Research from the National Housing Finance and Investment Corporation (NHFIC), which administers the First Home Loan Deposit Scheme (FHLDS), has analysed the portion of properties first home buyers can afford based on their incomes.

This data was collected in June 2020 - nine months of soaring house prices ago - and it shows low rates of housing affordability for first time buyers on low or even moderate incomes.

According to the research, the bottom 60% of income earners looking for their first home can afford just 10–20% of properties in Sydney and Hobart.

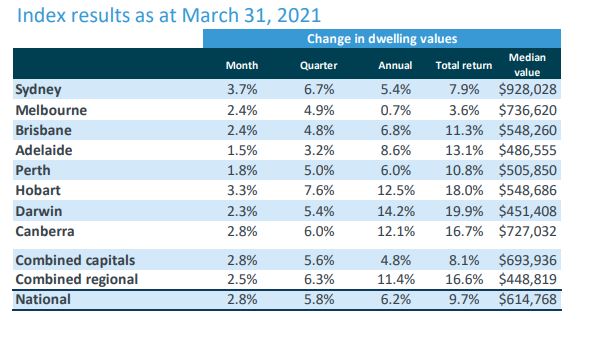

The median dwelling value in these cities is now $923,028 and $548,686 respectively.

Renters in these cities don't fare much better, with 0–10% of homes considered affordable for the bottom 40% of income earners.

'Affordable' in this instance refers to the ability of a household to meet its housing costs (like a mortgage or rent) without compromising basic needs like food or medicine.

This can also be called rental or mortgage stress, which is generally defined as 30% or more of take home income being spent on housing.

Melbourne too has poor affordability for some first home buyers as well as renters.

In the Victorian capital, only 10-20% of properties are affordable for the bottom 40% of income earners, but it gets slightly better, as the bottom 60% of the market can afford between 50% and 60%.

Rentals were deemed unaffordable for the bottom 20-40% of income earners in Melbourne, but this was the case in most capital cities.

See also: Rental affordability the best in 13 years (as long as you aren't on JobSeeker)

Brisbane the most affordable for first home buyers

While Sydney and Hobart might look unaffordable, the story isn't quite so bad in other capital cities.

NHFIC's research shows the most affordable city for potential first home buyers is Brisbane: the bottom 40% of income earners can afford to pay off a mortgage for around 60–70% of homes in the sunshine state capital.

Meanwhile Perth is the best city for rental affordability, as 90-100% of all rental properties are deemed affordable for the lowest 40% of incomes.

Perth and Adelaide fared quite well in terms of housing affordability, falling just behind Brisbane - see the infographic below for the full breakdown of how many properties are available in each capital city based on income groups.

Related: Top 10 affordable Australian regional areas in 2021 revealed

First home buyer numbers are still high. How?

According to Australian Bureau of Statistics data (ABS), lending to first home buyers rose to a 12 year high in January 2021, occupying a market share of 36.5%.

This seems counter-intuitive based on these affordability statistics, and the fact that house prices have only continued to grow so fast since then that regulators have weighed up stepping in.

There are a number of reasons why first home buyers are still entering the market in droves.

First of all, separate NHFIC data shows much of this growth is being driven by the number of state and federal grants available, like HomeBuilder, the First Home Owners Grant (FHOG), or stamp duty concessions.

The combined value of the schemes and concessions can be worth tens of thousands in grants when used together. A first-time buyer in Victoria and NSW could qualify for up to $86,000 and $85,000 worth of grants and concessions respectively.

These bonuses help certain buyers enter the market sooner, but also boost demand and therefore are partly responsible for booming prices.

Other reasons include:

- Record low interest rates

- A surge in parental guarantors (the bank of mum and dad is now the 9th biggest lender in the country)

- Buyers stockpiling cash during the pandemic and bringing their purchases forward

- More buyers looking to regional areas (which now also have worsening affordability)

Photo via Joan You on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan