These changes include 45 basis point interest rate cuts to its eight-month term deposit products:

- The eight-month term deposit with interest paid at the end of the term now has an interest rate of 2.1% p.a, down from 2.55% p.a.

- The eight-month term deposit with interest paid monthly now has an interest rate of 2% p.a, down from 2.45% p.a.

Rate cuts of 40 basis points were made to Greater Bank’s 10 and 11-month term deposits – these rates now sit between 2.1% p.a. to 2.2% p

Rate changes were also made to other terms, including a few increases.

Greater Bank’s three, four and five-year deposit rates were increased by five, 10 and 15 basis points respectively, while its six-month term deposit was increased by 40 basis points.

Some of these changes are summarised below:

| Term | Old interest rate | Change (basis points) | New interest rate |

|---|---|---|---|

| Six months | 1.90% p.a. | +40 | 2.30% p.a. |

| Eight months | 2.55% p.a. | -45 | 2.10% p.a. |

| Nine months | 2.60% p.a. | +10 | 2.50% p.a. |

| 10 months | 2.60% p.a. | -40 | 2.20% p.a. |

| 11 months | 2.60% p.a. | -40 | 2.20% p.a. |

| Two years | 2.80% p.a. | -15 | 2.65% p.a. |

| Three years | 2.75% p.a. | +5 | 2.80% p.a. |

| Four years | 2.75% p.a. | +10 | 2.85% p.a. |

| Five years | 2.75% p.a. | +15 | 2.90% p.a. |

Note: Above interest rates are for Greater Bank term deposit products paying interest at the end of the term. Based on a deposit of $10,000

Greater Bank’s latest term deposit rates remain fairly competitive, but still some way off the highest interest rates on the market.

Greater Bank not alone

Greater Bank is just one of several institutions to make changes to their term deposit products over the past few weeks and months.

The institution joins the likes of Macquarie, UBank, NAB, Commonwealth Bank, ANZ, Heritage Bank and Rabobank, among others, who have changed interest rates recently.

In March 2019 alone, 20 institutions have made changes to their term deposit interest rates.

While there have been some increases scattered about in the large list of changes, the majority of them are decreases.

But more rate cuts could be on their

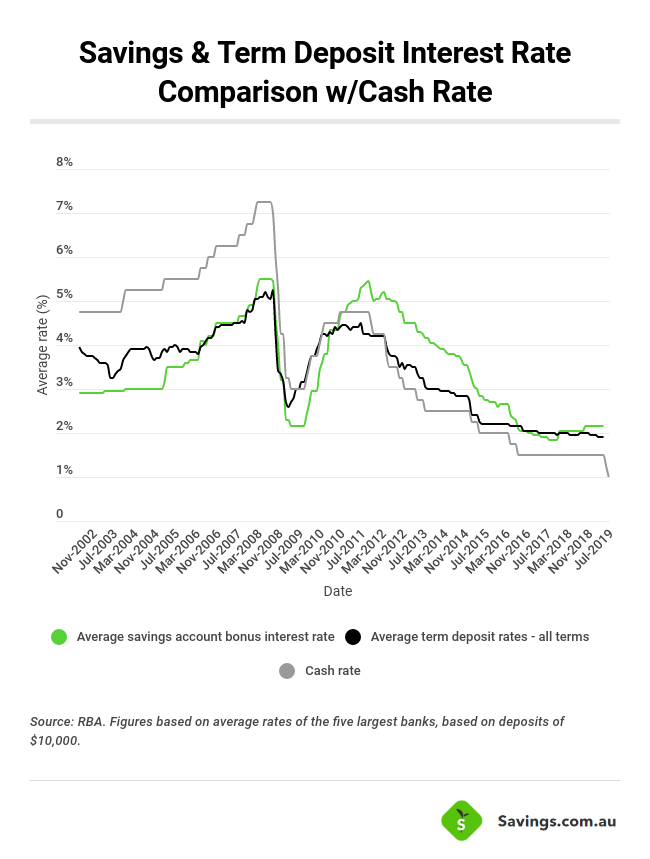

Our cash rate currently sits at 1.50% – already a record low – yet the likes of NAB, Westpac, Morgan Stanley, UBS, AMP and JP Morgan have all chimed in over the past few weeks and stated the Reserve Bank will cut rates in 2019.

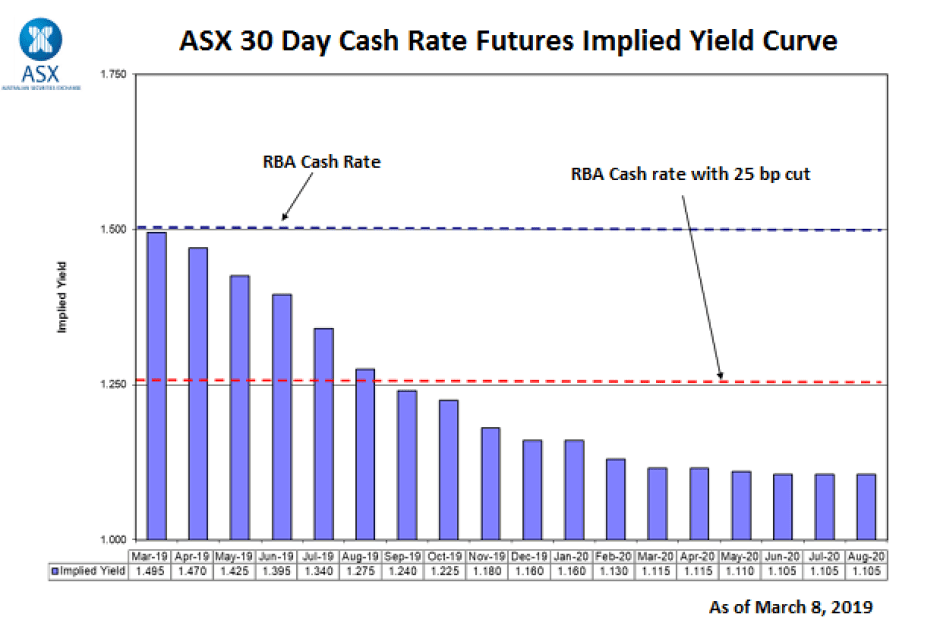

According to the ASX, the futures market has also priced in a 25 basis point cut by September 2019.

Source: ASX

A number of institutions have forecast that there will be two 25 basis point cuts in 2019, bringing the cash rate down to 1.00%

Of course, term deposits rates are fixed, so customers who lock in a good term deposit rate now won’t be affected by rate cuts over their term until it has expired.

But when the term does expire, customers will often have their rate rolled over to whatever that term’s new rate is – unless they switch to a new term deposit.

Bernadette Lunas

Bernadette Lunas

Harry O'Sullivan

Harry O'Sullivan

Dominic Beattie

Dominic Beattie

William Jolly

William Jolly