CBA has attached the deal to eligible conditionally pre-approved home loan customers - estimated to save home buyers up to $2,700.

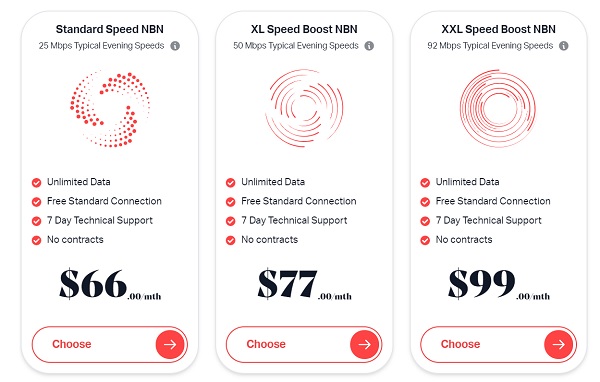

Existing customers can also get 30% off More NBN plans for the first 12 months when they sign up using their existing credit or debit card.

The free deal applies to the $77 per month plan, which has a typical evening speed of 50Mbps.

Eligible customers include those who have a home loan of at least $250,000 - construction loans are ineligible.

Customers must fund $250,000 or more and find a home between 31 May and 31 December 2022, and the offer must be claimed by 30 June 2023.

Dr Michael Baumann, CBA executive general manager of home buying, said this is an offer to ease cost of living pressures.

"We know that the rising cost of living is being felt by all Australians, particularly those looking to purchase a property in the current environment. We want to support pre-approved home loan customers where we can, and that includes longer-term savings on essential and ongoing bills and commitments like internet," Dr Baumann said.

This offer comes after research from CommBank suggested the majority of Aussie households are ready for rate rises.

With the RBA tipped to increase the cash rate target on Tuesday, the target is poised to sit at either 0.60% or 0.75%, which theoretically pushes up variable home loans by between 25 and 40 basis points.

Increasing a 30-year $600,000 home loan from 2.75% p.a. to 3.00% p.a. adds $81 a month to the base mortgage repayment.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Photo by LinkedIn Sales Solutions on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly

Harrison Astbury

Harrison Astbury