According to founder and CEO of Metropole Property Strategists Michael Yardney, less than 4% of properties currently on the market are ‘investment-grade’.

So what makes an investment-grade property and what are the things should you be looking for when searching for one?

Looking for an investment property: what to consider

A good property can either make or break your fate as a property investor, so it’s important to get the foundations right, says principal of Good Deeds Buyers Agents and co-host of Foxtel's Location, Location, Location Veronica Morgan.

“If your foundation is not strong and solid when it comes to building a property portfolio you will never get a number two,” Ms Morgan told Savings.com.au.

“There’s a reason that over 70% of investors only ever get one investment property and don’t ever get to the second.”

Location, location, location

Location does 80% of the work, according to partner at Empower Wealth and co-host of Foxtel's Location, Location, Location Bryce Holdaway.

“Most of the time, I find people talking about the property first and the location second. I would actually say that you need to really focus in on the investment-grade location because it will do most of the heavy lifting,” he told Savings.com.au.

Pictured: Bryce Holdaway

“First-time property investors may say they have to buy a house at all costs, which means they might be 50, 60, 70 km out. Whereas if they decided that they could buy a townhouse closer into one of the big built-up areas, they might get a better outcome.

“An average house in a great location will do better than a great house in an average location.”

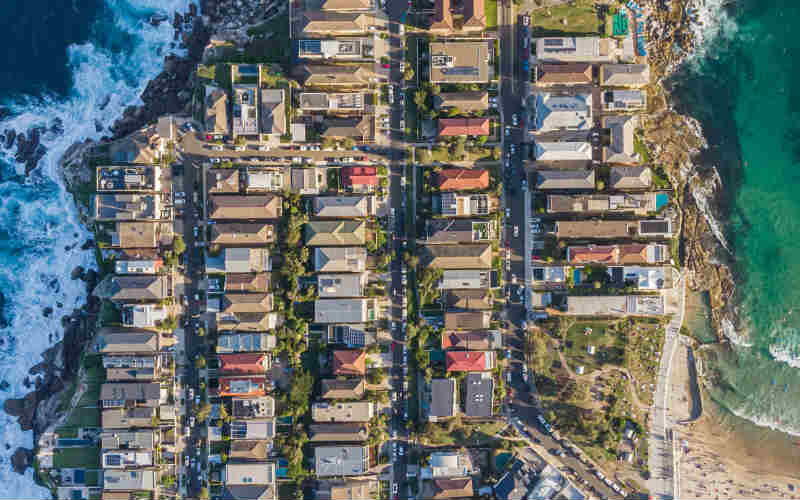

In terms of what makes a location great, most of the experts we asked agree that being close to either the CBD or the beach is key, as is close proximity to lifestyle amenities like cafes, shops, restaurants, parks, good schools and public transport.

Property Investment Professionals of Australia (PIPA) chairman Peter Koulizos said location is a golden rule of real estate and matters because unlike a home, it's permanent.

“You should pick an A-grade property in an A-grade location, however, if you can only afford one of these factors, ensure you pick the right location. You can change the property but you can’t change the location,” he told Savings.com.au.

Buyers are often advised to look for areas where demand is high and the supply of new stock coming on to the market is limited.

Investors should also look at the vacancy rate of the suburb they are targeting, according to property investment adviser Niro Thambipillay from investmentrise.com.au.

“An investor needs to ensure they can get their property rented first and foremost,” he told Savings.com.au.

“Too many investors buy in an area without considering whether it can be easily rented or not and this can cost them from a cash flow and lifestyle perspective.”

Generally, the lower the vacancy rate is, the better for investors as it can be an early indicator of the potential for future capital growth.

On the other hand, a high vacancy rate can be an indication of oversupply (like a bunch of new high rise apartments being built in the area), which means investors will struggle to get their property rented out because they will all be competing for the same pool of tenants.

It’s widely known that the industry standard of a market imbalance is a vacancy rate of around 3%, so investors should aim for suburbs with a vacancy rate below that.

Potential for capital growth

Besides buying in a good location, investors are also often advised to target properties that have potential for capital growth, which can go hand in hand with buying in a good location.

Mr Yardney said investors should look for areas with a long history of strong capital growth and that will continue to outperform the averages because of the area’s demographics, including gentrifying areas.

Capital growth refers to how the property appreciates in value over time, and it’s also a key way investors build wealth, so it’s crucial in an investment property.

Ms Morgan, who has launched a mini-course for first home buyers, said one of the biggest mistakes first time investors make is not focusing enough on capital growth.

“Too many investors focus on things like getting depreciation, saving tax, they look at rental yield but what they really need to be looking at is capital growth and types of properties and areas that are likely to give you good capital growth because, without that, they’re taking way too much risk with too little gain,” she said.

Mr Yardney also says investors may wish to look for properties where they can manufacture capital growth through renovations or redevelopment.

An element of scarcity

There are many reasons why property experts say off the plan apartments usually make terrible investments, one of them being that high-rise and medium-density accommodation often have little to no scarcity value.

Just because high-rise developments are designed for the investor market, it doesn’t make them investment-grade, according to Mr Yardney.

“They are what the property marketers and developers sell in bulk to naive investors – usually off the plan, but they are not investment-grade because they have little owner-occupier appeal, they lack scarcity, they are usually bought at a premium and there is no opportunity to add value,” he said.

Instead, Mr Yardney said investors should aim for properties that offer something scarce, unique or special, such as an older-style apartment built between the 1920s and 1970s because their architectural style tends to be scarce and timeless and they’re often located in areas where land is rare and in demand.

Art deco, character or period properties can generally make good investments too as demand for these types of properties will always outweigh the supply.

High land to asset ratio

Mr Yardney said a high land to asset ratio doesn’t necessarily mean a big block of land, but one where the land component makes up a significant chunk of the asset value.

“I’d rather own a sixth of a block of land under my apartment building in a good inner suburb, than a large block of land in regional Australia,” he said.

In an advice column for Domain, founder and managing director of Property Planning Australia David Johnston said that knowing the land to asset ratio of a property is essential as land value typically rises which drives price growth, whereas a dwelling usually depreciates in value. Because of this, it can pay to have a significant percentage of the property made up of the land value.

“From an investment perspective, you should strive to select an asset where the land represents 70 per cent of the value of the property, with 50 per cent as the minimum,” Mr Johnston said.

“You can have a high land-to-asset ratio due to a large land size, an older dwelling or a high land value per square metre.

“Of these factors, it’s best to focus on the latter, as it is more likely to occur in a highly sought-after locations.”

Mr Johnston also wrote that in highly sought-after locations, typically close to CBDs, the suburbs are more established and have a high number of older or character style homes.

“These properties are more likely to have a better land-to-asset ratio than recently built properties that are yet to complete their depreciation phase,” he said.

Maximum appeal to owner-occupiers

Two-thirds of Australians live in a home they own while the remainder are renters, according to data from the Australian Bureau of Statistics (ABS).

With that in mind, owner-occupier appeal should be a key thing investors look for because they’re the buyers that make up the largest segment of the market.

Ms Morgan said investors should target properties that will appeal to a wide range of owner-occupiers.

“We encourage our investor clients to think like owner-occupiers, as owner-occupier appeal is really what is one of the foundations of capital growth,” she said.

That’s because owner-occupiers tend to buy with their heart, not their head when buying a property drives prices up.

“One of the big mistakes investors make is that they’re buying ‘investment stock’ and they’re not thinking about the bigger market. There’s no secondary market for that sort of stock unless it actually appeals to owner-occupiers,” Ms Morgan said.

“Ultimately who pushes prices up, it’s owner-occupiers and investors in the mix as well. But you want more than one type of buyer that’s interested in a property down the track when you go to sell it.”

Mr Yardney said this will be particularly important in the future as the percentage of investors in the market is likely to diminish.

Besides being in a good location, qualities owner-occupiers look for in a property is street appeal, lots of natural light, openness, a connection between the indoors and outdoors, good ventilation, lots of storage and a good floor plan.

A, B and C-grade properties: Why the grade matters

You’ve probably heard the term ‘A-grade property’ get thrown around quite a bit, but what does it actually mean?

“An A-grade asset is something that lots of other people want. There’s scarcity,” said Ms Morgan.

“It also has certain characteristics that make it appeal to more buyers than others. For instance, in a family-oriented area, you want a property that's really going to have maximum appeal to families in that area. So a three-bedroom home is not going to be as appealing as a four-bedroom home.

“An A-grade property is going to have all those characteristics that a lot of people will go for. And when there's a lot of property on the market, you want your one to stand out as being, ‘I want that I'm not going to compromise and have a triangular block or buy on a main road or buy something with a steep block. I'm going to buy something that's got everything I want in it'.

“So that's fundamentally what the definition of an A grade is, it’s got more characteristics that people want.”

On the other hand, B-grade properties are usually in the right suburb, but not necessarily where buyers prefer to be. So they might be further away from amenities, lack parking, or have an awkward floor plan.

“A B-grade property could be on a really good street, but the property doesn’t necessarily have a lot of emotional appeal through the actual architecture, but it’s really well located,” Mr Holdaway said.

Properties that get a C-grade could be located on a main road or on steep or battle-axe block, and have little appeal.

“C-grade is actually more of a, just a cookie-cutter approach, nothing unique about it,” he said.

Ms Morgan said the grade matters because it will affect how your investment property performs.

“An A-grade property will go up at more than the median house price, and if everything goes down, it's going to go down less than the median. So it will always perform better than the median.

“There's a lot of sayings that go around with property. One is ‘a rising tide lifts all ships’, well that's crap. Any given suburb, any given types of property, you get some that perform better than others. So they're not all being risen or dropped at the same rate.

“Another saying is ‘safe as houses’. Well, that's actually crap too, because there's plenty of people that lose money in property. And it happens way more than people want to talk about.”

Capital growth versus rental yield

Almost all the experts we spoke to unanimously agreed that rental yields are not a reliable indicator of a good investment property.

“You do need to be able to afford to hold property and the problem with an A-grade asset is they are typically hard to buy, they’re competitive, you have to spend more money buying that property in the first place, and often the yields are very low on an A-grade property. So it’s sort of counter-intuitive to what you would expect,” Ms Morgan said.

.jpg?language_id=1)

Pictured: Veronica Morgan

“The problem with that is that a lot of people go the safe route. They borrow less money and they go for where they get more rent because that makes them feel better that they can pay a mortgage off, but the problem is you’re just buying the right to collect rent, you’re not actually buying an asset that’s going to grow in value.

“Yield and growth tend to be mutually exclusive. The higher the yield, the higher the risk and the less potential for capital growth.”

Mr Holdaway said while rental yields are not a good indicator of a good investment property, they do help with cash flow.

“Capital growth is what you’re chasing, but the rental yield is what you’re actually wanting ultimately because you want to live off the passive income that comes from having the rent into these properties,” he said.

“I think you should chase capital growth in the early part of your investing accumulation cycle. And then towards the end, you want to be able to retire out the debt so that you can live off the rents, but in some cases, people who don't have a lot of equity really rely on that rent return early.”

Mr Yardney said that in Australia, residential real estate is a high growth, relatively low yield investment.

“Those who try to invest for cash flow never develop the financial freedom they’re looking for,” he told Savings.com.au.

“You can’t save your way to wealth, so it is very clear that capital growth should be the main aim of property investors and not cash flow, at least not in the short-term until they have built a sufficiently large asset base.

“Unfortunately, that’s just how property in Australia works – it’s not a cash cow. Sure cash flow is important to keep you in the game, but it’s capital growth that gets you out of the rat race.”

On the flipside, Co-founder of Freedom Property Investors Scott Kuru argued rental yields are a reliable indicator of a good investment property.

“If demand is high, rents are high,” he told Savings.com.au.

“An important part of investing in property is being able to service your loans and expenses. If your rents are too low it will hurt you when you apply for a loan for your next investment.”

“Don’t buy just for depreciation reasons”

Another thing investors may want to avoid doing is buying an investment property (particularly off the plan) purely for depreciation and tax reasons.

“It’s a massive red herring,” Ms Morgan said.

“With depreciation, you’ve got to spend a dollar to get back a maximum 47 cents or whatever the top tax rate is now. I mean, it’s just simple maths. It doesn’t make sense.

“If you’re not buying with capital growth as a primary motivator, then why lose 53 cents in every dollar that you spend?

“If you look at off the plan sales in Melbourne and Brisbane in particular, over the past decade the proportion that have lost money on the second resale. In some cases, up to 60% of resales are at a loss. That’s a massive price to pay to get some good depreciation benefits.”

Mr Holdaway said too many first time investors get lured in to buying an investment property - particularly off the plan apartments - because of the depreciation.

“They get seduced by bling, which means they get sold by some slick salesperson saying they should buy properties for depreciation and for tax benefits,” he said.

“But I say that's actually just a bonus. It's the cream. It's not the reason that you buy - you should actually be buying for the growth potential first before you worry about a tax outcome.

“I wouldn't buy off the plan just to get depreciation, I'd want the investment to stack up first and then make sure I get the most depreciation that I possibly can after making that decision first.”

Savings.com.au’s two cents

Clearly, there are a LOT of things to keep in mind when buying an investment property - and we’ve only just scratched the surface!

If you are considering buying an investment property, it’s important to consider if it actually makes sense for your personal investing goals, risk profile and your current situation.

Can you afford to purchase an investment property and hold it? It makes little sense to buy an investment property if the costs of holding it will have an adverse impact on your monthly cash flow and lifestyle.

It’s important to remember that property isn’t the only way to invest - more Aussies have been investing the sharemarket in the wake of COVID-19. Depending on your risk profile and goals, this may be more suitable for your situation. Read our article about the pros and cons of investing in property versus shares for more info.

As always, have a careful think about your personal financial position and consider speaking to a qualified financial adviser before you make any major investment decisions.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Alex Brewster

Alex Brewster

Denise Raward

Denise Raward