One of the key findings made in the 648-page Retirement Income Review released by Treasurer Josh Frydenberg was that the family home is an untapped asset and a “more optimal retirement income system would involve retirees more effectively drawing on all their assets, including the equity in their home, to fund their standard of living in retirement.”

Australia’s retirement income system is made up of three ‘pillars’: compulsory superannuation, a means-tested Age Pension; and voluntary savings which includes the family home.

But according to data from the Australian Bureau of Statistics (ABS), the Age Pension was the most common source of retirement income for almost half of retirees in the 2018-19 financial year, while superannuation was the second most common income source.

Home equity remained largely untouched.

“The existence of many ‘asset rich, income poor’ retirees on the Age Pension suggests home equity release has significant potential to help support retirement incomes,” the review said.

“If this potential were realised, housing would take on an even more important role in the retirement income system.”

One of the most popular equity release options is taking out a reverse mortgage.

How a traditional reverse mortgage works

A reverse mortgage allows older Australians (typically over the age of 60) to access the wealth that’s tied up in their home by using the equity as security for the loan.

The amount that can be borrowed is based on the customer's age and the value of their home. The younger the borrower, the lower the percentage of the property they can borrow. This helps to reduce the risk of the loan growing more than the property value if they live longer in retirement.

Image source: Heartland

Borrowers can choose to receive the loan as a lump sum payment, a regular income stream, a line of credit, or as a combination of these options to pay for travel, medical expenses, home renovations, aged care, consolidate debt and cover everyday bills.

No regular repayments are required until the property is sold, but borrowers can usually make early voluntary repayments if they choose.

Because the loan doesn’t need to be repaid immediately, interest is calculated on the daily balance outstanding and compounds, usually monthly. Before the Australian Government introduced the No Negative Equity Guarantee (NNEG) in 2012, this meant that borrowers faced the risk of owing the lender more than they could recover from selling the property if their reverse mortgage did not include this provision in the loan agreement.

However, the introduction of the NNEG being compulsory ensures the amount required to repay the loan will never exceed the net sale proceeds of the property - so with current day reverse mortgages you can’t end up owing the lender more than what the home is worth.

Despite the introduction of the NNEG, Head of Operations at leading reverse mortgage provider Heartland Finance, Sharon Yardley said there’s still a lot of misunderstanding around reverse mortgages.

“There is a misconception in the market and a lack of understanding about modern day reverse mortgage products,” Mrs Yardley told Savings.com.au.

“Australian regulatory reforms mean that reverse mortgages are arguably one of the most heavily regulated consumer finance products on the market in our country.”

Among the most common misconceptions surrounding reverse mortgages is that the lender owns the home (they don’t), that a reverse mortgage requires regular repayments (it doesn’t), and that the debt will be passed on to the children over and above property sale (the NNEG means that can’t happen – it can be repaid through the sale of the property, or through other means).

Heartland has created a simple video explaining these misconceptions.

Benefits of a reverse mortgage could outweigh the cost

Mrs Yardley pointed out that holding onto the family home and using equity release, rather than selling, provides many benefits such as being able to ‘age in place’ and the potential for the property to increase in value.

“Many don’t realise that holding onto your home and taking out a reverse mortgage could increase ‘net equity’ overtime,” Mrs Yardley said.

“In some cases it can be more beneficial to take out a reverse mortgage than sell.”

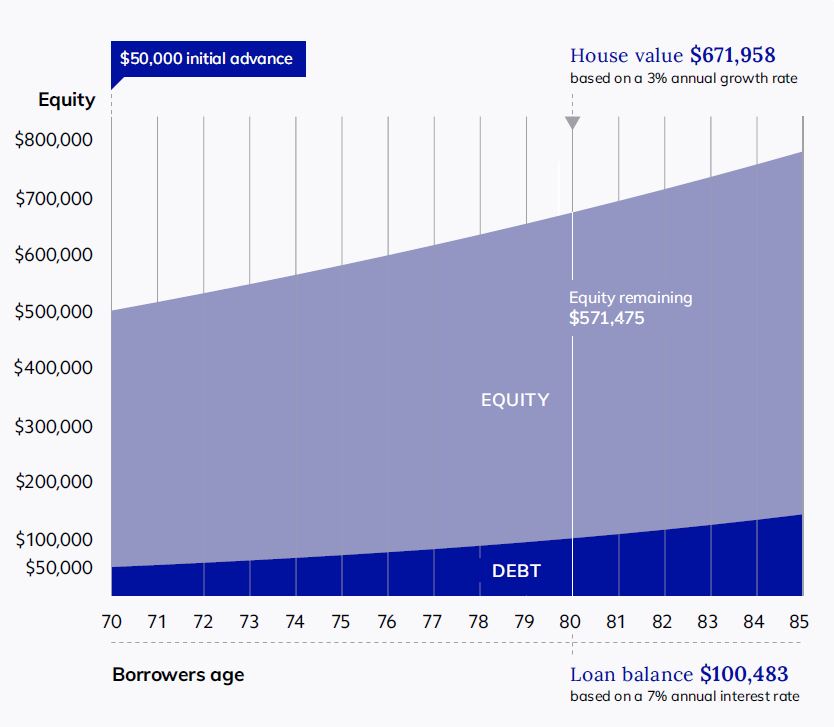

Here’s an example of how taking out a reverse mortgage could be beneficial for the borrower:

Example borrower scenario

|

Mrs Yardley says reverse mortgages can also be more suitable than the alternative finance options for seniors, like credit cards or personal loans.

“The flexibility of the loans and features we offer mean that borrowers can draw down funds when needed, and can choose to make regular repayments or repay their loan at the end when it comes due,” she said.

“Most other financial products require borrowers to make regular repayments which adds unnecessary and ongoing financial stress.”

What’s more, Mrs Yardley says the benefits associated with a reverse mortgage can outweigh the cost compared to other alternatives.

Image source: Heartland

“It is not only the monetary cost that concerns people, but also mental and physical costs.

“Data from a recent customer survey indicates the most important thing to people in retirement is peace of mind, free from financial stress, and the ability to continue to live in one’s own home, all of which a reverse mortgage provides.”

Heartland customers Don and Shirley* (names have been changed) can attest to this. The couple took out a reverse mortgage in 2019 because they realised their savings wouldn’t allow them to live as comfortably in retirement as they had hoped, but they wanted to remain in their home.

Don and Shirley initially took out a lump sum payment to cover home improvements that would make their home more suitable for retirement. The couple also set aside some funds in a cash reserve facility (similar to a line of credit) just in case they needed access to funds for unexpected bills or emergencies, which came in handy recently when they needed to pay for medical expenses.

“Our Heartland Reverse Mortgage has enabled us to remain in our home by making improvements ensuring our home ‘works for us’ as we get older and as our needs change,” they said.

Compounding interest rates could take a bite out of the estate

But there are some legitimate concerns around reverse mortgages, the first being the cost.

Interest rates on reverse mortgages tend to be much higher than standard home loans - the average variable rate on a reverse mortgage is between 5.00-6.00% compared with the average variable rate on a standard home loan which is closer to 2-3%.

Mrs Yardley said there are a number of factors why reverse mortgage interest rates are higher than standard home loans: namely that there is no requirement to make repayments until the end of the loan, and that the NNEG means that if the home is sold for less than the value of the loan, the lender has to cover the difference. Furthermore, the interest rate can be much lower than other forms of finance, such as credit cards or personal loans, available to seniors.

Because compounding interest can reduce equity in the home, reverse mortgages have the potential to decrease any inheritance that might be passed on.

Here’s an example of how this could happen:

Example borrower scenario

|

Because the compounding interest can erode equity in the home, reverse mortgages have the potential to reduce any inheritance that might be passed on. However, retaining the home (rather than selling), means that borrowers could also benefit if there is any increase to their home value.

To make sure taking out a reverse mortgage is in the best interests of the borrower and their beneficiaries, Mrs Yardley said Heartland has a number of processes in place.

“This includes mandatory independent legal advice and recommended financial advice and family involvement,” she said.

“We (Heartland) also encourage people to consider their future needs including aged care, and if they want to leave any funds to beneficiaries.

A useful tool that is provided to all customers, and their solicitor, is loan projections using ASIC’s MoneySmart Reverse Mortgage Calculator, which demonstrate the value of the loan and how the debt grows overtime.

“These processes are in place so that borrowers are fully informed prior to taking out a loan with us, including their families, on how the reverse mortgage will affect them now and in the future.”

A rethink of how Australians finance their retirement needed

The Retirement Income Review has shone a spotlight on how retirees are ignoring the potential of tapping into their home equity to finance their retirement - and how doing so could have a “bigger impact on improving retirement income than increasing the superannuation guarantee”, which is set to increase from 9.5% to 12% by 2025.

The review found that keeping the superannuation guarantee at 9.5%, but tapping into voluntary savings (like the family home) more efficiently would allow most retirees to achieve the recommended 65-75% income replacement rate.

“Without improving the way retirees draw down their assets, extra contributions to superannuation will not result in most retirees maintaining their living standards,” the review said.

“Fully drawing down superannuation can substantially boost retirement incomes, without having to increase contributions.”

Mrs Yardley said if the rise in the superannuation guarantee occurs, the implications it could have on the reverse mortgage space is unclear.

“The rise is unlikely to have a huge impact on those that are entering retirement soon, or in the next 10 years, which means it is unlikely there will be a change in this space for a while.”

Research by the Royal Melbourne Institute of Technology (RMIT) in conjunction with Heartland found that an overwhelming number of retirees (90%) want to remain in their home during retirement, but 36% of older Australians live in a home that may be unsuitable for ageing in place, without upgrades or renovations.

Report lead author Associate Professor Stuart Thomas said the traditional pillars of retirement funding like superannuation and the age pension won’t be enough for retirees to realise that goal.

“Financial products designed to access equity in the home have the potential to allow senior homeowners to ‘age in place’ but these products are not well understood and the markets for them in Australia are not well developed,” Professor Thomas said.

The report, which analyses 15 years of reverse mortgage user data in Australia, found that 42% of Australians remain undecided on how they will fund their retirement - something Mrs Yardley sees as something Heartland can help with, if access to funds is the only reason to sell the family home.

“That 42% of people could need our assistance, and will only increase in numbers as the ageing population and cost of living also continue to increase,” she said.

“With little other options out there for retirees requiring finance, we know that utilising home equity could be a great option and will only continue to grow in popularity as we continue to spread awareness and educate people.”

Australia’s reverse mortgage market is relatively small but it is growing, and is currently estimated to be worth $3.4 billion according to APRA ADI data in 2019. Meanwhile, APRA data shows the reverse mortgage loan books of banks was just $2.46 billion in the 2020 September quarter, down from $2.64 billion a year earlier.

See also: Reverse mortgage market to triple by 2031

According to ASIC, over 80% of the dollar value of all reverse mortgage loans issued between 2013 and 2017 was dominated by two providers: Commonwealth bank (including its subsidiary Bankwest) and Heartland Reverse Mortgages. Other current providers include Household Capital, P&N Bank, IMB Bank, Gateway Bank and G&C Mutual Bank.

In recent years, Commonwealth Bank (and its subsidiary Bankwest), Westpac and Macquarie Banking Group have all withdrawn their reverse mortgage offerings.

For widespread use of equity release products like reverse mortgages to be possible, Professor Thomas said more consumer education and demand in the market is needed.

“Equity release can be an answer for many retirees, but more education and an openness by regulators to new products and providers is needed in order to create the demand and supply needed to make this industry a viable fourth pillar in retirement funding.”

Mrs Yardley said reverse mortgage providers have their work cut out for them in educating consumers.

“Awareness and education about how a reverse mortgage works and how it can help people live a more comfortable retirement, is our biggest hurdle,” she said.

“With little other options out there for retirees requiring finance, we know that utilising home equity could be a great option and will only continue to grow in popularity as we continue to spread awareness and educate people.”

Image supplied by Heartland

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan