Last Friday, the Queensland Government unveiled its first emergency housing measure, enabling secondary dwellings to be made available to people other than immediate family members.

“I know the rental market is tough and, right now, homeowners can’t rent secondary dwellings to anyone other than immediate family,” Queensland Premier Annastacia Palaszczuk said.

“Changing this will mean many cheaper properties will enter the rental market, helping thousands of people across our state.”

Queensland Deputy Premier Dr Steven Miles said the new initiative will allow homeowners to earn rent and ease the pressures of cost of living.

REIQ CEO Antonia Mercorella welcomed the State Government’s granny flat solution.

“We know finding immediate solutions is very challenging in the current market given the backdrop of the construction crisis, so the ability to open up the option of granny flats to people outside of immediate family members is a great way we can make a considerable difference today,” Ms Mercorella said.

“It opens up new avenues to housing that are certainly much better than seeing people in our community facing homelessness or living in cars, tents, and hotel rooms.”

According to figures from SQM Research, the Brisbane's vacancy rate held steady in August at 0.7% - the third-lowest in the country behind Darwin and Hobart, and tighter than the national average of 0.9%.

Meanwhile, PIPA’s Annual Investor Sentiment Survey found nearly 30% of rental dwellings have been stripped from the Queensland property market over the last two years.

What you need to know before renting out your granny flat

While Ms Mercorella said Queensland needs every available property on the market, there are some elements to watch out for with these new planning changes.

“We appreciate that sometimes red tape gets in the way of creative solutions, but equally, we don’t want to see a 'free for all' where there’s no regulation, leaving people vulnerable to being exploited,” she said.

“For example, we don’t want people to think they can suddenly use inappropriate structures such as garden sheds or garages and pass these off as granny flats.

“We’d also issue a word of warning to homeowners - it’s important to do your research to understand the potential tax implications that this could create, in terms of capital gains tax at the time of sale, as well as potentially triggering land tax liabilities under recent land tax reforms.”

This comes as the Queensland Government introduced new tax brackets for Queensland residents holding property investments interstate, of which the REIQ has been highly critical.

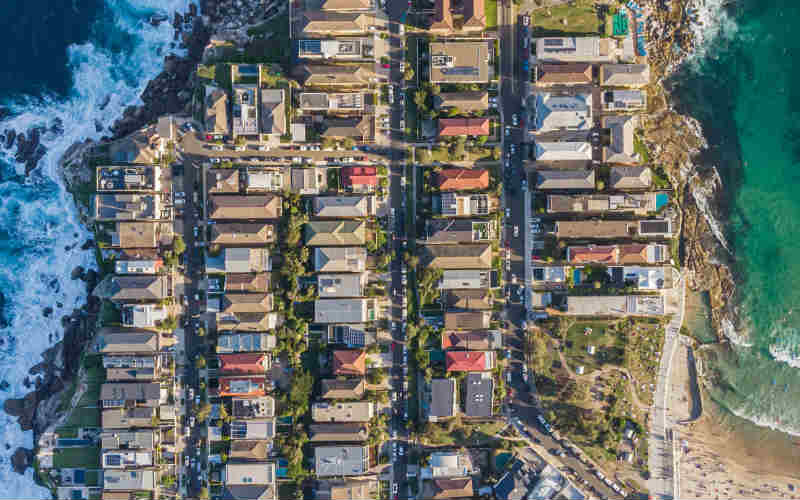

Image by Andrea Davis via Pexels

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Emma Duffy

Emma Duffy

Harrison Astbury

Harrison Astbury