That’s according to ‘Your Property Your Wealth’ director and buyer’s agent Daniel Walsh who said switched on investors were making the most of lower repayments by funnelling extra cash flow into their loans.

“Investors with variable mortgages have seen interest rates tumble by one to two percentage points over the past year,” Mr Walsh said.

“Some investors have also opted to refinance now that the lending environment is more favourable to them, which has resulted in their repayments dropping even more.”

“Rather than frivolously spending that extra cash flow, many investors are opting to pay down their debt.”

The Reserve Bank of Australia has cut the cash rate three times in 2019 to a historic low of 0.75%,and investors are now seeing variable loans with rates as low as 2.99% p.a. at the time of writing.

Mr Walsh said the tactic of making extra repayments wasn’t surprising, given that most portfolios would become neutral or positively geared in the near future.

“In fact, the 2019 PIPA Investor Sentiment Survey found that 52% of investors expected to be positively geared within five years,” he said.

“What’s interesting is that the research was conducted before one of the recent rate cuts, so that timeframe is likely to be dramatically shortened.”

Mr Walsh bought his first property a decade ago at age 19 as an apprentice and has since expanded to a nine-strong portfolio worth $4 million.

He recently refinanced his portfolio and now has an extra $9,000 in cash flow to pay down his borrowings, in addition to increasing his passive income to $68,000 a year.

“We are using those extra funds to pay down our portfolio, which at the end of the day is the goal for all investors,” he said.

“Of course, buying strategically located properties will increase your chances of solid future capital growth.

“However, the debt does need to be repaid at some point and the current lending conditions as well as low interest rate environment makes the timing perfect for investors, like us, to do just that.”

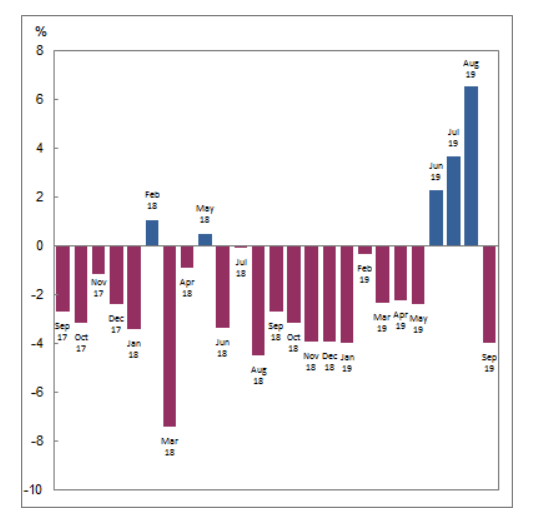

Investor lending commitments fall

Australian Bureau of Statistics data released earlier this month found that new lending commitments for investment dwellings fell 4.0% from August to September 2019.

This data comes after three straight months of rises, totalling 11.6%: the fastest rate of growth in the value of investment loan commitments since November 2016.

The September falls were driven by Victoria and Queensland, down 6.5% and 7.0% respectively.

Investment dwellings excluding refinancing. Source: ABS

2019 has been a favourable year for investors, with lending restrictions relaxed by lenders.

Westpac raised their maximum loan-to-value ratio (LVR) for interest-only loans and loosened rules around its Household Expenditure Measure (HEM).

ANZ made the same changes to investor interest-only loans in March, while the two big four banks made several cuts to their serviceability floors over the course of the year.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Aaron Bell

Aaron Bell

Harrison Astbury

Harrison Astbury