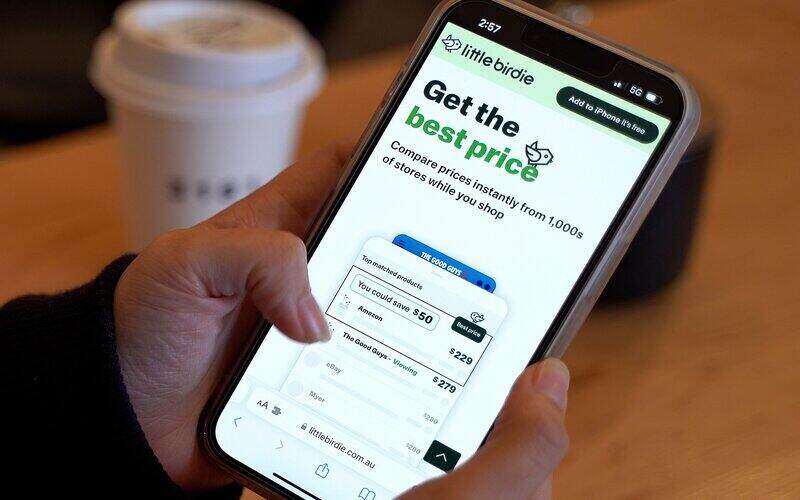

CommBank-backed AI-powered bargain finding technology has officially launched in Australia, promising to save shoppers hundreds, if not thousands, of dollars each year.

Little Birdy offers a browser extension that automatically compares prices across thousands of retailers to find the best bargain available.

The big four bank was an early, cornerstone investor in the tech outfit, snapping up a 23% stake for $30 million in 2021 – valuing Little Birdie at more than $130 million.

On the back of the investment, CommBank customers can access exclusive daily offers, sales events, and vouchers within the bank’s app.

“Little Birdie’s mission is to bring transparency to online retail and to save people their hard-earned money every time they buy online, just by making sure they get the best price out there,” Little Birdie founder and CEO Jon Beros said.

“Aussies spent nearly $64 billion online in the last year alone.

“Yet the average shopper might not know how often retailers are changing pricing which makes you think you’re getting a good deal.”

A CBA spokesperson told Savings.com.au the bank's partnership with Little Birdie is "a fantastic way for our approximately 8 million digitally active customers to access the best online shopping offers."

"CBA customers can access personalised offers from Little Birdie in the purpose-built Rewards hub in the CommBank app including spend and save offers from well-known brands like Bing Lee and Fila."

The browser extension’s launch comes as Australians continue to battle the cost of living crisis.

The majority are said to be concerned about rising living costs, while half are putting off purchases as they wait for sales or deals.

“Using Little Birdie when shopping online can save the average household many hundreds, possibly thousands of dollars every year,” he said.

“At a time when the price of everything is rising, installing Little Birdie will not only keep money in your bank, but being able to see what everyone is charging will also give you the confidence you aren’t overpaying or missing a great deal.”

Little Birdie can be installed on Chrome or Safari, allowing use on desktop and iPhones.

More Aussie investors use AI to manage their portfolios

Beyond saving money, one in ten Australians are turning to AI to help make money.

A study of 10,000 retail investors, including 1,000 Australians, by trading platform eToro found 14% are using tools like ChatGPT to help pick and change investments in their portfolios.

“AI harnesses the ability for retail investors to analyse vast amounts of data, generate new investment ideas and overcome human biases, whilst saving themselves precious time,” eToro market analyst Josh Gilbert said.

“This means that AI has the potential to tilt the scales more towards retail investors and provide them with the tools to make better-informed investment decisions.”

Beyond those already turning to AI for investing purposes, another 32% were found to be open to the idea of doing so.

Of those, more than half said they would let AI execute trades for them in the future.

But Gilbert admits the technology is “far from faultless”.

RMIT Associate Professor of Finance Angel Zhong previously told Savings.com.au that while AI tools can help investors and consumers in numerous ways, they have strict limitations.

“Human advisors can offer critical analysis, consider the broader context, and provide guidance beyond what AI algorithms can offer,” she said.

Image supplied

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

William Jolly

William Jolly