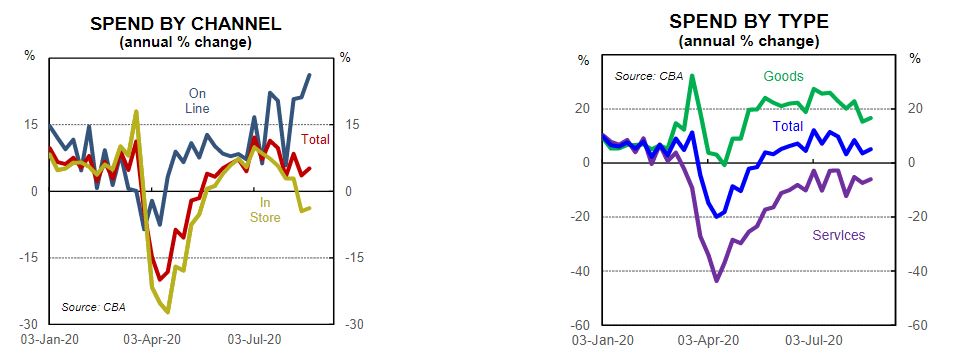

The latest Commonwealth Bank credit and debit card data for the week to 21 August shows nationwide card spending is little changed over the week and still sits 5% higher compared to 12 months ago, with states like Western Australia, Queensland and Tasmania actually running above pre-COVID levels in terms of spending.

But it's a very different story in Victoria, where, thanks to stage four restrictions, Victorian spending is still down 10% compared to a year ago, a number that would be much worse if not for a significant lift in education spending.

Source: CBA

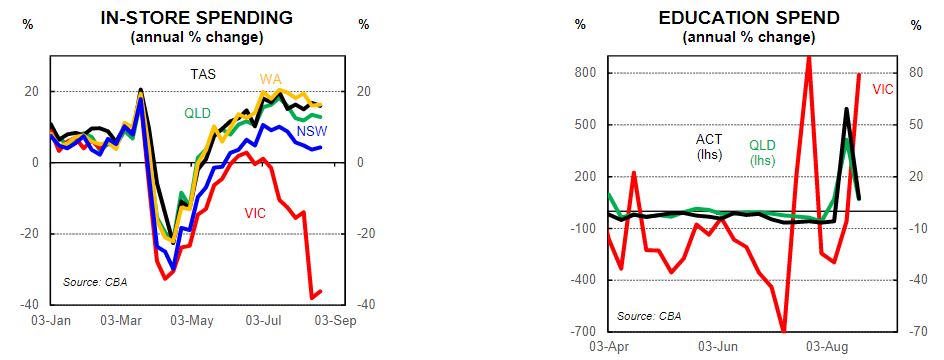

In-store spending in Victoria is particularly weak, down almost 40% from a year ago.

"The divergence between state in-store spending is material. State success in controlling COVID-19 will likely continue to dictate in-store spending patterns," CBA economist Kristina Clifton said in the report.

"In-store spending is strongest for WA, QLD and Tas, But Vic in-store spending remains extremely weak."

Source: CBA

"In Victoria, the various COVID-19 restrictions have seen spending at pubs, bars and nightclubs remain very weak," the report said.

"This also looks to have partially spilled-over into NSW. Meanwhile, in WA drinking-out has thrived over the past five weeks with spending up around 40% on year-ago levels.

"National in-store spending has been weak with NSW and Vic placing a lid on total spending growth over recent weeks."

Spending and confidence improving slightly

Despite spending in Victoria being down 10% on 12 months ago, there may be some green shoots appearing.

The prior week's CBA card spending update - for the week ending 14 August 2020 - showed that nationwide spending was 4% higher over the year and card spending in Victoria was down by 15%. .

Today's weekly ANZ-Roy Morgan Consumer Confidence shows consumer confidence moved up 4.1 points to 92.7 on 22 August - the highest level it's reached since late June.

ANZ-Roy Morgan Aus Consumer Confidence: Jumps more than 4% for the strongest gain in some time. Current economic conditions up 25% in the past two weeks, but still a way below neutral. Confidence is now above neutral in Perth & Adelaide. #ausretail @DavidPlank12 @roymorganonline pic.twitter.com/fW0tZFMb2g

— ANZ_Research (@ANZ_Research) August 24, 2020

According to the report, confidence rose as new cases of COVID-19 in Victoria plunged to their lowest level since early July.

ANZ's Head of Australian Economics David Plank said this was an encouraging development.

"The substantial decline in active cases in Melbourne and continued low numbers in Sydney have raised hopes that the pandemic can be contained without a broadening of lockdowns beyond those already in place," Mr Plank said.

"Confidence was up firmly across all states except Victoria and NSW, where the gains were more subdued. Sentiment is now above neutral in Perth and Adelaide."

Harrison Astbury

Harrison Astbury

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy

William Jolly

William Jolly