A survey commissioned by Tribeca Financial found over 44% of Australians admitted to creating debt with indiscriminate, everyday purchases such as ordering takeaway food and eating out.

More than half (54%) of those surveyed said holiday spending, education costs, updating homewares and furniture, and ‘big ticket’ purchases were to blame for their for spiralling debt.

Tribeca Financial’s CEO, Ryan Watson said he is disillusioned about people getting themselves into debt and their admittance to drowning in debt.

“It is alarming for people to get into credit card debt over insignificant purchases like takeaway food and Uber Eats. The debt mounts up, leading to Aussies managing debt with high interest rates,” Mr Watson said.

“It is concerning, and it’s causing financial stress for two in five Australians.”

One third (31%) of Aussies confessed to poor financial management, such as using cash advances on credit cards, not knowing how to budget, not paying attention to debt, and racking up late fees on credit cards.

The research shows nearly nine million Australians are aware of their own credit mismanagement, with two-thirds of this group admitting to experiencing issues with repaying credit card debt.

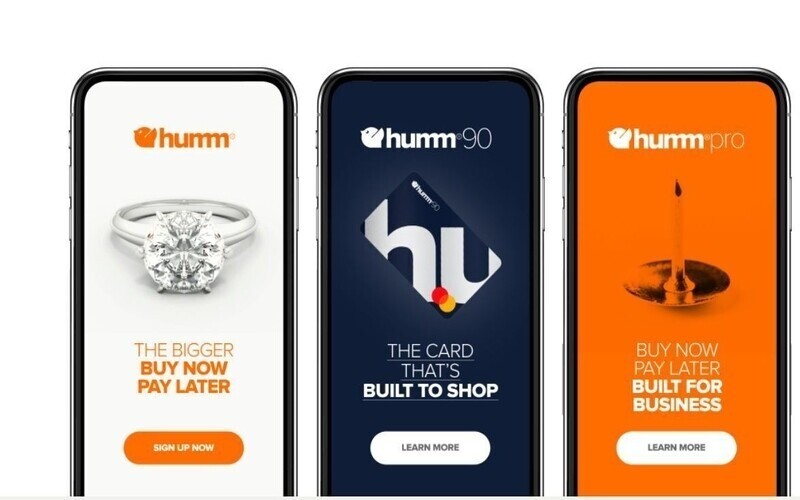

Nearly half (48%) of Australians who are aware of their credit mismanagement said they have maxed out their credit card, gone over their spending limit, continued to make purchases with buy now, pay later services, or have purposely made purchases late at night in an attempt to rort the credit card approval system.

“I am consistently disappointed by lenders who act in their own best interests, often with no consideration of an individual’s ability to manage debt. Our research found almost nine in 10 Australians have been subject to additional charges relating to their credit card,” Mr Watson said.

But he says the blame can’t all be laid on credit card providers.

“It seems Aussies are knowingly getting themselves into debt, and banks and financial providers are benefitting as a result.”

Harrison Astbury

Harrison Astbury

Denise Raward

Denise Raward

Dominic Beattie

Dominic Beattie