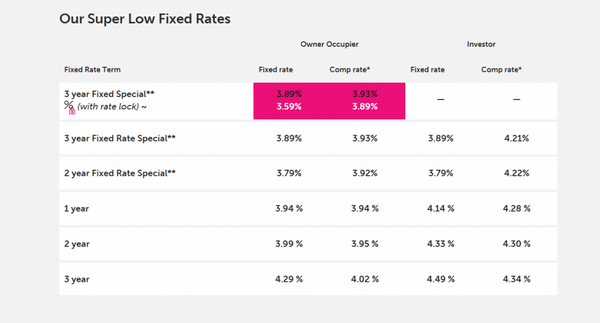

Loans.com.au’s three-year fixed special home loan for owner-occupiers (not investors) has been reduced from 3.89% to 3.59% (3.89% comparison rate) for borrowers that pay a ‘rate lock’ fee.

The rate lock will cost customers a one-off fee of $350 but guarantees the rate does not increase above 3.59% after application, so long as settlement occurs within 60 days.

So a rate lock can essentially offer borrowers the peace of mind in knowing that the three-year fixed interest rate they applied for won’t be higher by the time the loan settles.

Loans.com.au’s Managing Director Marie Mortimer said this move is in response to feedback from borrowers around the lack of certainty and confusion around the movement of interest rates.

“It is very hard to predict where the economy is going right now with so many things pointing in different directions,” Ms Mortimer said.

“You’ve got perceived weakness in the property market, the Federal budget surprisingly coming back into surplus and then, just to muddy the waters even more, you’ve got a Federal election just around the corner with wildly different policies on the table.

“Home buyers are looking for certainty and we have taken the lead in the market to offer a super-affordable fixed rate so that regardless of what happens in the near future, borrowers will know they are protected.”

This is the third home loan product change in a month for loans.com.au.

Last month it launched a variable interest rate home loan called the ‘Smart Home Loan’, which boasts a temporary interest rate of 3.48% (3.50% comparison rate).

It also loosened the eligibility requirements for its ‘Essentials’ home loan product, allowing people with a 10% deposit to apply when it had previously only allowed a minimum of 20%.

“We are the leaders when it comes to innovative products and service that results in discounted interest rates for our customers and, although we are much smaller than the Big 4, we often succeed in forcing them to drop their rates in response,” Ms Mortimer said.

At the new 3.59% interest rate, the product is now one of the lowest-rate three-year fixed home loans on the market.

It’s also competitive compared to variable interest rate products, which is rare for a fixed home loan rate.

The special three-year fixed rate is only available for owner-occupiers on principal and interest repayments with an LVR of 80% or less (that’s a deposit of at least 20%).

Fixed rates on the decline

Loans.com.au is just the latest in a growing line of home loan lenders to drop their interest rates in recent weeks and months, with fixed rates in particular seeing a lot of movements.

For example, just in the past few weeks:

- Macquarie Bank has decreased some of its fixed interest rates by up to 60 basis points

- ME decreased some of its fixed rates by up to 50 basis points

- ING decreased various fixed investment rates by up to 10 basis points

- Suncorp decreased owner-occupier and investment fixed rates by up to 70 basis points

- Bankwest decreased various long-term fixed home loan rates by as much as 55 basis points

While rate changes happen all the time, they do seem to be happening more frequently of late.

Economists from major banks NAB and Westpac have both forecast two cash rate cuts by the Reserve Bank of Australia (RBA) before the end of the year, which could see lenders lower rates even more.

In the interests of full disclosure, Savings.com.au and loans.com.au are a part of the Firstmac Group. To read about how Savings.com.au manages potential conflicts of interest, along with how we get paid, please click through onto the web site links.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Rachel Horan

Rachel Horan