According to Insignia Financial’s Financial Freedom Report, Aussies are now more inclined to pursue their dream life (60%) over owning their dream home (40%).

In what appears to be a shift from the past, the most common aspirations held by Aussies today are achieving financial freedom, 55%; taking regular holidays, 50%; maintaining a good work/life balance, 45%; home ownership, 45%; and building a trust group of friends/family, 44%.

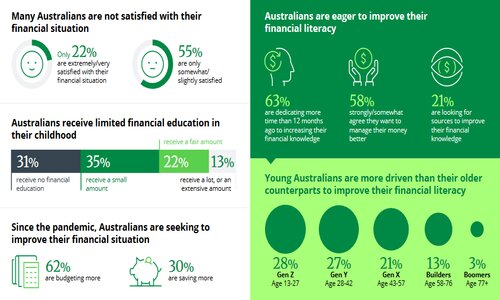

The survey of 2,511 respondents found the impacts of Covid-19 and the increased cost of living have forced three in five Aussies to adjust their household spending and budget more.

When asked if they would be able to maintain their current lifestyle over the next two years, 56% were not confident this would be possible compared to the 44% who strongly or somewhat agreed.

Insignia Financial Chief Executive Officer Renato Mota said Aussies are taking proactive steps to achieve their goals.

“It’s clear Australians have changed their priorities in life from the traditional dream of owning a home to living their dream lifestyle, which is under pressure from the current economic climate,” Mr Mota said.

“Australians are deeply aware of their financial wellbeing because it ultimately enables them to achieve the things that matter most to them, whether that be travel or spending time with loved ones.”

Improving financial literacy at the forefront

A third of respondents (31%) said they received no financial literacy education in their childhood, while 35% received a small amount and only 22% received a fair amount.

From a young age, females are most likely to report receiving no financial education in their childhood.

| Female | Male | |

| Gen Z | 20% | 11% |

| Gen Y | 28% | 14% |

However, the report found women are working hard to achieve their dreams, with the research indicating they are more motivated than men (55% compared to 44%).

As the cost of living crisis eats into Australians' pay packets, there’s more of an appetite for improved financial literacy.

One in five (22%) say that they are not satisfied at all with their financial situation and more than half are only somewhat/slightly satisfied with the state of their finances.

To remedy this, 58% want to manage their money better and 63% are dedicating more time and energy to increasing their financial knowledge compared to a year ago.

Image by jcomp via freepik

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly

Rachel Horan

Rachel Horan