According to the The Association of Superannuation Funds of Australia (ASFA), using super for housing would "put significant upward pressure on house prices and exacerbate housing affordability concerns for low-income earners."

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

ASFA CEO Dr Martin Fahy said Australia already has some of the most expensive housing in the world - as other studies have reported - and such a policy would make the situation worse.

"With the prevailing macro-economic conditions and surging demand for housing, using super for housing deposits would be disastrous and push prices even further out of reach of first-time buyers,” Mr Fahy said.

“Superannuation isn’t the reason young Australians can’t afford to buy a home of their own. A lack of supply, and the policy settings with respect to residential investment property has had a distortionary effect on demand.

"These are the real issues that must be tackled to generate improvements in housing affordability."

The argument for using superannuation funds to buy a home has gathered momentum in recent months following the introduction of the COVID-19 early access to super scheme.

Liberal MP and Chair of the Economics Committee Tim Wilson is a fervent supporter of this movement, even starting his own website 'Home First, Super Second'.

“There is only one policy that stops young Australians using all of their savings to buy their first home, and it is prioritising super over home ownership,” Mr Wilson told The Saturday Paper.

In bizzaro land of @IndustrySuper Big Super funds investing your money in housing they own is good, and you investing your super in housing you own is bad. They want to empower themselves, that’s why it should be https://t.co/zExyqfwTFD

— Tim Wilson MP (@TimWilsonMP) February 25, 2021

First home buyer numbers are actually at their highest point since June 2009, accounting for 35.9% of all owner-occupied loan commitments.

Yet affordability is worsening across the country: House prices increased at the highest rate in 17 years in February (up 2.1%), while even regional affordability is declining faster than capital cities.

ASFA's review found enabling Australians to use super deposits would not help affordability at all, instead reporting:

- It would be inequitable and ineffective since it would most likely be used by higher income earners who can afford a home already, and

- The increased purchasing power would be near fully capitalised into higher house prices, exacerbating the upswing of the current house price-credit cycle.

"Using superannuation for housing deposits is fundamentally inconsistent with the objective of superannuation to provide an adequate retirement income, Dr Fahy said.

"None of the comprehensive reviews of superannuation over the last decade have recommended it, while several have made recommendations to the contrary.

"Patient, long-term superannuation capital has the capacity to generate increases in housing supply and improve tenure and affordability in the rental market.”

Former Prime Minister Malcolm Turnbull is one high-profile person to reject the proposal of using super to buy houses.

"I can only comment on what has been proposed by them, and I have great affection for them, but they are just wrong," Turnbull said.

"It is honestly wrong. If you've got a fire you put water on it, not kerosine. The last thing the housing market needs is firing up stronger demand."

Incentives that boost demand for housing are seen by some experts as a key reason for booming house prices, such as cash grants for first home buyers and the recent HomeBuilder scheme.

Instead, ASFA's review recommends supply-based policy changes to address affordability concerns, like:

- Improving land release, zoning, planning & approval processes

- Reducing stamp duties or replacing them with land taxes (some state governments are already trying this) which removes the economic

barrier of high transaction costs - Removing or reducing negative gearing concessions

- Removing or reducing Capital Gains Tax (CGT) exemptions

- Including the family home in the Age Pension asset test, which it says would increase equity in the retirement income system

- Increasing the supply of social and affordable housing (this has been recommended by a majority of economists before)

"There have been several academic reviews of the Australian housing market in recent years and all raise supply as a crucial contributor to lack of affordability," ASFA's report said.

"It is also widely recognised that favourable taxation and transfer policy has a distortionary effect on the demand for residential housing."

Related: RBA watching housing market boom 'carefully', may intervene

What about using your super to pay down a mortgage?

The Federal Government's Retirement Income Review released last year found there is a growing number of retirees still paying their mortgages in retirement, which other data has also shown in the past.

One in 10 retired Australians are still paying a mortgage when they retire, and this is only expected to increase.

The retirement income review found one of the biggest reasons for inequality in retirement is still paying a mortgage, or not owning a home at all.

"If households are diverting their income to pay down large mortgage debts, they could struggle to build retirement savings outside the home. This could delay when some households retire," the review found.

While there are many critics of using superannuation funds to buy a house, using said funds to pay off an existing mortgage ahead of retirement is generally seen as a more viable strategy for some.

Australians over 65 can currently withdraw from their super under any circumstances, and over-60s can make lump sum withdrawals tax-free.

Paying a chunk off a mortgage could have substantial benefits for retirees, as it would help alleviate the high household budget costs of monthly repayments.

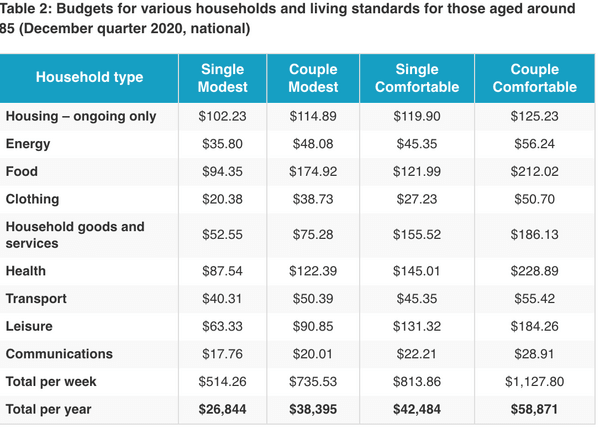

Housing is consistently one of the highest weekly costs in retirement. Source: ASFA

Photo by Maricar Limjoco on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Aaron Bell

Aaron Bell

Alex Brewster

Alex Brewster