The 2019-20 Federal Budget was announced last night by Treasurer Josh Frydenberg, with the Treasurer going to great lengths to emphasise how the budget was ‘back in the black’, meaning it had hit a projected surplus for the first time in 12 years.

“The budget is back in the black with the Morrison Government delivering the first budget surplus in more than a decade,” Mr Frydenberg said.

“Surpluses will continue to build toward one per cent of GDP within a decade.

A surplus on the macro level is all well and good, but how does the 2019-20 budget affect the average person’s wallet and purse?

Essentially, there are five key areas outlined in this year’s budget that have the potential to affect everyday savings:

- Income tax cuts

- Lower taxes for small business owners

- Greater superannuation flexibility

- One-off energy payments

- Additional funding for banking regulators

Income tax cuts

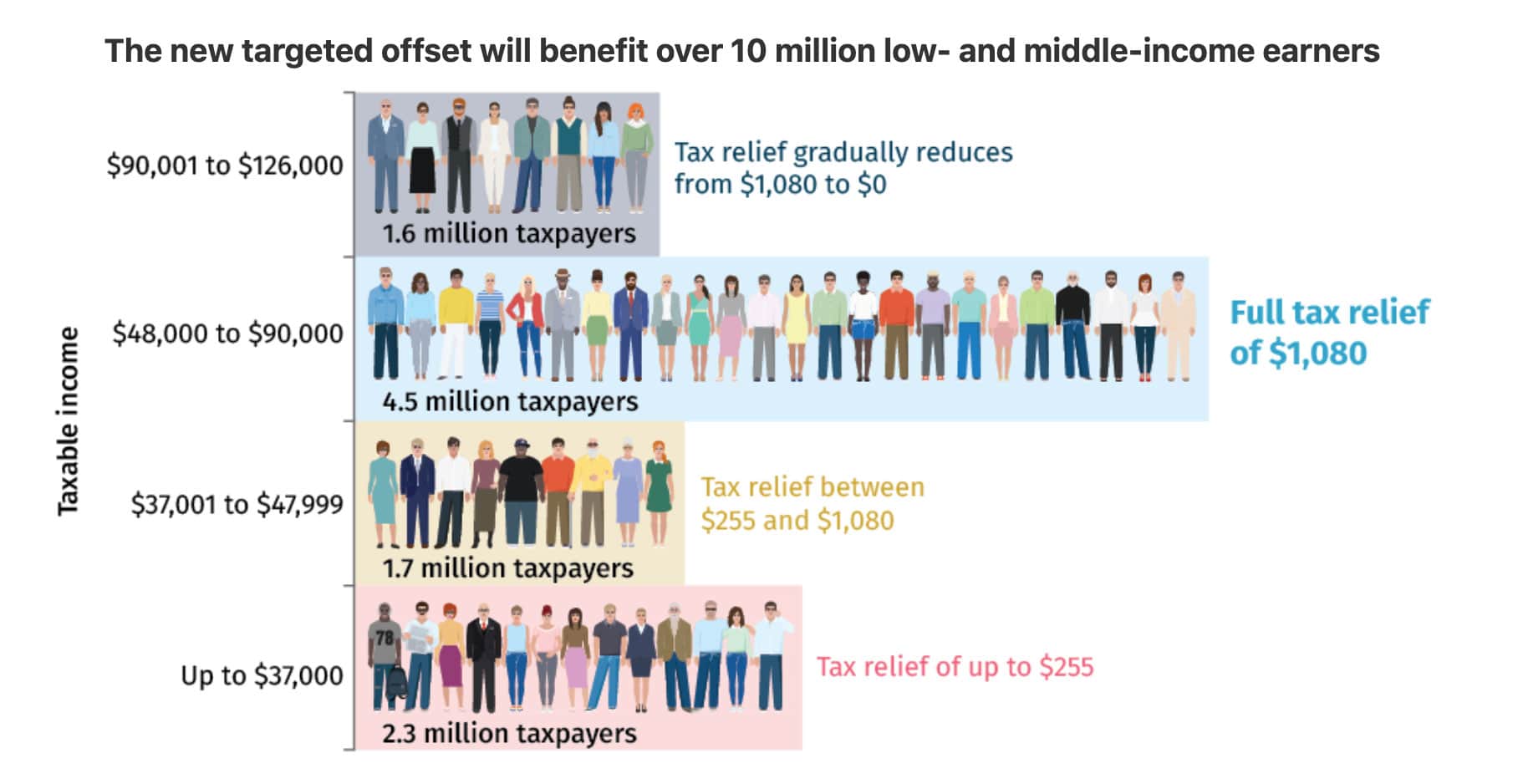

Middle-income earners were the big winners in this year’s budget, with the Coalition announcing a tax offset for Australians earning up to $126,000 a year.

“The Government is more than doubling the low and middle income tax offset from 2018-19,” Mr Frydenberg said.

“Taxpayers earning up to $126,000 a year — including teachers, tradies and nurses — will receive a tax cut.”

How much is this tax offset? Up to $1,080 per year for single-income families and $2,160 per year for dual-income families, which can be claimed in 2018/19’s tax return.

The maximum offset is available for those in the sweet spot of $48,000-$90,000 a year, while those earning between $37,001-$47,999 a year will get between $255 and $1,080.

The closer people get to the $126,000 maximum, the closer their tax offset gets to $0, while people earning up to $37,000 will get up to $255.

The Coalition pledged to keep this tax offset available for the next four years – so long as they get re-elected.

Another key change announced is the reduction of the marginal tax rate for those earning between $45,000 and $200,000 from 32.5% to 30%. This isn’t planned to be rolled out until July 2014 however,.

Another upcoming change for 2022 is the preservation of tax relief for low and middle-income earners.

The 19% tax bracket threshold will be increased from $41,000 to $45,000, allowing more lower-income Australians to pay less in tax.

Lower small business taxes

Middle-income earners aren’t the only ones to get a tax rebate.

The Government also announced tax changes for the 3.4 million small to medium-sized businesses in Australia.

There are two key changes:

- Their tax rate will be cut from 27.5% to 26% next year, then 25% in 2021;

- Instant asset write-off has been increased to $30,000 and can now be used for multiple assets

These changes will apply from 2 April 2019 to 30 June 2020.

The Council of Small Business Organisations Australia (COSBOA) CEO Peter Strong gave the budget an 8.5/10 from a small business perspective.

“In any budget there are sometimes hidden gems and the funding of innovation games for small business is such a gem,” Mr Strong said.

“Small businesses bought together to innovate with the best talent emerging from our education institutions, rolled out on a national scale. Excellent focus on the future.”

Greater superannuation flexibility

Outlined in the Budget were three key changes to superannuation:

- Australians aged 65-66 will now be able to make voluntary super contributions without meeting the work test (that’s working a minimum of 40 hours over 30 week periods)

- The age limit for people receiving contributions from their spouses will increase from 69 years to 74 years.

- People 66 and under will now be able to make three years’ worth of non-concessional contributions to their super in a single year

According to the Australian Institute of Superannuation Trustees (AIST) CEO Eva Scheerlinck, these “modest” changes won’t help most Australians build their nest eggs.

“The vast majority of members of profit-to-member superannuation funds will not benefit from these changes,” Ms Scheerlinck said.

“Most ordinary working Australians cannot afford to make extra contributions and can only dream of having the money to pour an extra $300,000 into their super fund in a single year.

“This budget is a missed opportunity to improve retirement outcomes for low income workers and the many women with broken work patterns who still retire with around half the super of men.”

One-off energy payments

The Government announced before the Budget’s release that nearly four million eligible social security payment recipients would receive assistance with their energy bill in the form of one-off, tax exempt payments.

Worth $75 for singles and $125 for couples, the one-off Energy Assistance Payment will be handed down to people such as parents, age pensioners, veterans, carers, and those on the Disability Support Pension before July.

Although not in the official budget papers, Newstart recipients will also receive these handouts.

There are those who believe this is a last-minute change from the Government after copping backlash for not making any substantial changes to Newstart allowances.

The initial decision to not increase the Newstart payment was described as “unnecessarily cruel” – Newstart recipients currently take home $538.80 per fortnight, while aged pensioners take home $834.40.

Australian Council of Social Services chief executive Cassandra Goldie said Mr Frydenberg’s backflip was not enough.

“People on Newstart shouldn’t have been excluded in the first place, and the one-off payment of $75 is a pittance compared to the high end tax cuts that mean more than $11,000 extra a year for people on more than $200,000 once they’re in place,” Ms Goldie told News.com.au.

“What people on Newstart — $15,000 per year — really need is an urgent, ongoing increase, after 25 years.

“The energy bills will keep coming and this one-off payment of $75 will do nothing to support people to get through tough times while they look for suitable paid work.”

This Budget is the 25th in a row to refuse to deliver a real increase in Newstart.

— ACOSS (@ACOSS) April 2, 2019

The Government has once again turned its back on people on the lowest incomes. ACOSS Budget Media Release https://t.co/AMiNLMYeG9 #RaiseTheRate #KeepMyTaxCut #SaveOurServices pic.twitter.com/dbjDSyq0u2

Additional funding for banking regulators

Although this will have a less-immediate effect on people’s savings, the Government announced it would pump $550 million into banking regulators in response to the royal commission.

ASIC will get $400 million while APRA will get the remaining $150 million over the next four years.

$27.5 million to be spent on ant-related issues

In a matter that’s rather unrelated to personal finance, $27.5 million is set to be spent on ant control – specifically fire ants, Argentine ants and yellow crazy ants.

What is this.. a budget for ANTS?!?

— Alice Workman (@workmanalice) April 2, 2019

There’s not one, not two but THREE ant eradication plans in #Budget2019 pic.twitter.com/DCEZgWV4XH

In the writer’s personal opinion, we should be spending much more than $27.5 million on this – nothing less than the total eradication of these nightmare creatures will do.

For feedback or queries, email will.jolly@savings.com.au

.jpg)

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy

Aaron Bell

Aaron Bell