Commonwealth Bank (CBA) announced it had partnered with Slyp on Monday, allowing its customers to automatically receive an itemised digital receipt through the CommBank app when they pay with their card or digital wallet at participating retailers.

The app aims to make it easier for customers to manage returns, warranties and financial management, while doing away with paper receipts.

Commonwealth Bank Group Executive Retail Banking Services Angus Sullivan said the fintech would further extend the capabilities of CBA's "industry-leading" app.

“We are thrilled to partner with the team at Slyp. Their technology provides an intuitive solution to an everyday problem for our seven million digitally active customers," Mr Sullivan said.

“The partnership is also an example of the bank’s goal of leading in technology.

"Integrating Slyp into our core digital channels, we're continuing our journey to build smarter banking experiences our customers will love.”

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest non-introductory interest rates on the market.

4 0 0 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Savings Accelerator

Savings Accelerator

4 0 0 1 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details FEATURED High Interest Savings Account (<$250k)

High Interest Savings Account (<$250k)

0 0 0 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details FEATURED*Score $20 using code SWIPE20 Save Account

Save Account

4 0 0 0 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Hi Saver

4 0 0 0 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Bonus Saver

4 0 0 1 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Online Saver

0 0 1 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Up Saver Account

0 0 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Qsaver

0 100 1 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Bonus Saver Account

0 100 0 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Bonus Saver

3 0 0 0 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Maxi Saver

0 100 1 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Bonus Saver Account

4 0 0 1 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Netsave Account

0 200 1 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Growth Saver

4 0 0 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Simple Saver

0 1000 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Virgin Money Boost Saver

0 2000 0 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details HomeME Savings Account (<$100k)

0 200 0 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Online Savings - Premium Saver

0 10 0 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details mySaver

3 0 0 0 $product[$field["value"]] $product[$field["value"]] $product[$field["value"]] More details Online Savings Account

CBA's investment makes Slyp the first independent fintech to have the backing of all four major banks, after NAB and Westpac invested in 2018 while ANZ came on board in September 2019.

With the large majority of Australians banking with the big four, the Slyp platform presents the opportunity to create a unified digital receipt standard.

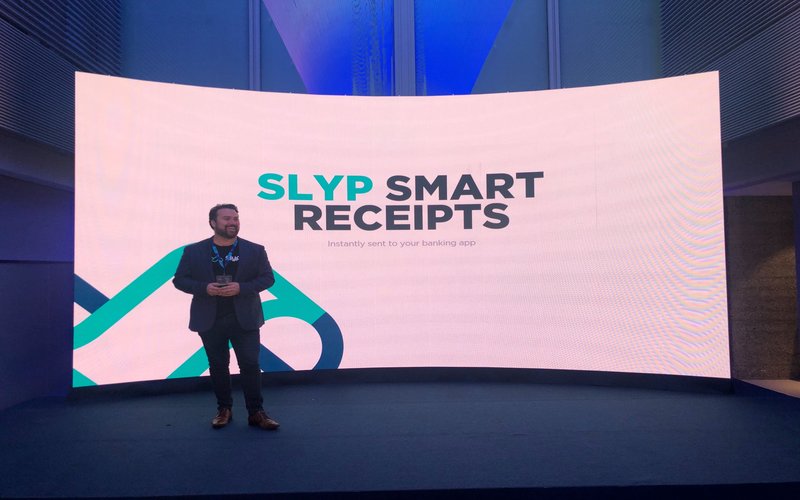

CEO and co-founder of Slyp Paul Weingarth said the partnership with CBA was a major breakthrough for the company.

"To deliver a truly ubiquitous industry standard of digital receipts, we knew early on that we would need to partner with the banks," Mr Weingarth said.

"Now, with their backing we are in a strong position to push towards eliminating paper receipts and provide retailers and banks with a new way to delight and engage their customers post-payment.”

Slyp directly integrates the receipt information from the merchant’s point of sale system, matching it to the customer’s card and displays it inside their banking app.

Slyp - Smart Receipts in your banking app! from Slyp on Vimeo.

Mr Sullivan said the new technology couldn't come at a more opportune time, given the increased focus on hygiene due to COVID-19 making cashless payments the preferred way to pay.

“COVID-19 has been a catalyst for retailers to encourage contactless, digital payments in their stores," he said.

"Digital receipts are a natural extension to this, which will benefit both shoppers and retailers.”

Retailers already signed onto the Slyp app include Harris Farm, Bing Lee, Cue fashion and Barbeques Galore.

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly