NAB's quarterly Consumer Anxiety survey, released today, shows a clear spike in anxiety in March as the pandemic sees hundreds of thousands lose their jobs and stricter social distancing measures enforced.

Consumer anxiety lifted across all measures but the biggest increase was around job security, which was up 5.8 points to a survey high of 52.3.

This is despite the survey predating some of the biggest job layoffs triggered by the enforced shutdowns.

NAB's Head of Behavioural and Industry Economics Dean Pearson said the survey showed “just how quickly consumer anxiety is climbing and how our behaviours are changing, really quite rapidly, due to the fear surrounding the coronavirus and the isolation being imposed on many Australians."

NAB's Consumer Anxiety Index rose by 2.4 points over the quarter to 60.1 points: A reading of 100 points indicates 'extreme anxiety'.

Around one in four consumers said they had spent more than they had earned in the last three months, and that number was significantly higher among lower-income groups.

Household spending behaviours were also more conservative as consumers significantly cut back their spending on non-essentials.

Overall, Australians reported a decrease in their income and a strong decline in their savings over the last three months.

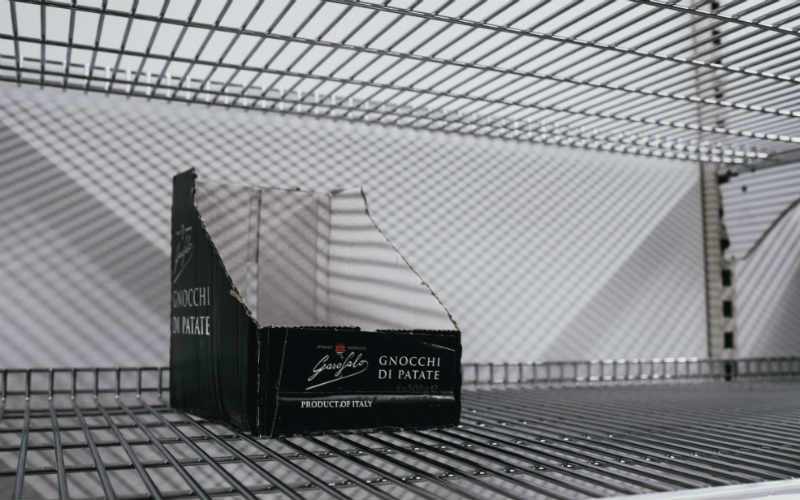

While increasing levels of consumer anxiety and shutdown measures means consumers are spending less money on non-essentials and travel, they are spending up big on essential household items such as groceries.

"The most obvious change has been the bulk buying of household supplies, creating significant shortages in supermarkets," Mr Pearson said.

"There has been strong growth in demand for anything that revolves around being at home, including work, entertainment and health, driving demand for everything from toilet paper, fitness equipment, gardening supplies to home improvement."

Forced isolation and social distancing measures are also driving consumers to shop online.

"Demand for delivery services is strong, with growth extending well beyond retail, including food and on-demand products such as streaming services, gaming and a range of other goods and services perceived as helping us better adapt to these unprecedented times," Mr Pearson said.

"We may also see the market penetration of online deepen as people historically more reluctant to use e-commerce, such as the elderly, change their habits.

"Retailers are also driving this change. For example, due to the huge demand for online grocery, some supermarket chains have been giving priority access to online delivery slots for older Australians.

"More generally, the shortage of some items has prompted shoppers to search online for types of products they would have normally never sought to purchase this way. Cashless payment adoption and usage can only continue to grow."

Looking ahead, Mr Pearson said it is difficult to see how consumer anxiety will not continue to climb from here.

"Spending will fail to rebound strongly once concerns around the virus dissipate," he said.

"Indeed, when asked in the survey about their expectations in making a major purchase over the next 12 months, on balance consumers were deeply negative and particularly pessimistic about major household items, travel/holidays and investment properties."

Harrison Astbury

Harrison Astbury

Denise Raward

Denise Raward

William Jolly

William Jolly