As a young person, I have always dreamt of owning my own home, but I often wonder how difficult entering the housing market will be when it comes time for me to buy.

I’m hesitant to take advantage of the government schemes floating around and buying with a 5% deposit. On the other hand, I don’t have anywhere near 20% saved yet. With the median house price in Brisbane sitting at almost $700,000, the thought of saving $140,000 seems downright impossible.

In all honesty, the more I save, the further I seem to feel from my dream of home ownership. Unsurprisingly, house prices are climbing much quicker than my bank balance. I’d imagine for people living in places like Sydney and Melbourne, the gap is even wider, and the dream feels even further away.

I’m stressed, I’m scared, and I’m always thinking about whether the Australian dream of home ownership is slipping through my fingers.

But I know I’m not alone. The fear of being unable to afford a house is shared by many right now. So I thought, why not deep dive into the topic and address the seemingly unanswerable question: how hard is it to actually going to be for me, a young person, to buy my first house?

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

The history of Australian house prices: A snapshot

Unsurprisingly, house prices have risen significantly over the past 50 years. As a real-life example, my father purchased a house in Brisbane in the early eighties for roughly $40,000. Today, that same house is pushing $700,000.

Of course, this doesn’t account for inflation - that is, how the dollar today compares to the dollar back in the day. Despite things being very different 50 years ago, or even 30 years ago, the affordability gap between buying then and buying now is unquestionably wider. “But people were paid less”, “interest rates were higher, I was paying 17% when I bought my house” - both classic arguments used by boomers to say that it was actually just as difficult to buy a house back then as it is now.

Interestingly, the stats paint a different picture. It seems that even with inflation factored into the equation, house prices are significantly higher now than they were even 30 years ago.

To give you an idea of house price activity over the past 30 years, we’ve compiled the house prices from 1990 vs 2020 adjusted (to factor in inflation) and non-adjusted. This way, we can truly see just how much house prices have risen just in the past three decades, and put that annoying argument to rest.

Today, houses are even more expensive than they were in 2020. This year alone, Westpac economists have predicted house prices will increase by 18 to 22% on a national scale. But in Sydney, house prices could rise by 27%. How much have wages increased in this time? From the latest release for the June 2021 quarter, wages have increased 1.7% over the year. Unless we’re all about to get massive pay rises, wage growth is nowhere near house price growth.

But just how much have wages increased over time? you might be wondering. The Australian Bureau of Statistics (ABS) has that information too. Below are the weekly wages all the way from 1970 to 2020 compared to the average house price in Sydney at the time.

|

Year |

National average weekly full-time wage |

Average house price in Sydney at the time |

Annual income as a percentage of average Sydney house prices |

|---|---|---|---|

|

1970 |

$84.80 |

$18,700 |

24% |

|

1980 |

$278.40 |

$68,850 |

21% |

|

1990 |

$555.60 |

$194,000 |

15% |

|

2000 |

$802.60 |

$287,000 |

15% |

|

2010 |

$1,272.50 |

$590,000 |

11% |

|

2020 |

$1,737.10 |

$1,211,000 |

7% |

Sources: ABS Average Weekly Earnings, Peter Abelson & Demi Chung.

Why are house prices so high right now?

This begs the question: why are house prices so high right now? Even COVID-19 - which was initially projected to tank the housing market - couldn’t slow things down. Rather, the pandemic actually had the reverse effect. But let’s break this down, so that next time your uncle tries to tell you why it was just as hard for him to buy his first home, you’re equipped with knowledge to tell him exactly why he’s wrong.

Concerns about housing affordability are being flagged left, right and centre. From big banks, countless researchers, online platforms, and even the Reserve Bank of Australia (RBA) - the fact that housing affordability is a pressing issue is undeniable.

But why exactly is that? There isn’t really one answer to this question - rather, a number of factors that have come together to create the perfect storm.

Firstly, we can look to a recent paper from the Grattan Institute which aims to address and provide solutions to housing affordability concerns. This paper names an undersupply of properties available as the main cause of rising house prices. It points out that if 50,000 homes were built every year for 10 years, house prices would be 20% lower than they would be otherwise.

Another significant factor that played into the housing boom is the record low interest rates. James Austin, CFO of non-bank lender Firstmac, said much of the current housing boom is a ‘direct result’ of the Term Funding Facility (TTF) provided to the authorised deposit-taking institutions (ADIs), otherwise known as banks and credit unions. This cheap funding - at 0.10% - allowed lenders to offer competitively low interest rates and cashback offers which, in turn, caused house prices to 'explode’.

A report by insurer QBE points to migration for putting pressure on the housing market. Specifically, limited overseas migration, and an unprecedented outflow to regional areas, both had ‘significant’ effects on house prices. The report also points to a few factors that led to surging house prices: people having more money in savings from lockdowns; wanting more space due to working from home; and the many government incentives available.

The government has launched several incentives to get first home buyers into their first homes sooner. Mainly, the First Home Loan Deposit Scheme (FHLDS), the First Home Super Saver Scheme (FHSSS), and the New Home Guarantee (NHG) are geared specifically towards helping first home buyers. There are a few other government schemes, like the Family Home Guarantee and the Victorian government’s Homebuyer Fund, that are open to not just first home buyers.

How much would you need to earn & have saved to buy a house right now?

Looking across the board, saving up 20% to buy a house in any capital city as a young person, let alone a young person on a single income, can seem impossible. However, for argument’s sake, let’s look at how much you would need to have saved and earn in order to put down that deposit, plus manage a mortgage for the foreseeable future.

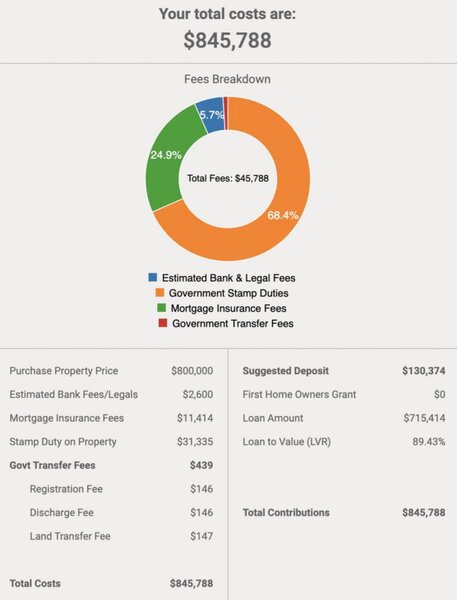

David Sutantyo, Managing Director of finance brokerage firm Twelve Grains, provided us with a break-down of how much a person would need if they were going to buy an $800,000 home with a 10% deposit plus home buying costs, without factoring in any first home buyer schemes.

Source: David Sutantyo

“The rule of thumb is, the amount of debt that you have shouldn’t exceed six times your annual gross income,” Mr Sutantyo told Savings.com.au.

“'Suggested deposit' is what a borrower should have ready in their bank account to contribute to the purchase.

“Assuming the borrower doesn’t have any other liabilities (student loans, car loans, credit cards, etc.), for a $716,000 loan, they need to be earning $120,000 in gross annual income in order to comfortably afford the loan.”

What young person is realistically earning $120,000 in gross annual income? None that I know. Plus, just to put down a 10% deposit, you’d need an eye-watering $130,374 ready to put down on a house. Even just for a 5% deposit - which is the bare minimum - you’d need $65,187 in the bank. I’m not sure about you, but this didn’t make me feel any better about my chances of owning a house in the near future.

So does this mean the Australian dream of home ownership is completely unattainable? I mean, not really - I did kind of assume buying an $800,000 property was out of my reach. If anything, it puts things more into perspective.

Let’s come up with our own hypothetical example that might be more on-par with your personal situation. Off the back of Mr Sutantyo’s example, let’s say you’re earning a modest $60,000 in gross income annually. Six times your income ($60,000) is $360,000. Meaning, you can take on a mortgage of approximately $360,000. On an 95% LVR home loan, a $360,000 home loan could buy you a house valued at around $378,950, with you chipping in the 5% deposit of about $18,950. More doable than $130,000, right?

Will you be able to purchase a beautiful mansion in the heart of Sydney? No, not at all. But can you purchase a small two-bedroom apartment? Depending on where you live - maybe!

Alternatively, you could look towards rural Australia. If you’re a city dweller like me, living hours away out in the middle of nowhere is probably not an option. But house prices out of the capital cities are often much lower, which means you could be able to purchase a house instead of a unit. This is where rentvesting could enter the chat - but we’ll talk more about that later.

Expert opinions: Wait it out & save or buy now?

Here’s a question: should you wait and save as much as you can before you buy, or buy using one/some of the government incentives as quickly as you can? My father, being an old-fashioned accountant who purchased his first house with cash, always tells me it’s better to save as much as you can, only going to the bank for a mortgage once you’ve got well over 20% sitting in the bank. I’m not sure how much he thinks I earn, but to do that, I’d be saving for a really, really long time. By the time I’d saved up enough, house prices would probably be even more expensive than they are now. Then what?

To chime in on my internal debate, I reached out to a few experts to get their opinion. Is it better to wait it out and save? Or should I really be jumping on the government incentives and get my foot into the property market now?

Mr Sutantyo said he totally recommends for anyone that can get their hands on any government incentives to go for it and to buy now. But he said the issue is, it’s actually harder to get government grants than it sounds.

“First home buyers need all the help they can get, especially in this everlasting “bubble” (it’s not),” he told Savings.com.au.

“Unless something extraordinary happens to the housing market, properties aren’t getting more affordable. If you could get your hands on any help to get your foot in the door, do it now.

“Saving up [to 20% deposit] might be a riskier move, you don’t want to be scraping for every single dollar and leave yourself with no reserve in the future just to purchase a growingly mediocre property should you be able to find one.”

Mr Sutantyo said that the biggest misconception about buying with a low deposit is that borrowers think that by taking on higher leverage loans, they are taking on more risk.

“The truth is, the lenders are the ones taking on more risk here. Why? On a higher LVR loan, should the borrower fail to repay and lenders need to foreclose, there’s a bigger chance that the forced-sale proceed of the property will be less than the amount owed,” Mr Sutantyo said.

“Being a property owner with only 5% of the property cost is not risk, it’s liability.”

Mal Cayley, Director and Founder of Direct Collective, said waiting it out and saving 20% ‘wouldn’t be the smartest way to go'.

“Even with a 20% deposit, using it all wouldn’t necessarily be the best possible outcome,” Mr Cayley told Savings.com.au.

“It depends if you are in a position to ‘out save’ the market, i.e. can you save faster than the property can grow in equity. If you can, you might be looking at the wrong property – unless you plan to live there for decades.”

Daniel Hilton, Managing Partner, Lending & Finance at Findex, told Savings.com.au saving 20% is ‘very difficult’ and can take years, but using LMI parental security guarantees can enable entrance into the market.

Mr Hilton also said using government incentives are a ‘great option’ as they assist in meeting deposit requirements/reduce overall debt levels.

“The First Home Loan Deposit Scheme (FHLDS) enables eligible borrowers with as little as 5% deposit to apply for a loan, with the government guaranteeing the remaining 15%,” he said.

“This can be great for first-time buyers but it’s important to note that places are limited for both new and existing properties, and available with participating lenders only (two majors and 25 smaller lenders).

“Individual circumstances should be strongly considered when utilising FHLDS and only having a 5% genuine deposit. There are significant affordability risks associated with high debt levels.”

What happens when interest rates go up?

The historically low interest rates won’t be around for much longer. The cash rate being at its record low is not going to last, which means the low interest rates won’t either. The RBA’s Governor Dr Philip Lowe was adamant that the cash rate won’t go up until 2024, though he recently dropped this guidance. On the other hand, some experts argue it could go up as soon as 2022. Either way, even if it doesn’t go up until 2024, that isn’t that far into the future - it’s just over two years away.

Before we talk about what’s going to happen when interest rates go up - a quick little lesson into the banking world and how lenders offer their interest rates is in order. Basically, the cash rate is the rate at which banks and other lenders borrow money as decided by the central bank - the Reserve Bank of Australia (RBA) - which they then lend out to us normal folk. The cash rate influences the interest rates banks and lenders charge us when we borrow money. So when the cash rate is low, interest rates will typically be low. But when the cash rate goes up, so do interest rates.

Slowly but surely, lenders are already starting to raise their interest rates. What’s going to happen when the cash rate goes up and these historically low interest rates are nothing but history?

Off the back of that explanation, it makes sense when Mr Cayley said the main outcome of interest rates going up will be - “money will cost more”.

“It's not a smart comment, its just there is so much fear around this statement but its unwarranted,” Mr Cayley told Savings.com.au.

“Your ability to afford a loan and repay it (serviceability) is assessed at an interest rate as much as 3% higher than what the rate you will be offered is. So the lenders are already working in future increases.”

“Australia has one of the strongest loan books in the world, so should the interest rates go up a couple of percentiles, the majority of borrowers should still be able to afford the repayment without feeling stretched,” Mr Sutantyo told Savings.com.au.

“However, this will curb new borrowing and [hopefully] cool down the spiraling property prices a little.”

How hard is going to be to buy my first house?

So, time to address the overarching question: how hard is it going to be for me to buy a house?

As a Brisbane-born girl myself, I’m always looking on realestate.com.au at the market activity going on in my area. I’ve watched house prices go up over the past few years, so I know that even with help from the government, it’s definitely not going to be easy. If I was to buy right now, I’d probably need to look into moving out towards Moreton Bay, or I’d need to curb the house dream and buy an apartment instead.

“There are benefits to joining the property ladder sooner rather than later, but investing in a property you can afford right now may not always be the right decision for you later down the track. It’s important to marry up your current lifestyle with your desired lifestyle,” Mr Hilton said.

“For example, if you purchase a smaller property, it’s important to consider whether this is a long-term investment. If you’re going to quickly outgrow a property, there are costs to moving and remortgaging as you seek a larger home, so it may be smarter to wait until you have a deposit for a property that will grow with you.”

On the deposit front, even purchasing on the outskirts of Brisbane would mean saving up a good thirty to forty grand (at least). Is that super realistic for me? Even if it is realistic - is it worth it?

“In majority of cases that we’ve seen, saving up 20% deposit (plus costs) to purchase a house is proving more challenging than it should be,” Mr Sutantyo told Savings.com.au.

“The main reason being the rate of house price increases far supersedes the ability of average income earners’ ability to save up, with ever-increasing living expenses. The dream of purchasing your forever home when you’re under 30 might not be realistic anymore.”

Instead of stomping on your dreams, Mr Sutantyo suggests that you buy what you can for now, not what you want.

“This is where rentvesting becomes popular – you rent where you want to live, and if you’d like to get a foot in the property market, you’d purchase an investment property where you could afford and where the numbers make sense,” Mr Sutantyo said.

The concept of rentvesting involves purchasing a property where you don’t want to live but can afford to buy, while renting where you want to live but can’t afford to buy. This way, you’ve got a property under your belt building up equity. The idea is that when the chance arises to buy where you want to live, you can either sell up and use the cash to buy or use any equity you build up to put down as a deposit. That’s the goal, anyway - and it still comes with its fair share of risk.

“Rentvesting is typically popular with younger professionals as not only does it mean you might be able to get onto the property ladder sooner, but it also brings lifestyle benefits,” Mr Hilton said.

“Buying in an area you can afford also means you don’t have to wait to enter the real estate market - potentially achieving higher capital growth compared to where you rent.”

He said that renting does mean you become ‘beholden’ to a landlord, which comes with its limitations. For example, if they decide to sell, you need to uproot your life and find somewhere else to live.

“Something else to keep in mind with this strategy is that there will be Capital Gains Tax (CGT) implications for when you sell your investment property. Additionally you are doubling agent costs and receive no stamp duty concession on the investment property,” Mr Hilton said.

“Rentvesting can be a smart strategy but research is important to reap the best results - chat to a professional adviser if you’re unsure on whether it’s the right option for you.”

Going back to the Grattan Institute’s report, another factor that can influence how hard it is to buy is who your parents are. Marcus Roberts, founder of mortgage broker Brighter Finance, said that parents are shifting away from being guarantors and are gifting their children money instead.

With this said, guarantor loans are up 71% over the past six years, and 21% in the past financial year alone, according to research from Aussie Home Loans.

“We find parents are still wanting to help as the property market is notoriously considered “unaffordable”, but more parents are gifting money rather than going guarantor so that they are not putting their house on the line,” Mr Roberts told Savings.com.au.

A final note

All in all, to answer the seemingly impossible question - I still don’t really know just how difficult it will be for me to buy my own house. My ability to buy a house will be highly contingent on a few factors:

-

How much I have saved for a deposit;

-

How much I’m earning and can afford to borrow;

-

Whether I can access any government support;

-

How much house prices are at the time (will I have to rentvest instead?).

And so on. Who really knows how hard it will be? I can’t look into the future and know what my situation will be next year or even tomorrow. Will house prices be higher than they are now? Will interest rates go through the roof? Unfortunately, no one knows.

Regardless, the dream is not dead. Hopefully one day, I’ll read this article again in the comfort of the house I purchased and say you did it, girl. And hopefully, I’m not a senior citizen at the time.

Image by Andrew Mead on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy

Rachel Horan

Rachel Horan