As part of the review of the four major banks, House of Representatives Standing Committee on Economics Chair Tim Wilson asked the big banks how many customers have had their repayments reduced since the Reserve Bank’s first cash rate cut in June.

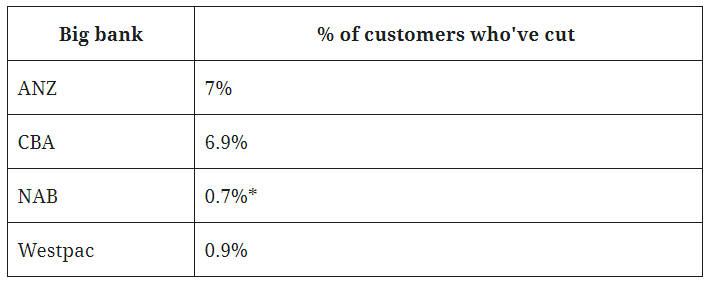

The responses from each of the major banks revealed that fewer than 10% of variable-rate principal and interest (P&I) home loan customers have reduced their monthly repayments.

The nation’s biggest lender, Commonwealth Bank, said about 69,000 of its one million variable P&I mortgage accounts chose to reduce their repayments (6.9%), worth about $116 million.

ANZ, who has about 680,000 of these customers, said about 7% had cut their repayments.

ANZ estimates the reduction in interest due as a result of the two reductions in June 2019 and July 2019 to be worth approximately $57m per month.

Westpac said 0.9% of its 1.1 million variable P&I customers had reduced their interest rate, while NAB cited 0.7% of its customers had reduced from the June and July rate cut (not counting the October rate cut).

Source: House of Representatives. *NAB data only includes responses to June and July rate cuts

Out of the 75 basis points of cash rate cuts over June, July and October, the big four reduced variable home loan rates by an average of 57 basis points.

Why so few?

Lenders typically require home loan customers to notify them if they want their repayments lowered following a cash rate cut.

In its response to the committee, the Commonwealth Bank said it proactively notifies customers if they are eligible to reduce their minimum repayment amounts.

“These customers have the choice to contact us online, via phone or branch to inform us they would like to reduce their monthly repayments to their new minimum repayment,” Commonwealth Bank said.

But some banks reduce customers’ repayments automatically.

For example Bankwest, which is owned by Commonwealth Bank and manages about 173,000 variable P&I mortgage accounts, automatically passes on the interest savings to the customers from the effective date of the interest rate change.

In its November monetary policy statement, the Reserve Bank of Australia (RBA) acknowledged the low number of people who’ve requested their bank to lower their home loan repayments.

“To date, the pick-up in new borrowing has been accompanied by faster repayment of existing loans,” the RBA said.

“This is consistent with historical experience that only a small share of borrowers on variable-rate mortgages actively adjust their scheduled repayments in the months following interest rate reductions.”

Further in its response, CommBank pointed out the benefits borrowers may have by not reducing their repayments in line with the cash rate cuts.

“If the customer chooses not to reduce their monthly repayments to reflect a recent rate change, then the differential is paid towards their loan in the form of an advance repayment,” Commbank said.

“If they have a loan with a redraw facility available, the differential may accumulate in the redraw for them to access later – providing flexibility to manage their financial circumstances beyond their home loan.”

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan

William Jolly

William Jolly