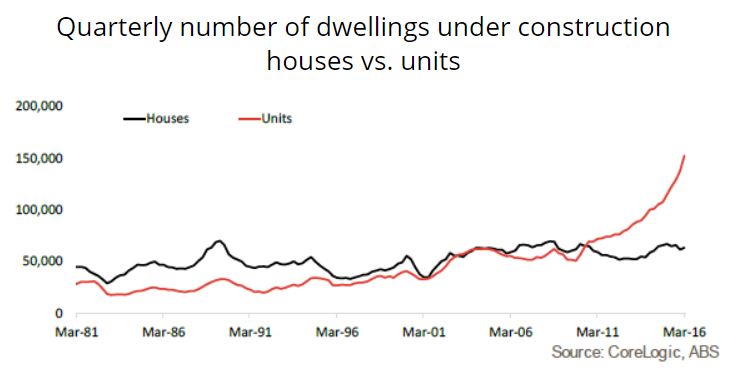

For the past two decades, Australia has been in an apartment building boom. According to data from the Australian Bureau of Statistics (ABS), over 667,000 apartments have been constructed since 2000. Right now, there are plans to build another 140,000 apartments around the country. What could possibly go wrong?

Chances are if you’ve bought a high-rise apartment that’s been constructed within the last decade or so, you’ve probably bought an apartment with defects. As Australia’s apartment boom has raged, the oversupply of apartments and falling property prices means developers have been cutting corners to save money.

When Sydney’s Opal and Mascot Towers were evacuated because of structural cracking, a spotlight was shone on the issue of shoddy construction practices and poor regulation contributing to a national trend of defective high-rise apartments. The Opal and Mascot Towers are just some examples in a long line up of emerging defective buildings. Who can forget the 2014 Lacrosse tower fire in Melbourne, or the recent evacuation of an apartment in the Sydney suburb of Zetland? A Brisbane woman hasn’t been able to live in her $1.7 million apartment for two years because of serious defects.

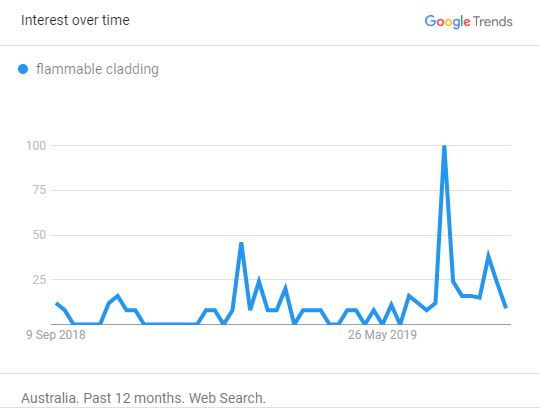

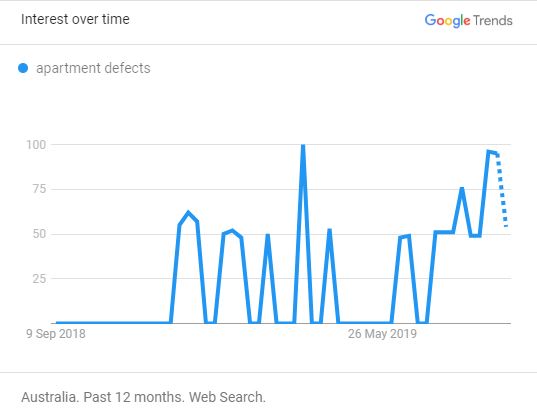

As you can see, apartment defects are a pretty hot topic right now.

Why has the quality of construction gone down?

In a recent Four Corners report, building defects consultant Ross Taylor said the problems plaguing new apartment buildings start right back at the drawing board with the developer. Mr Taylor says it’s common practice for developers to use big-name architects only at the concept stage to lure buyers in.

“Developers, when they develop a strategy for selling, they have to get the sales off-the-plan straight away. Once they’ve got the pre-sales and the bank then allows the money to flow, they then cut the name architect and then go to an unregistered architect or draftsman just to map out the basics to go to tender. That’s the start of the defects,” Mr Taylor said.

In the industry, this is known as the “design and construct model” and it’s at the root of defects in new apartments. If changes are made to the original design, it could fundamentally alter the functioning of the building.

“The builder, who has no training in design by the way, now takes responsibility for the design done to date and completing the last half of the detail. Now he’s doing that on a tight budget. And so what frequently happens is he gets the sub-contractor to finish the designs – the way they see fit. The subcontractor doesn’t have time to complete that design and so he gets the tradies to turn up on the job, to finish the design off on the go. That’s the design and construct model that’s operating in most of these high-rise buildings and is at the heart of the problems we’re seeing today,” Mr Taylor said.

Take the troubled Elara apartment complex in Canberra for example. The developer for that project hired the same architects who designed Parliament House. The architects were replaced before construction started.

Australia has seen a significant increase in the construction of high-rise apartment buildings in the last 30 years. According to ABS data, the number of apartments being built in high-rise buildings in Australia every year has tripled in less than 10 years. In 2007, 30,000 high-rise apartment buildings were constructed. In 2015, that number jumped to 90,000.

Once a builder has been contracted to use the design and construct model, they often work to find efficiencies and any cost savings (in other words, they find ways to cut corners) in the development of the design and construction of the building.

Even though building approvals are required, the very nature of the design and construct model means that many aspects of the design have changed after the initial approval has been given. The Shergold and Weir Building Confidence report looking into the extent of problems in the building and construction industry found that the majority of building work is completed without any oversight.

“We have consistently heard that the adequacy of design documentation is generally poor and that, on occasion, builders improvise, making decisions on matters which affect safety without independent oversight. This exacerbates disputes about the quality and compliance of building work,” the report said.

“Those involved in high-rise construction have been left largely to their own devices”

– Shergold and Weir Building Confidence report

The national shift towards private certification 25 years ago was also highlighted as a major contributing factor. State governments started allowing building work to be signed off by private contractors to speed up the approval process.

“The certifier in this current system is contractually obliged to the developer. The developer hires them. So in a lot of ways, they’re representing the developer, not the future owner. The certifier system then has become virtually, it’s a placebo system. It’s one you put in place when you feel you have to have one that is of no actual effect,” Mr Taylor told Four Corners.

The report said that it “carried with it an inherent potential for conflict of interest”, with certifiers tempted to pass non-compliant buildings as compliant to secure future work from the developer.

And that’s how we’ve ended up with the broken, flawed system we have today.

Research from the University of NSW in 2015 found that 85% of new apartment buildings built since 2000 had defects at completion. The most common defects found were problems with waterproofing and cracking to internal or external parts of the building – most of which haven’t been fixed.

Obvious safety issues aside, buying one of these apartments can have drastic impacts on your finances. Owners are often left to foot the repair bill because the builder or developer winds up the company upon completion to avoid their warranty obligations. Apartment values plummet and the reputational damage can make selling almost impossible.

For many Australians, our homes are now multiple storeys up in the sky. High-rise apartment living is becoming increasingly popular; one in 10 of us live in an apartment according to ABS data. If you’re considering buying an apartment, how can you avoid buying a ‘lemon’? Here’s what you need to know before buying into the next Opal Tower – and potentially waking up in a pile of rubble.

What is buying off-the-plan?

Buying off-the-plan is when you sign a contract to purchase a property that hasn’t been built yet (not to be mistaken for house and land packages – these are different). This means off-the-plan buyers make their mind up purely after inspecting the developer’s construction plans and artistic renderings of the apartment – foregoing the opportunity to get the true look, feel and smell of the place before the purchase decision. Buyers will usually need to put down an initial 10% deposit prior to construction. Remaining payments will be made after the settlement date when the property has been completely built.

When you’re buying an apartment off-the-plan, there’s usually a display apartment that buyers can inspect to get a better idea of what their apartment might look like. It’s important to keep in mind that the demo isn’t always indicative of the end result though, as things like fittings and fixtures could change.

Should I buy a new high-rise apartment?

In the Four Corners report, Bronwyn Weir, co-author of the Building Confidence report looking into the effectiveness of building and construction industry regulation straight up said she would not buy a new apartment in Australia. That should probably tell you something.

“I wouldn’t buy a newly built apartment. No. If I was going to be investing in an apartment, I’d buy an older one,” Ms Weir said.

The decision to buy a new apartment will largely depend on your investment purpose and the amount of risk you’re willing to take. Some people may buy a new apartment and never experience any major issues like Opal or Mascot Tower. But if you ask any of the owners of apartments in those towers whether they’d buy a new apartment again, the answer is simple.

“I would not buy a new apartment ever again. This has done the damage for me. I don’t want to go through this again,” one apartment owner told Four Corners. Another apartment owner said buying a new apartment is a roll of the dice.

Propertyology Head of Research, Simon Pressley said the problem is much bigger than the Australian public realises.

Pictured: Opal Tower in Sydney. Image by Simon_sees via Flickr

“There’s more to it than the highly publicised modern buildings with major defects that have already been exposed. Anything built over the last 20 years is at risk of being exposed at some time. The ‘lucky’ building which never ends up with major defects will still suffer significant value depreciation risks due to the stigma associated with building constructed over the last 20 years and the everlasting uncertainty than prospective buyers will have,” he told Savings.com.au.

“I would never, ever buy an apartment within a large complex that has been constructed any time post the late 1990s.

“If you’re the owner of an apartment within a medium to high-density building that was constructed within the last twenty years, you’ve contracted Australian real estate’s equivalent of the bubonic plague. There’s no vaccine for this horrible disease and the best treatment is most likely to sell sooner rather than later.”

Yikes.

If, after reading that, you’re still on the fence about buying a new apartment, here are the pros and cons.

Benefits of buying an off-the-plan apartment

There are certainly benefits to be had when buying an off-the-plan apartment. The idea of buying something with brand new fittings and furnishings that has never been lived in before really appeals to some buyers.

More time to save

There’s a reason why off-the-plan apartments are popular with first home buyers – it’s easier to crack into the market. You often only need to put down an initial 10% deposit and pay the rest back at settlement once construction is complete. The time it takes for construction to be completed (which can sometimes be years) gives savvy buyers the time to save up more money so they can pay down their loan faster.

You can customise the apartment

Deciding on the fixtures and fittings you want in your brand new apartment is pretty exciting and it’s definitely something you can’t do when you’re buying something that’s already established – unless you plan to renovate.

Depending on your developer, you may be able to have a say in how your apartment is designed – from the floor plan to the fittings and fixtures. The earlier you buy into a development, the more likely it is that you’ll have more of a say in this.

Incentives and grants

Some developers have been known to offer lucrative incentives to lure buyers in, like paying all your bills for the first year or knocking a few thousand off the purchase price. Some developers may even offer non-monetary incentives to buy, like furniture packages or a gym membership.

If you’re buying an off-the-plan apartment you may want to see if you’re eligible for any government grants. If you’re a first home buyer, you may be eligible to receive the First Home Owners Grant (FHOG). At the time of writing, the FHOG is available in every state and territory in Australia in some form. The details of the grant can differ depending on where you live, but in most states and territories it’s available only to those purchasing a new home – including off-the plan-apartments.

Risks of buying an off-the-plan apartment

If you’ve been keeping up with the news, you’ll know there are significant risks associated with buying a new apartment. Besides the risk of potentially arriving home to find your apartment building is now just a pile of rubble, there are a few other downsides to consider too.

Bank valuations below the purchase price

When you’re buying a property as an investor or an owner-occupier, you probably want to sell it at some point. When you buy an off-the-plan apartment, you may be in for a nasty shock when the time comes to sell because the value may have dropped.

That’s been the case in Sydney and Melbourne recently where off-the-plan apartments purchased at the peak of the market have been valued by as much as 10% lower than their purchase price. When settlement comes, if you’re left with an apartment worth less than what you agreed to pay, the bank is unlikely to finance the full loan amount.

CoreLogic’s Head of Research Tim Lawless says this may leave you in negative equity and you may need to finance the gap yourself.

“Buyers receiving a lower than expected valuation at the time of settlement may be required to top up their finance in order to meet their lender’s loan to value ratio (LVR) requirements,” Mr Lawless said.

It may also make it hard to get a home loan for an off-the-plan apartment. The lender may charge you more for LMI because they’re taking on more risk, or not give you a loan at all.

“Some lenders may no longer have the risk appetite to finance a new apartment purchase, especially in areas where the pipeline of unit supply remains high. In this case, off-the-plan buyers would typically need to seek out alternative credit arrangements.”

Developer might go bankrupt

Buying an apartment off-the-plan can quickly turn into a nightmare if the developer goes bankrupt. If this happens, you may as well wave goodbye to your dreams of moving into your brand new apartment. The developer may not even give you your deposit back, depending on the terms of your contract.

This is why it’s so important to research the developer before signing on the dotted line. If you are going to buy an off-the-plan apartment, consider opting for developments being constructed by bigger companies like Mirvac or Hutchinson that have a good reputation. The risk could be lower and you’re more likely to be approved for finance as lenders may prefer to approve off-the-plan properties that have been constructed by reputable builders.

Structural quality could be poor

A big risk of buying off-the-plan is that you really have no way of knowing what the structural quality is like, as there’s no history of the property to look over. Until the apartment is built, you won’t know what the structural quality is like. Even then, it can be years before structural issues or other defects become apparent.

A study by Deakin and Griffith Universities found that more than 70% of apartments constructed since 2003 in Australia had some form of defect. Defects relating to building fabric and cladding were the most prevalent, followed by fire protection. Lead researcher Dr Nicole Johnston said new apartments in Australia are “plagued with defects”.

“While the building itself can be fractured by these defects, it is the residents living there who face the impacts. The financial burden placed on owners when builders fail to rectify defects can lead to a number of psychological health impacts, particularly stress-related, and for some are financial ruining,” Dr Johnston said.

It may not meet your expectations

When you’re buying an apartment off-the-plan, you run the very real risk of being disappointed by the end result because there’s no guarantee what you see in the pretty artist renderings will look like that in real life.

If a developer runs into financial issues, they may make some changes to cut costs. Depending on the terms of your contract, developers can be allowed to make changes to fittings and finishes during construction. But if a developer makes a major change, they should notify you first. Check to see if you’re allowed to visit the site during construction to avoid being disappointed.

Sunset clauses

Sunset clauses provide a maximum time limit for the development to be completed by. If the development hasn’t been completed by the ‘sunset date’, the contract is void and the buyer will receive their deposit in full, which all sounds well and good. However, even if you do receive your deposit back, the time you’ve spent out of the property market may have been wasted and you might not have much to show for it. By the time you get your deposit back, property prices may be a lot more expensive than they were when you put your deposit down, making it harder for you to get back on the property ladder.

Another big risk to be aware of is developers doing the dirty on you. Some off-the-plan developers intentionally delay developments, voiding the contract so they can resell the properties at a higher price, ripping off the buyer in the meantime. Fortunately, there are now consumer protections in place to protect buyers against developers who do this on purpose, but it’s still something to be aware of.

How to avoid buying a dodgy apartment

The advice from Philip Gall, chairman of the Owners Corporation Network is blunt. “Don’t buy a new apartment over three storeys,” he wrote in an opinion piece for ABC News.

“Think about older, simpler, three-level walk-up options.”

That’s because, in most states, home warranty insurance cover isn’t required (or even available) for new apartments over three levels. Older apartments have also had more time for any defects to become apparent; you can observe how the building is weathering the years in the strata minutes.

“Don’t buy until it is six, seven, 10 years old,” Mr Gall said.

Mr Pressley also advises people to opt for older, established apartments.

“Generally speaking, older-style dwellings within small complexes and in close proximity to a major city’s CBD are generally sound assets. Whilst every property purchase should be subjected to a prudent health check, the older apartment blocks were built in an era of good hygiene,” Mr Pressley said.

Buyer’s agent Simon Pressley calls the high-rise apartment the ‘bubonic plague’ of Australian real estate. Image supplied.

“As for any Australian contemplating buying a property now or in future years, be absolutely crystal clear that your structural integrity risk and financial performance are exponentially higher should you choose purchase any medium to high-density apartment that was built during the bubonic plague era (the last 20 to 25 years). It makes zero sense to enter such an infested cesspit.”

If you are willing to take on the risk and buy a brand new apartment, you’ll want to do your research into the builder and the developer. Find their previous projects and see if you can inspect them.

Another step to take is to visit the Australasian Legal Information Institute website which holds databases of court and tribunal decisions. Search the developer’s name under the body for your state to see if they’ve been involved in any disputes. Another good resource is the ASIC Connect website. Search the names of the developer’s directors to see if other companies they’ve been involved with have shut down.

If you’ve got a few thousand in spare cash just lying around, you can pay an independent certifier to inspect the building for defects – but there’s no guarantee they’ll be able to pick up everything.

Mr Gall told The Guardian he doubts the Mascot Tower fault could have been picked up this way because independent certifiers don’t do a ‘destructive inspection’ – only a visual one. If a crack has been filled in and painted over, they won’t know.

“Once a building is built, it’s impossible to get 100% reassurance from an independent expert. There are good developers and good builders out there but you don’t know who they are anymore. Some of the good ones are now producing worse quality. You simply don’t know if the builder you are dealing with is going to close down tomorrow, whether they are on edge and cutting corners.”

There’s also the possibility that the apartment owner will keep quiet about any structural defects they’re aware of because speaking out publicly is highly likely to drive down the value of their property. So you may not even know there’s an issue with the building you’re buying into.

What are your rights as an owner if your new apartment is defective?

The owner’s corporation is responsible for having defects repaired (for common property) but they don’t necessarily need to foot the bill. When you’re buying an apartment off-the-plan, you have rights under the Australian Consumer Law but these rights can vary, so there’s no guarantee you’ll get a good result.

Depending on where you’ve purchased property in Australia, warranties differ from state to state. Consumer protections vary from state to state but the general rule of thumb is that you can claim against non-major defects for two years and major defects for up to six years from when the building was completed – not when the apartment was purchased.

- In NSW, major defects are covered by warranty for six years while all other defects are covered for two years.

- In VIC, structural defects are covered by warranty for six years. Non-structural defects are under warranty for two years.

- In WA, defects are covered by warranty for six years after the building has been completed.

- In SA, defects are covered by warranty for five years after the building has been completed.

- In QLD, work is covered for six years and six months. For structural defects, owners have to lodge a complaint form within three months of noticing it. For non-structural defects, owners have to lodge a complaint within seven months of the completion date.

- In the NT, defects are covered for up to 10 years. However, poor workmanship, minor cracks, or anything else that sits outside of the National Construction Code is not covered.

- In TAS, defects are covered by warranty for six years after the building has been completed.

These are the time periods in which you can take a developer to court if the problems aren’t repaired – but you want to go with a developer who’s likely to still be around if the cracks quite literally start to show.

Unfortunately, some developers do what’s known in the industry as “phoenixing”. This is where a company trades for a bit, gets into a lot of debt, goes into liquidation and shuts down the company, only to reappear later under a different company name. Like the mythical bird, the company rises from the ashes. Unfortunately, it happens often enough that the ATO has set up a ‘Phoenix Taskforce’.

If a builder winds up the company upon completion to avoid footing the bill for fixing up mistakes, the apartment owner is the one left holding the tab.

If your warranty is over or the builder has done a runner, you may be able to access an insurance scheme that will pay for repairs. This is known as home building compensation (HBC) but it’s only available in New South Wales and again, only for buildings under three storeys.

So basically, if you own an apartment in a high rise tower and the defects don’t become apparent until the warranty has passed, or the builder won’t pay up, you’re kind of screwed.

Owners forced to evacuate the Opal Tower apartment complex in Sydney’s west because of building cracks have been forced to look “offshore” for insurance. https://t.co/7qEEzCgO6q

— The Australian (@australian) August 12, 2019

That’s the nightmare facing apartment owners in Mascot Towers who have been left to foot the bill to repair structural damage.

Stephen Goddard, strata lawyer and spokesman for the Owners Corporation Network recently called for better protections for owners.

“Consumers have nowhere to go in these sorts of situations, there’s nobody for them to sue, there’s nowhere for them to turn. People have more consumer protection buying a fridge than a million-dollar apartment,” Mr Goddard told the ABC.

“It’s time for governments to adopt a policy ensuring that people who buy off the plan have better consumer protection than they have when buying a fridge. That’s not what’s happening now.”

What are your rights if you’re on a lease?

There are some legally specified reasons for breaking a lease, one of which is when the dwelling becomes uninhabitable. If your apartment has become unlivable (the property is dangerous or poses a health hazard), you can usually terminate the lease early without incurring extra costs in most states and territories.

If your apartment has become uninhabitable and you want to break the lease, you will need to appeal to your local tribunal to make an order on these grounds for the legal reasons to apply. If you don’t do this and break the lease without giving a legal reason, it will be treated as you abandoning the tenancy and you may be liable for extra costs.

A spokesperson for NSW Fair Trading told Savings.com.au that if a tenant is required to move out temporarily because the property is considered to be unlivable the rent may be waived or reduced. Whether any rent is payable at all as well as the amount payable will depend on the extent of the damage and the amount of use the tenant has of the property. The tenant can give a termination notice in writing to end the tenancy which can take effect immediately. Any rent already paid in advance has to be fully refunded.

If your apartment has become unlivable, you may also be compensated on a case-by-case basis.

“In the instance a tenant has had to move out of their home due to building issues and defects, Fair Trading encourages tenants to negotiate concerns with their landlord or agent, including the release of their bond,” the spokesperson said.

A spokesperson for the Residential Tenancies Authority (RTA) told Savings.com.au that even if you’ve been evacuated and can’t access your apartment, you still have to pay rent.

“The tenancy agreement does not automatically end due to the property becoming unlivable. The tenant has an obligation to pay the rent in full (even if they have been evacuated from the property) until the tenancy agreement formally ends.”

The spokesperson added a reduction in rent may be possible if the property has been damaged, as long as the request is put in writing.

How hard is it to get a home loan for a new apartment?

With so many dodgy new apartment buildings making headlines, it’s only reasonable to assume that lenders will start factoring in issues with new buildings into their lending criteria. This may reduce the amount they’re willing to loan to you or prevent you from lending to you at all.

There are some lenders who may be more reluctant to provide finance for an off-the-plan apartment because there’s a risk the property may be sold for less than what it’s worth. If the market is uncertain, the value of the apartment may drop between the time it takes to sign the contract and complete the build.

Because of that, some lenders have a maximum loan-to-value (LVR) ratio of 80% for off-the-plan apartments. Off-the-plan apartments also have the potential to take anywhere between 18 and 24 months to be completed, so lending policies may have changed in this time. What a bank or lender accepted a year ago may not fly by the time you apply for formal approval at settlement.

Mortgage Choice chief executive officer Susan Mitchell advises borrowers to be careful.

“I would encourage borrowers to beware of off-the-plan purchases,” Ms Mitchell told Savings.com.au.

“A lot can happen in 18 months or more, and dwelling values data reveals that property prices have fallen considerably in this time, particularly in the nation’s capital cities. Unfortunately, our brokers have seen a number of borrowers come to them after signing on to purchase an off the plan apartment 18 months ago in areas which have since experienced significant value falls. This will ultimately affect how much the buyer can borrow and if obtaining finance is now not possible, they may risk losing their deposit.”

Savings.com.au’s two cents

Of course, when you think about the sheer number of people who live in apartments in Australia, the number of people who have had to be evacuated from their apartments is minute. But that’s not really the point. The situation has led to a crisis of confidence. Some buyers are dropping out of their high-rise apartment purchases because the risk is just too great for them.

CBRE managing director for residential projects, Andrew Leoncelli told Domain one buyer on his books pulled out of their $2 million apartment purchase after watching the Four Corners report. Other potential buyers have started asking questions about the building engineer and asking for extended defect warranty periods in the wake of recent headlines.

The Building Confidence report made 24 recommendations to address the issues in the industry, but so far, there’s only been scant progress. For some, the damage has already been done. Confidence in building regulation and quality has continued to deteriorate among the public.

“There is no silver bullet to resolve these problems”

– Shergold and Weir Building Confidence report

While the recommendations may be all well and good for future high-rise apartments that haven’t been constructed yet, it’s a matter of too little, too late for the existing high-rise apartments, as Ms Weir said:

“The existing building stock is what it is. We have hundreds of thousands of apartments that have been built across the country over the last two, three decades. The prevalence of noncompliance has been particularly bad, I would say in the last 15 to 20 years. It’s gotten worse over that period. There’s lots of existing building stock that has defects in it. We’ve heard many reports of owners dealing with those challenges that can’t be fixed by reforms responding to our recommendations.”

It’s hard to wrap this up with a nice little bow because it’s such a complex situation. If you are considering buying an apartment, it may be wise to go for something a little bit older, that’s under three storeys. If you can afford a house, that may be the better option. The decision to buy a high-rise apartment will depend on the level of risk you’re willing to take. If it’s a risk you are willing to take, proceed with caution.

Have you bought a new high-rise apartment and regretted it? Send us your story.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harrison Astbury

Harrison Astbury

Harry O'Sullivan

Harry O'Sullivan