According to Commonwealth Bank's early credit card data, retailers experienced an especially good Black Friday and Cyber Monday, with record numbers of shoppers heading in-store and online to take advantage of the deals.

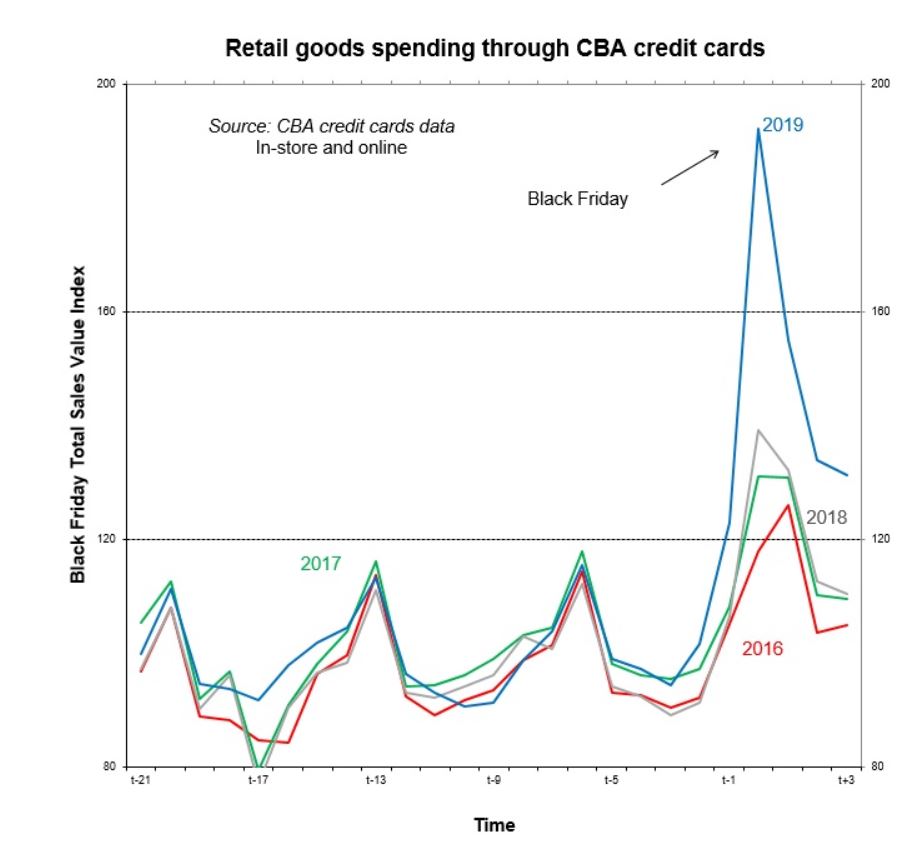

Retail expenditure lifted 87% on Black Friday compared with the average spend in the three weeks prior, according to Commonwealth Bank Senior Economist Kristina Clifton.

"Retail goods spending across the weekend following Black Friday and on Cyber Monday was also well above average November sales. We have seen spikes in spending at time of the Black Friday sales in the previous years but they have been much smaller in size, averaging around 28%," Ms Clifton said.

Over the four-day sale period, electronic goods and department stores experienced the biggest online uplift.

"By category, online spending in department stores and electronic goods retailing rose by 238% compared to the average November daily spend, while in store spending was up by 153%," Ms Clifton said.

"Online clothing sales rose by 146% and in-store clothing sales rose by 52%. Home furnishings and equipment spending was up by 116% online and 33% in-store. Not surprisingly, food and liquor posted smaller rises than the other categories both online and in-store."

eBay Australia Head of Retail Insights Gavin Dennis said this year marks the first time in many years that Black Friday has fallen so late in November.

"Our data reinforces the changing buyer behaviour with Australians shopping smarter and taking advantage of retailer discounts ahead of Christmas," Mr Dennis said.

Compared to Black Friday last year, home furnishings and equipment saw more than four times the uplift in-store while liquor stores saw more than three times the uplift in online sales.

Commonwealth Bank Chief Economist Craig James said the spike was likely because consumers were waiting for the sales periods to spend up big.

"If you have been given a handout by the Government, would you spend it immediately or wait to spend it at a time when it had greater purchasing power - like Black Friday/Cyber Monday sales? Most people would say the latter, and judging by the retail trade figures, that is likely what Aussie consumers have done," Mr James said.

"We'll have to wait for the November and December figures to see if consumers engaged in more significant retail therapy."

Ms Clifton said most consumers probably took advantage of the sales to do their Christmas shopping.

"It's likely that consumers brought forward some of their usual Christmas spending to November or early December to make the most of the discounts. It may also prove the case that some consumers had been holding on to their tax rebates to spend in the Black Friday sales," Ms Clifton said.

Harrison Astbury

Harrison Astbury

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy