Rabobank is a relative newcomer to Australia banking, only opening for business in 2007. It's a historical institution though, beginning in the Netherlands in 1895 as an agricultural bank. To this day, agriculture underpins Rabobank's business - in Australia it doesn't write home loans or personal loans, focusing entirely on agribusiness lending.

Those loans need funding though, and Rabobank's relevance to consumers not involved in farming comes from its range of deposit products. Rabobank has consistently offered highly competitive rates to savings account and term deposit customers in recent times. Here's what to know.

Rabobank savings accounts

Rabobank has three savings account products currently available, along with several term deposit options. These products are also available to SMSFs, although rates may vary.

Here's a breakdown of the different options:

High Interest Savings Account

As you'd expect, Rabobank's 'High Interest' savings account offers the bank's highest interest rate. It has an 'introductory rate' which is the highest maximum rate on Savings.com.au's database (at the time of writing). This rate applies for the first four months before reverting to a lower ongoing base rate, on balances up to $250,000.

Julie Blanchard, Rabobank head of deposits, told the Savings Tip Jar podcast this strong introductory rate is an attempt to catch the eye of customers who might be unfamiliar with Rabo.

"[There are] no ongoing conditions, no hoops to jump through to actually earn the rate, it's an introductory rate to get people on board with Rabo and hopefully enjoy the experience so they want to stay," she explained.

Premium Saver

The 'Premium Saver' is Rabobank's bonus rate savings account. It has a modest base interest rate, with an additional 'bonus rate' added each month that you grow your balance by at least $200. Again, the maximum rate applies on balances up to $250,000, with a lower rate for balances between $250k and $1m and then a further discount on any portion of the balance above $1m.

At the time of writing, the ongoing rate on the Premium Saver is higher than that of the High Interest account, excluding that initial four month period.

Notice Saver

Finally, the 'Notice Saver' is an alternative product slightly unusual in that it requires advance notice to access your funds. The longer the notice period, the higher the rate. Currently Rabo offers 31, 60 and 90 day Notice Saver accounts, with a higher ongoing rate than the revert rate on the 'High Interest' account (although not quite as high as the 'Premium Saver').

Term Deposits

Rabobank also offers a variety of term deposit options, with terms ranging from one month to five years. The minimum deposit amount is $1,000 and the usual penalties apply for early withdrawal.

Rabobank Savings Account eligibility

To be eligible for a Rabobank savings account:

-

You must be at least 18 years old.

-

You must have a least one form of ID available (Australian driver's license or passport).

-

You must have an Australian residential address.

You'll also likely need to provide the following:

-

An Australian bank account in your name with another financial institution.

-

A valid Australian driver's license or passport.

-

Your Tax File Number (TFN).

Rabobank savings account review

You might not have heard of Rabobank but if you're looking for a competitive, no-frills savings product, you will want to consider the Dutch multinational.

It operates via a distinct co-op model, helping fund the ventures of Aussie farmers. And the result for regular savers is that the agricultural bank, is well, rather agricultural in nature.

Rabobank stands out for having competitive savings account rates with little admin required to get the top rates. For term deposits, it was the only bank to my knowledge to raise rates after the RBA cash rate cut in February 2025.

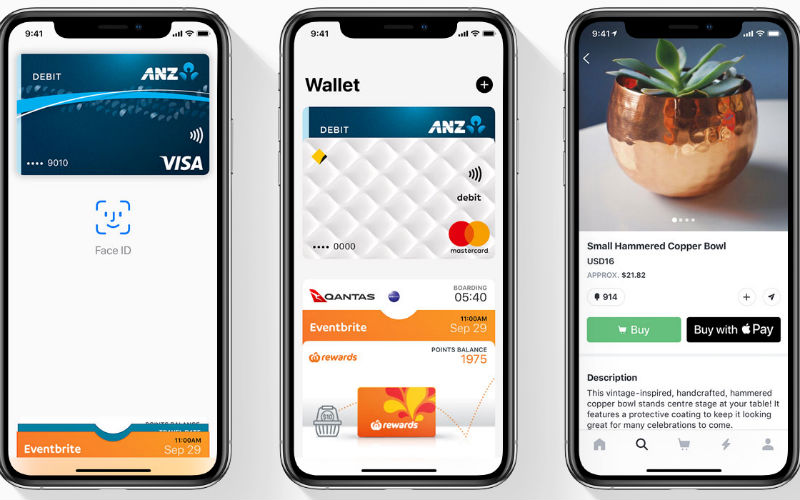

A big negative is that the bank is not on the New Payments Platform or Osko, nor does it seem in a rush to join. This means if you're transferring sums of money in and out, you might be waiting a couple of days.

Until recently it offered a physical security token resembling a pocket calculator sent via the mail, meaning you couldn't actually do anything until that letter arrived - the security token has since gone digital.

Rabobank also has no other consumer products outside of savings and TD accounts, meaning you come to the bank for depositing (albeit slowly) and that's it. That's by design. So the bank is no-frills indeed, just like a parmy-and-pot deal in a country pub.

-Harrison Astbury, InfoChoice Research Analyst

First published on September 2022

Image by Bart Ros via Unsplash

Emma Duffy

Emma Duffy

Denise Raward

Denise Raward