dr Cassandra Goldie said these figures were concerning.

"The study showed there is a clear way to reduce poverty in Australia, almost doubling the JobSeeker rate pulled 646,000 people out of poverty in 2020 - that is a huge advance in an incredibly short period of time," Dr Goldie said.

"The increased payments reduced child poverty by a massive 5.3%, giving 245,000 kids in Australia the chance of a better future."

Dr Goldie also noted that the report shows that the solutions to ending poverty in Australia are clear

"Increasing Jobseeker and related payments to at least $73 a day is a crucial first step, as well as an increase to Commonwealth Rent Assistance and a substantial investment in social housing so that there are enough affordable homes for people on the lowest incomes," Dr Goldie said.

"We must also invest in energy efficiency and solar retrofits for low-income homes.

"As it develops its approach to a well-being budget, the Federal Government should prioritise including specific targets and strategies for reducing poverty to ensure that no one is left behind."

Some Australians set to take home bigger pay slips

The Poverty in Australia 2022 report comes off the back of the Fair Work Commission's increase to minimum wages, which came into effect on 1 October, 2022.

More than 400,000 low-paid workers in key industries will now take home a bigger pay slip from today, thanks to a 4.6% increase to minimum wages under their awards.

Workers in industries such as hospitality, tourism and aviation are set to benefit, with full-time employees seeing a minimum $40 extra per week - while workers under 111 other awards received their pay rise in July.

The Albanese Government took to the election promising to support a minimum wage increase, which has now been one of its key priorities after taking office.

Prime Minister Anthony Albanese said his Government is focused on tackling the spiralling cost of living that is making life tough for too many Australians.

"That's why we put forward a submission to the Fair Work Commission to increase the wages of people who are on the minimum wage and successfully argued for the result, which was a 5.2% increase," Mr Albanese said.

"We must get wages rising again and make health care, child care and housing more affordable, while we work to grow the economy."

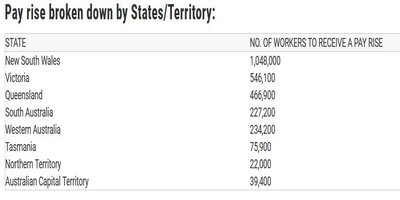

More than 2.7 million workers, covered by the combined July and October award increases, will receive a pay bump due to the Fair Work Commission decision.

It's expected there will be more policies targeting lower-income workers announced in this month's upcoming Federal Budget.

Source: The Federal Government.

Image by Nataliya Vaitkevich via Pexels.

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy

Aaron Bell

Aaron Bell