These trends which will emerge in 2020, at least according to urban planner Mike Day, co-founder and director of RobertsDay, who said what takes place in the next 12 months will set precedent for the next ten years.

“As our population grows, and innovative new technologies and ideas emerge, future generations will look back at the 2020s and point to it as a decade that reshaped our cities – especially our outer suburbs – more than any other decade in the last century,” Mr Day said.

Mr Day outlined his 10 city forecasts for 2020, with changes driven by Millennials and Baby Boomers alike.

1. ‘Mini Melbournes’ will emerge in outer suburbs

Mr Day said that inner neighbourhoods in Sydney, Melbourne and Brisbane are in demand not just because of their location.

“Their layout of small parks, little main streets, terraces, shop-top housing, laneways and public transport at their doorstep are highly attractive to residents,” he said.

“From 2020, designers and developers of fast-growing new communities in outer suburbs will use inner-city area templates to create equally attractive new communities, which will ‘urbanise the burbs’.”

Sydney and Melbourne property prices have surged in recent months while the combined capital monthly growth for October was 2.0%, according to CoreLogic.

With house prices expected to skyrocket in 2020, developers may look to capitalise on homebuyers looking outside the inner-city for more affordable housing.

2. Climate, environment and health will direct planning decisions

With an ever-increasing focus on climate change and renewable energy, Mr Day said the Australian public is beginning to expect organisations to think green.

“In 2020, air quality, water quality, waste management, green spaces, public spaces, public health and more will impact developer and urban planning decisions,” he said.

A report by the Climate Council released in May found Australia’s property market could lose $571 billion in value over the next decade thanks to extreme weather caused by climate change.

“Acting on climate change would be absolutely peanuts compared to the catastrophic costs of failing to act. This report quantifies that.”

— Climate Council (@climatecouncil) May 9, 2019

The property market is expected to lose $571 billion in value by 2030 due to climate change and extreme weather. https://t.co/mW8KErxi3F pic.twitter.com/AsR7zmZ9cz

3. Townhouses are the big trend for 2020

According to data from the Australian Bureau of Statistics (ABS), over 667,000 apartments have been constructed since the year 2000.

However, oversupply coupled with the recent Mascot and Opal Tower construction debacles could see townhouses become the new cool kid on the block.

“With home buyers’ growing lack of trust in new apartment blocks, due to recent construction crises, and their desire to have a direct street frontage and an urban courtyard, more developers and housebuilders will produce townhouses,” Mr Day said.

“Their sizes can range from 80sqm up to 400 sqm, and they are relatively affordable – an 80 sqm townhouse can sell for as little as $300,000 (depending on the location).”

4. Lower rates of private vehicle ownership

Having a car will soon be seen as a hassle rather than a luxury as Aussies in their teens and 20s opt out of getting a driver’s license if they live in a compact community.

“The loss of interest in personal vehicle ownership will be largely due to the cost of owning and maintaining cars and traffic congestion,” Mr Day said.

“The RACQ has estimated that a small car costs more than $6000, and a medium-sized car more than $10,000 a year to run – this is equal to servicing approximately $100,000 of a mortgage.”

New vehicle sales continue to struggle in Australia, with Australia’s peak automotive industry confirming a 20th consecutive month of falling sales figures.

According to the Federal Chamber of Automotive Industries (FCAI), there was a 9.8% decrease in sales of new cars in November 2019 compared to November 2018.

5. Growth in sustainable and affordable mobility

As car ownership decreases, growth in alternative and affordable transport will increase.

“The slowing interest in car ownership is also due to growing and widespread on-demand technology-supported transport options such as Uber and electric bikes and scooters, and affordable public transport initiatives such as trackless trams,” Mr Day said.

Australia’s most popular ride-sharing app Uber had a total of 42.6% (1 million) of Aussies aged 18-24 and 35.7% (1.3 million) aged 25-34 using its service in the three months up to August 2019, according to Roy Morgan.

Meanwhile, car rental services have begun to spike in popularity, with brands like Carbar and Maven expanding across the country.

6. A good ‘Walk Score’ will add thousands to property values

A ‘Walk Score’ is a system that measures the ease of walkability of any address to residents’ daily needs, such as schools, shops, parks and places of work, on a scale of 1-100.

“A Walk Score of 70, for instance, indicates that there is transit and therefore is the threshold that a resident at that address can access important amenities without the need for a car,” Mr Day said.

“Just like a property’s proximity to good schools, a high Walk Score value will be an asset that will add value to a property.

“Every point above 70 is worth between $700-3000 in value for a property.”

Australia isn’t a very walkable place currently. Here are the top ten Walk Scores in Australia, according to RobertsDay:

- Sydney – 63

- Melbourne – 57

- Adelaide – 54

- Brisbane – 51

- Perth – 50

- Newcastle – 49

- Wollongong – 48

- Gold Coast – 48

- Central Coast – 41

- Canberra – 40

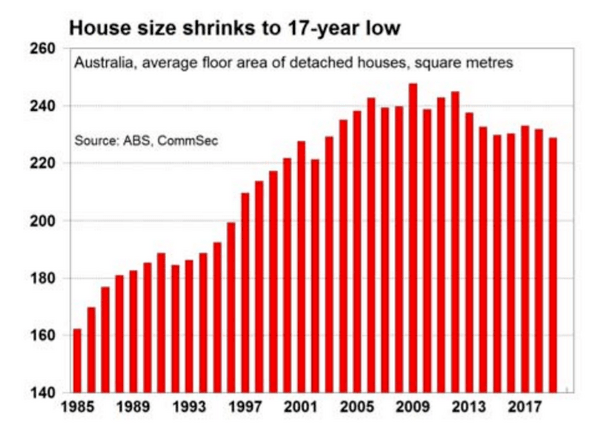

7. A return to smaller homes

The average size of an Australian home is at a 17 year low, a trend that Mr Day expects to continue.

“Next year will see the trend towards smaller homes that are connected to amenities in centralised community locations within walking distance,” he said/

“People in their teens and 20s, the elderly and those of modest means are less able to afford cars, driving the need for such amenities in close proximity to homes.”

8. The growth of ‘mixed-use’ developments

Mr Day said that more mixed-use developments will emerge to create self-sufficient communities framed around walkability.

“In addition, State Government planning systems are already beginning to change and promote ‘overlapping use’: the creation of residential properties on top of retail and commercial sites, and vice versa,” he said.

“The most common examples will be residential apartments constructed on top of shopping centres. This will also help to reinvent shopping centres.”

9. Separation of roads, bicycle paths and pedestrian paths

A report by the Grattan Institute released in October called for all major cities in Australia to impose a congestion charge on drivers during peak hours to ease heavy traffic in the CBD.

Banning cars entirely from CBDs is a topic that’s been brought up more than once in recent years, but Mr Day said investment in bike and pedestrian paths is the future.

“A segregation of roads, cycleways and pedestrian paths has been established and is working in Europe and will begin to grow in Australia’s major cities,” he said.

“As the health and wellness of residents will become a major focus for urban planners, designers, councils and developers, we will see the emergence of walking and cycling ‘superhighways’ (continuous paths) from next year to foster physical activity and social cohesion.”

10. Increased transit-based walkable neighbourhoods

In his final forecast, Mr Day said a strong sense of identity for small communities will drive planning.

“Pedestrian friendliness will be a major benefit that property buyers will start to look for,” he said.

“With this, will come an increase in public spaces, and will give communities a sense of identity and a soul.”

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Datamentary

Datamentary

Harrison Astbury

Harrison Astbury