New research by Boston Consulting Group (BGS) has found a significant number of Australians plan to cut luxury spending in the post COVID-19 economy, and will instead shift their attention to essential spending.

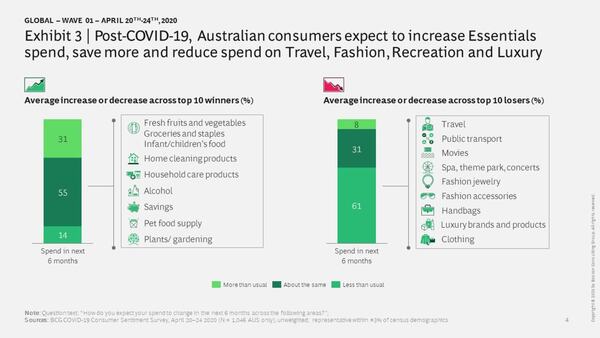

In the short and medium-term, more than two-thirds are expected to cut luxury spending, which includes things like travel, fashion and jewellery, accessories, movies and so forth, with the report stating that consumers believe basic and simple products are all they need at the moment.

Such luxury products are deemed unnecessary.

Consumers said they expect to cut spending in travel by 70% and luxury brands and products by 45%, while daily essentials expect a gain of 31%.

Meanwhile, spending on groceries is expected to rise by 31%, while things like home cleaning products, alcohol and money put into savings should increase by 55%.

In summary, the group expects $650 billion worth of sales will be lost in the global luxury sales market this year thanks to coronavirus.

“The impact will be worse than the global financial crisis of 2008,” said Sarah Willersdorf, Head of Luxury at the management consulting firm.

Source: Boston Consulting Group

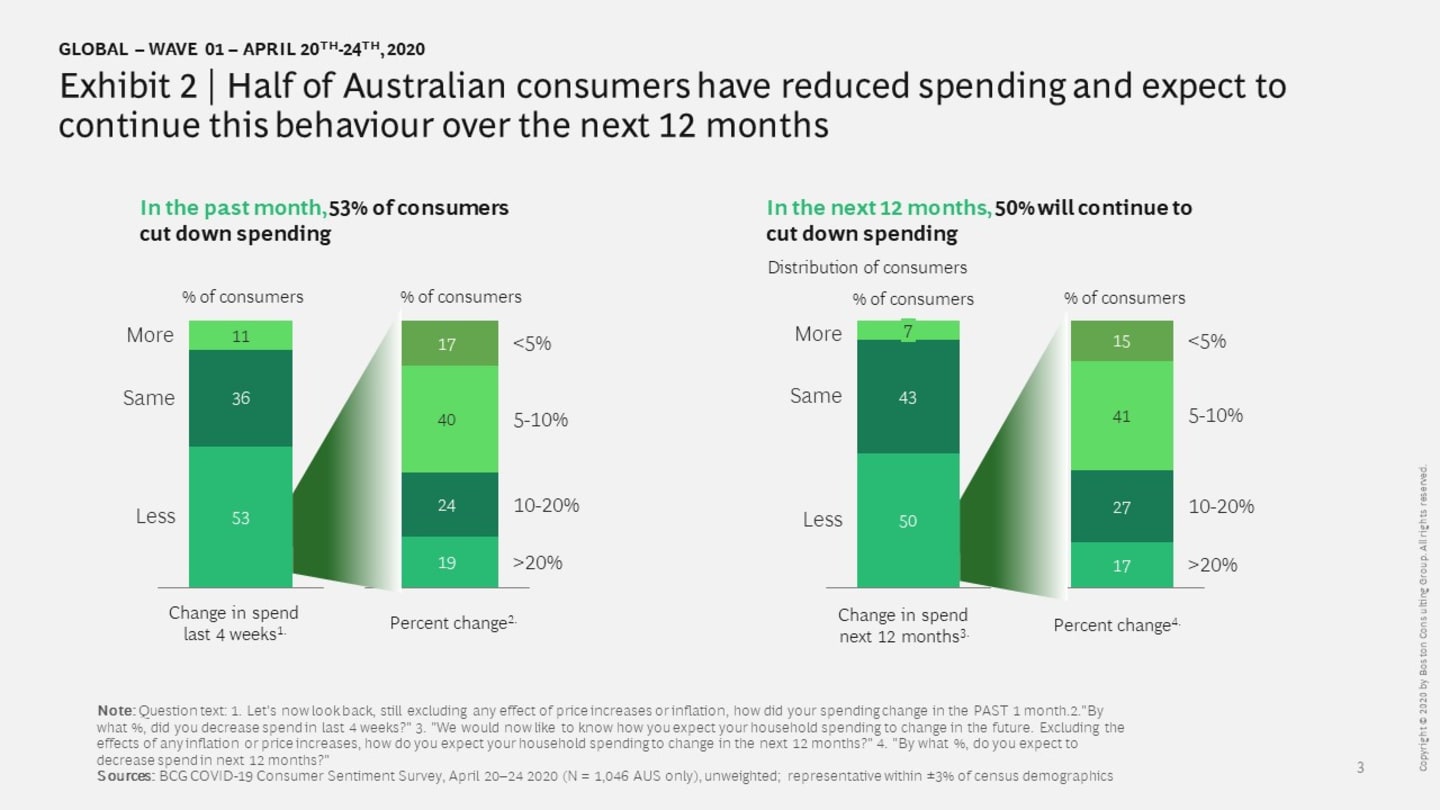

It's not just luxury spending that Australians plan to cut back on either, as overall spending is expected to go down.

According to the report, 53% of respondents said they have reduced spending in the past month, while only 11% reported an increase.

Over the next 12 months, 50% said they plan to spend less, 43% plan to spend the same, while a mere 7% will spend more.

Source: Boston Consulting Group

Previous data from the likes of the Australian Bureau of Statistics (ABS) saw retail sales explode by 8.5% in March - the biggest increase ever recorded - thanks to unprecedented demand in food retailing, household goods, and other retailing before COVID-19 restrictions set in.

However this number is expected to fall significantly in the coming months as the reality of the restrictions sets in, and that ABS data also shows a big drop in cafes, restaurants and takeaway food services (-22.9%), clothing, footwear and personal accessory retailing (-22.6%), and department stores (-8.9%).

"COVID-19 is also steering consumers towards a simpler way of life," the BGS report said.

"Ethnographic research conducted by BCG Platinion illustrates this retreat to the simpler life further with consumers using the time returned from commuting to pursue creative interests: baking bread, growing vegetables and nurturing gardens, and home maintenance.

"Our Consumer Sentiment study reveals that 74% of consumers who have cut down on eating-out are cooking meals at home, and one-third of Australians are taking up DIY home repairs."

Concerns about the economy grow

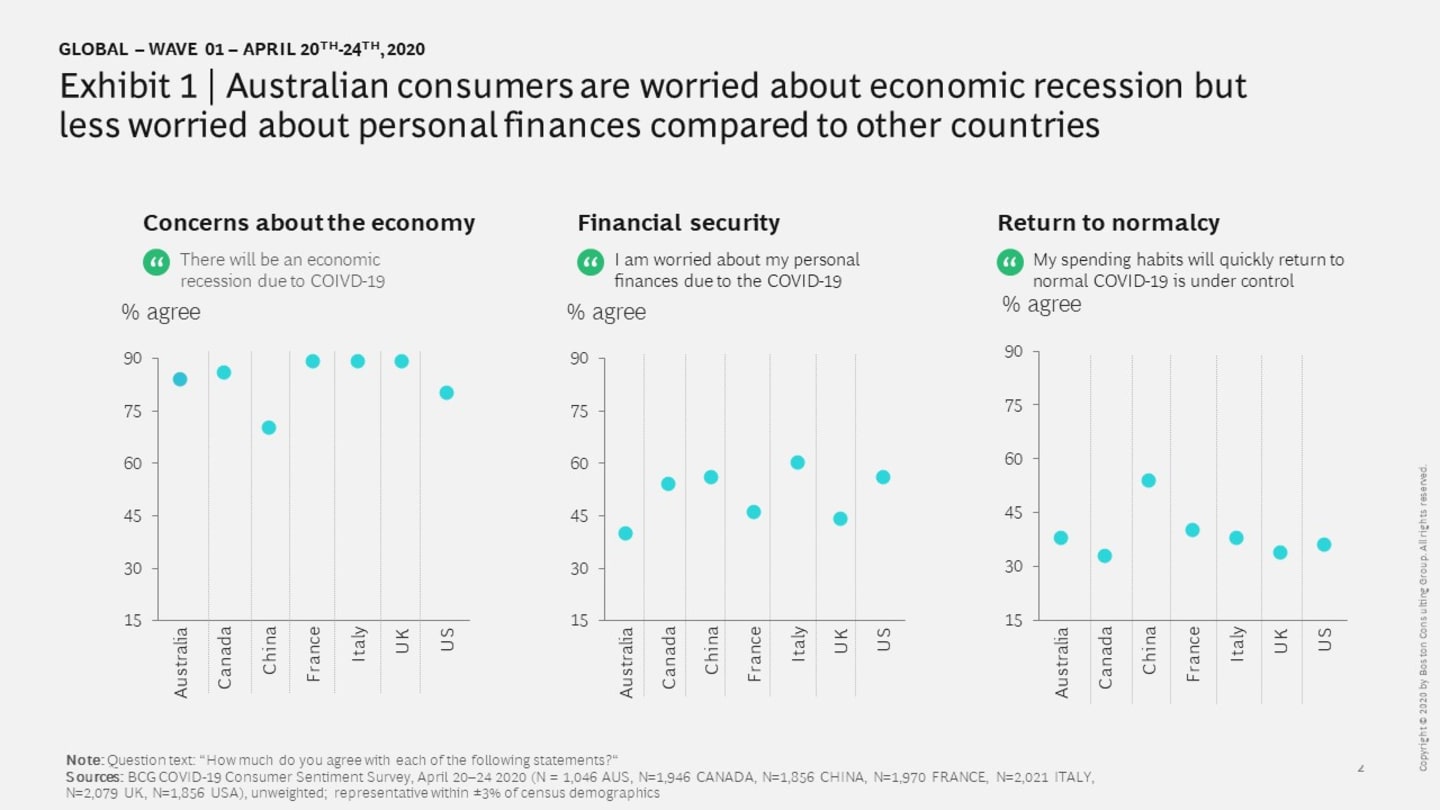

The report also revealed that Australians have grim expectations for the future economic outlook, and are planning to change their lifestyles accordingly.

More than 80% of consumers believe there will be a recession post COVID-19, while 40% of Australians feel financially insecure at the moment.

However, Australians are still more confident than other world markets such as France, Italy and the UK.

"All mature markets show a similar concern over the rate of recovery and whether their spending habits will return to normal post COVID-19, with Australia faring best on personal financial security," the report said.

"Contrasting with developed countries, Chinese consumers in this time of unprecedented change are more resilient and are already showing a return to normal spending habits."

Source: Boston Consulting Group

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan

William Jolly

William Jolly