As the coronavirus pandemic grinds the country to a halt, more Australians are adjusting to working from home as offices around the nation have been forced to close to stop the spread of the virus.

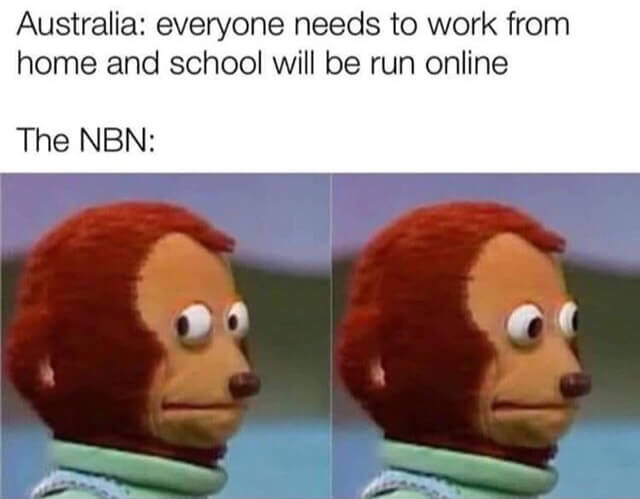

As a result, stationery shops have seen equipment flying out the door, telco companies have been forced to increase network capacity, and the NBN has been pushed to its limits.

While working from home can come with its benefits like getting to sleep in longer, avoid the daily commute and work from bed in your PJs, it can also hurt your hip pocket if you're having to fork out for expenses your employer would normally cover, like:

- Increased utility bills,

- Increased use of your phone and home internet

- Purchasing equipment so you can do your job

The good news is that you can claim most of these expenses back at tax time.

If you're one of the many Australians now working from home for the foreseeable future, here's what you need to know about the tax implications of working from home in the age of coronavirus.

Looking for a place to store cash? Below are a handful of 6-month term deposits with some of the highest interest rates in the market.

| Bank | Term Deposit | Interest Rate | Interest Frequency | Term | Automatic Rollover | Maturity Alert | Early Withdrawal Available | Minimum Deposit | Maximum Deposit | Notice Period to Withdraw | Account Keeping Fee | Online Application | Joint Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

4.30% p.a. | At Maturity | 6 months | $5,000 | $10,000,000 | – | – |

| Promoted | Disclosure | ||||||||||

4.40% p.a. | At Maturity | 6 months | $1,000 | $1,000,000 | – | – | |||||||||||||

4.20% p.a. | At Maturity | 6 months | $5,000 | $1,000,000 | – | – | |||||||||||||

4.40% p.a. | At Maturity | 6 months | $5,000 | $19,999 | – | – | |||||||||||||

4.10% p.a. | At Maturity | 11 months | $5,000 | $10,000,000 | – | – |

What can you claim?

According to the Australian Taxation Office (ATO), if you work from home then you can claim the work-related proportions of household costs such as:

- Heating, cooling and lighting bills

- Costs of cleaning your home working area

- Depreciation of home office furniture and fittings

- Depreciation of office equipment and computers

- Costs of repairing home office equipment, furniture and furnishings

- Small capital items such as furniture and computer equipment costing less than $300 can be written off in full immediately (they don’t need to be depreciated)

- Computer consumables (like printer ink) and stationery

- Phone (mobile and/or landline) and internet expenses

If you had to buy a computer so you could do your work from home, the ATO says you can claim the full cost of items up to $300. If your computer cost more than that, you can deduct the decline in value of your new computer by using the ATO's depreciation tool.

H&R Block Director of Tax Communications Mark Chapmann said those working from home need to identify a 'working area' in their home.

"Ideally, you should have a specific room set aside as a home office," he said.

"If you are using a room with a dual purpose (e.g. dining room), or a room shared with others (e.g. lounge room) you can only claim the expenses for the hours you had exclusive use of the area."

Not sure I’ve got this working from home thing down yet. After 12 hours on the journalism tools is it ok to still be in my pyjamas? Was I supposed to leave the house? And clean my teeth? Really? At least I have a rocking story for tomorrow’s @dailytelegraph #coronavirusau #auspol

— John Rolfe (@rolfey) March 25, 2020

How can you make your claim?

Mr Chapmann says there are two ways you can make a claim.

The first one is the diary method to work out how much of your household running expenses relate to doing work in your home office.

The diary needs to detail the time you spend in the home office compared with other people who use the home office. You should keep a diary record for a representative four-week period.

"The ‘work-use proportion’ you come up with over that four-week period can then be applied to all your actual expenditure over the course of the year," he said.

"Of the two methods this usually produces the larger deduction but the record-keeping requirements are more stringent.

"It may well be that you are already working from home from time to time but that the amount of home-working will spike over the next few weeks or months.

"If that’s the case, keep a separate diary for the period of your “corona-induced” home working to justify the larger claim over this period – and don’t try to apply this larger work-related proportion to the whole year!"

The other method is the 'ATO rate per hour method' where you use a fixed rate of 52 cents per hour for home office expenses like heating, cooling, lighting and the decline in value of furniture instead of keeping details of actual costs.

You just need to keep a record of the number of hours you use the home office and multiply that by 52 cents (0.52).

Assuming you work for eight hours a day, this would mean you could deduct $4.16 for running expenses for each day you work from home. Over a five-day working week, that would amount to $20.80. In a month, that adds up to $83.20.

In addition to claiming 52 cents per hour, Mr Chapmann says you can also make a separate claim for phone and internet expenses, computer consumables and stationery, and the depreciation of computers or other equipment.

The most famous working from home family on the planet are now live on BBC World pic.twitter.com/T9vGrKu8tJ

— Ryan Northover (@RyanNorthover) March 26, 2020

Common work from home mistakes

If you were hoping to claim back a portion of your rent or mortgage, Mr Chapmann has some bad news.

"Sadly, this isn’t allowable."

The other big mistake people make is trying to claim too much.

"It is quite common for people to have insufficient documentation to support a home office claim, particularly around the proportionate split between business use and personal use so be sure to keep records," he said.

Disclaimers

Savings.com.au does not provide tax advice. This material has been prepared by Savings.com.au and is for informational purposes only, and is not intended to provide, and should not be relied on for tax advice.

For tax advice relevant to you, visit the ATO or consult an independent tax advisor.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Hanan Dervisevic

Hanan Dervisevic