The 2023 edition of PRD’s Australian Economic and Property report found that while early signs are pointing to a recovery in the property market, thanks to a stable cash rate, there are multiple factors still at play.

PRD Chief Economist Dr Diaswati Mardiasmo said there are six different layers that interact and shape property trends.

- Housing strategies

- Financial readiness

- Government policy

- Population growth

- Demographic changes

- Cash rate

“Cash rates play a role as they determine our borrowing power and what we can afford,” Dr Mardiasmo said.

“Yet in some markets, cash rates play less of a role due to demand and supply imbalance.

“What’s more, individual household and financial readiness add another layer of complexity to decision making.

“Plus, as if our property layers are not complex enough, our demographics are shifting. We have smaller family compositions, more acceptance to long-term renting, generational co-living, and even a mindset shift regarding our wealth creation and spending preference.”

What’s the property outlook for early 2024?

Speaking to the Penny for Your Thoughts podcast, Dr Mardiasmo said there’s a lot riding on the property outlook for next year, and it all comes down to ‘hikes versus no hikes.’

“Coming into the end of 2023, I want to say we’re in a better place. Yes, our household budget has been hammered, but the cash rate has been held stable for the moment,” she said.

“If the cash rate is still being held at the current rate, then I would expect to see a recovery in every single market, whether it’s your capital cities or your regional areas, because more people become confident entering the market which pushes up demand.

“But I would say that we will not be seeing the massive boom in prices that we saw when we came out of the pandemic.”

What type of buyer will be coming back into the market?

Dr Mardiasmo expects the market will be tailored favourably towards owner-occupiers rather than investors.

“At the moment, there has been quite a lot of talk about whether now is a great time to come back as an investor or not because there has been an increase in investment upkeep costs,” she said.

“Upkeep used to cost around $15,000 whereas now it’s gone up anywhere between $25,000 to $30,000.

“As an investor, not only do you have to pay your loans, but also body corporate, council rates, infrastructure rates, property management fees, and insurance fees.”

The possibility of rental caps may also discourage some investors from buying and holding rental properties.

Housing shortage at the core of our issues

Australia is in the midst of a housing crisis - there’s not enough supply to equal the demand.

And it’s not just Aussies fighting it out for what little properties are left on listings sites; it’s also the 315,000 migrants expected to come into the country this financial year.

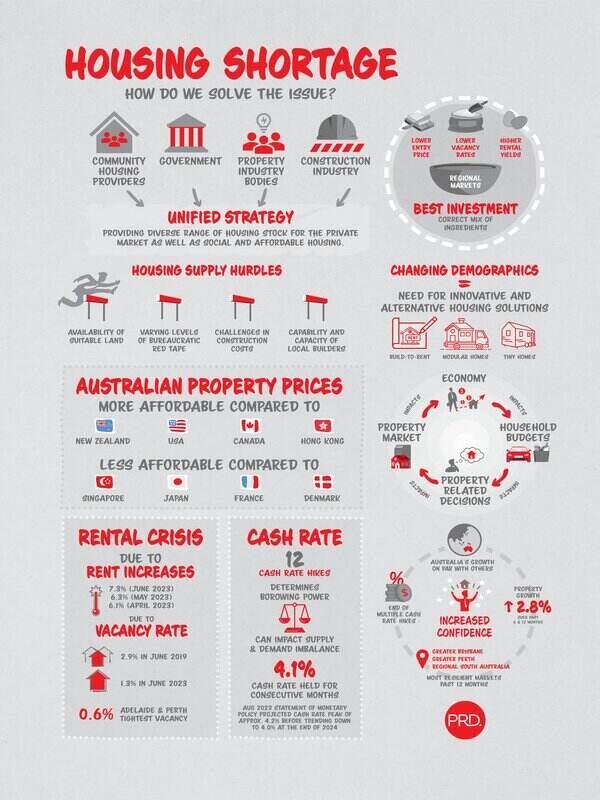

At the crux of the housing crisis lie four hurdles: availability of land, bureaucratic red tape, construction costs, and the capacity of local builders.

ABS building approvals data revealed total building approvals decreased by 8.1% in the month of July, which was driven by a 19.9% dip in apartment block approvals.

“Two back-to-back falls in approvals suggest a decline in residential construction activity toward the end of this year and into next, despite backlogs in the sector,” said Adelaide Timbrell, ANZ Senior Economist.

A lack of supply is also evident through Australia’s rental vacancy rate, which currently sits at 1.3% as of June.

“Vacancy rates have really suffered. Before the pandemic, the national vacancy rate was around 2.9%,” Dr Mardiasmo said.

“Now, we’re at 1.3% which means we only have half of the stock available.

“The Real Estate Institute of Australia has a healthy benchmark of 3% and anything below suggests demand is outstripping supply.”

With demand and supply for housing moving in opposite directions, PRD economists believe now is the time to entertain the idea of bigger family-friendly apartments to increase the diversity in property choice for Australians.

Read More: 2024 could see 'decade low' level of new houses built in Australia

Renters hit the worst

The Australian rental market has reached a point of severe stress, with rental prices remaining a “sticky point” in the declining trend of the consumer price index (inflation) for the last 12 months.

As a component of inflation, rents increased from 6.1% in April 2023, to 6.3% in May, to 7.3% in June. It’s one part of the inflation data that has yet to decrease.

“There’s no capital city where the rental prices have declined,” Dr Mardiasmo said.

Canberra continues to be the most expensive capital city to rent a 3-bedroom house at $650 per week, followed by Sydney ($620) and Darwin ($611).

For 2-bedroom units, Sydney takes out the top spot at $650 per week, followed by Canberra ($580) and Melbourne ($520).

Meanwhile, rentals in Brisbane are the most affordable for both 3-bedroom homes and 2-bedroom units, at $480 and $470 per week respectively.

In the March quarter 2023, renters spent 23% of their income on meeting median rents, a 3.6% increase in the past 12 months.

See Also: The solution to housing affordability? Experts say build-to-rent

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Tom Rumble via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Hanan Dervisevic

Hanan Dervisevic

Emma Duffy

Emma Duffy