Here’s our wrap of the latest interest rate changes affecting savers.

Savings account rate changes

Plenty of banks have cut interest rates on their savings accounts since the latest cash rate cut, with the average total savings account interest rate across more than 50 products now sitting at just over 1.70% p.a.

One of the more popular savings account products to have its interest rate slashed was ING’s Savings Maximiser account, which endured a 25 basis point cut on 9 July – a greater reduction than the 20 basis point cut due to be passed on to home loan customers later this month.

Including its 25-point cut on 17 June, this product has seen its maximum interest rate fall by 50 basis points in less than a month from 2.80% p.a. to 2.30% p.a.

ME’s Online Savings account, another market-leading product, has also copped 25-point chop, reducing its maximum rate from 2.60% p.a. to 2.35%.

So too has BOQ’s Fast Track Saver account.

Previously featuring as one of the highest savings account rates on the market, it too has seen its maximum interest rate fall by 25 basis points to 2.50% p.a.

It’s worth noting however that BOQ also offers a maximum interest rate of 3.50% p.a. to 14-24 year olds for balances up to $10,000, as long as $200 is deposited from a linked BOQ transaction account.

Savers still looking for market-leading interest rates could consider the following, but there’s a strong chance these institutions will also cut rates in the coming weeks:

| Product | Maximum interest rate (p.a.) | Base rate (p.a) | Bonus rate (p.a) |

|---|---|---|---|

| MOVE Bonus Saver | 2.60% | 1.40% | 1.20% |

| MyState | 2.60% | 0.80% | 1.80% |

| UBank USaver with Ultra | 2.60% | 1.54% | 1.06% |

| RAMS Saver | 2.55% | 1.15% | 1.40% |

Data accurate as at 12 July 2019. Introductory rates not included. Rates sorted by maximum interest rate then by the provider’s name (A-Z).

Big four savings account rate changes

Both ANZ and NAB have cut savings account rates for the second month in a row, with NAB slashing rates this month by 19 basis points and ANZ by up to 25.

In a statement, Commonwealth Bank said it would cut the interest rate on its NetBank Saver account by 15 basis points on 23 July.

Angus Sullivan, Group Executive Retail Banking Services at Commbank said the bank was focusing on balancing the benefits and costs of further interest rate reductions between its home loan and deposit customers.

“We have carefully considered how to respond to this latest official interest rate cut, given that it is not possible to pass on the full rate reduction to over $160 billion of our deposits, including deposits where interest rates are at or already near zero,” he said.

“We have made a deliberate choice to limit the interest rate reduction to 0.15% p.a. on our most popular savings account, NetBank Saver.”

It should be noted however that CommBank’s Netbank Saver product has an introductory rate of 2.20% p.a. for the first four months, before reverting to its standard rate of just 0.30% p.a.

NAB’s Chief Customer Officer for Consumer Banking Mike Baird said NAB had also assessed a range of factors in deciding what to cut by.

“Decisions like these are difficult and reflect the current unique circumstances, with home loan rates at record lows at the same time as deposit and savings rates also being at record lows,” Mr Baird said.

“Getting the balance right is an ongoing challenge for banks and with 9 million customers, making the right decisions for our customers matters for the Australian economy.”

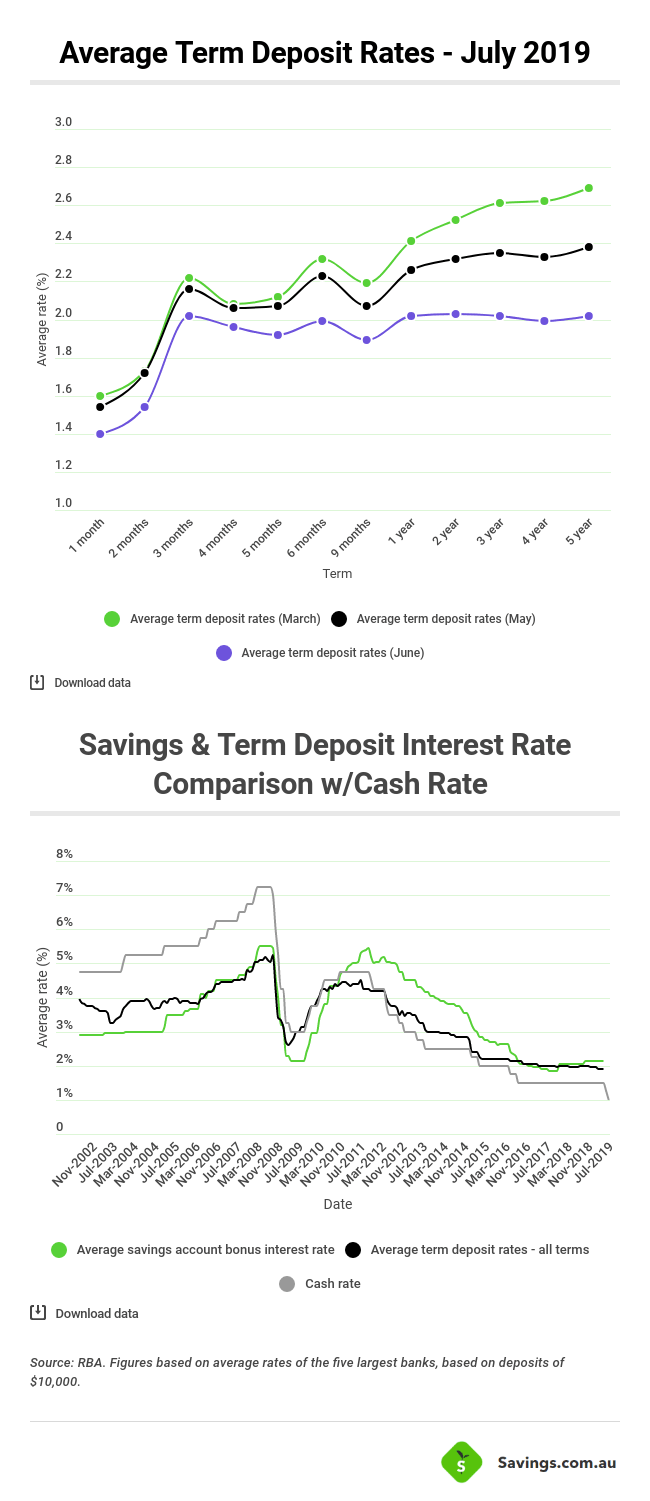

Term deposit rate changes

Term deposits haven’t fared much better than savings accounts, with many experiencing rate cuts, as expected.

Unlike savings accounts, changes to term deposits vary significantly, as each institution can have dozens of different term deposit products, all of which have different rates and terms.

Some of the key changes seen since the rate cut on 2 July include the following:

- ING decreased term deposit rates by up to 20 basis points (12 July)

- Delphi Bank decreased term deposit rates by up to 60 basis points (12 July)

- Heritage Bank decreased term deposit rates by up to 35 basis points (11 July)

- BOQ decreased term deposit rates by up to 40 basis points (11 July)

- RACQ decreased term deposit rates by up to 30 basis points (10 July)

- Bendigo Bank decreased term deposit rates by up to 25 basis points (10 July)

- UBank decreased term deposit rates by up to 10 basis points (9 July)

- Suncorp decreased term deposit rates by up to 50 basis points (8 July)

- Macquarie decreased term deposit rates by up to 10 basis points (8 July)

- ME decreased term deposit rates by up to 20 basis points (8 July)

- CUA decreased term deposit rates by up to 25 basis points (2 July)

Although most of the changes have been decreases, there are some increases scattered among them.

ING, for example, increased rates on its 330-day term deposits (11-months) by 80 basis points, going from 1.50% p.a. to 2.30%. p.a.

G&C Mutual Bank and Bank of Sydney have also increased rates on select term deposit products by up to 20 and 35 basis points respectively, so there is still a silver lining out there in the deposit market for customers who are willing to shop around.

The average term deposit rate for all terms, based on a comparison of most providers, now sits well below 2.00% at around 1.80% p.a.

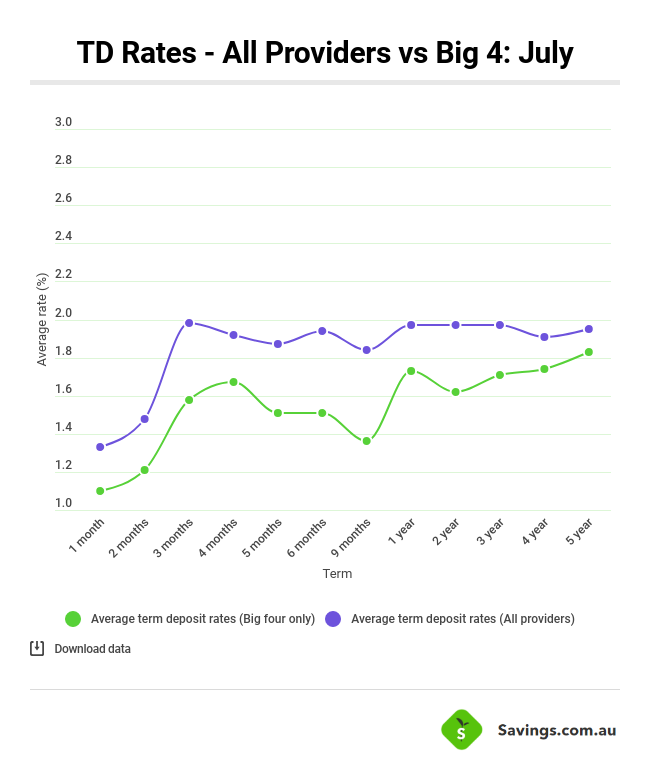

Big four term deposit rate changes

NAB and Westpac are still yet to make term deposit changes, but ANZ and Commbank have.

ANZ has made a host of changes, most notably dropping interest rates by as much as 50 basis points to its 11-month Advance Notice term deposit – a rate that was actually increased by 80 basis points in June.

CommBank meanwhile has dropped deposit rates by as much as 25 basis points but has also announced a new special five-month term deposit rate of 2.20% – a 20 basis point increase – with the potential to reach 2.30% p.a. for existing pensioner customers who visit a branch.

These changes, as well as the plethora of other cuts that occurred last month, mean the average term deposit rate across all terms from the big four banks is just over 1.50% p.a. based on a sweep of their products.

Bea Garcia

Bea Garcia

Bernadette Lunas

Bernadette Lunas

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury

William Jolly

William Jolly