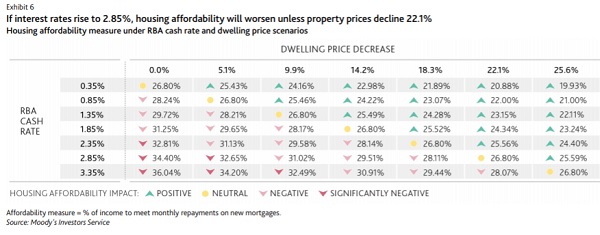

Moody's Investors Service found if the RBA raises the cash rate to 2.85% this year, property prices would need to fall 22% to compensate, which it does not forecast happening.

If the cash rate rose to 1.35% - only half a percentage point higher than where it is currently - property prices would need to decline 14.2% to see an improvement in mortgage affordability.

If it rose to 1.85%, prices would need to decline 18.3% to compensate.

The Reserve Bank previously said that the cash rate profile is somewhere around 1.50% to 1.75% by the end of 2022.

It’s important to note that Moody’s Investors Service measures housing affordability by the proportion of household income borrowers need to meet repayments on mortgages.

The report showed that on average, households with two income earners needed 26.8% of monthly income to meet their monthly mortgage repayments on new loans by the end of May. This is an increase of 1.1 percentage points from January 2022.

This measure of housing affordability declined in all Australian capital cities in May compared to January.

Sydney had the highest household income to meet mortgage repayments in May with 37.0% while Melbourne followed with 29.8%, Brisbane and Adelaide with 23.1% respectively, and Perth with a low 16.3%.

Anything over 30% is commonly dubbed mortgage stress.

"[A rising interest rate] increases the risk of delinquencies and defaults, particularly with inflation raising the costs of living,” analyst Si Chen said.

"Higher interest rates will dampen property market sentiment, weighing on house prices.

"However, our housing price and interest rate scenarios found that prices will not decline to the extent that housing affordability improves while interest rates increase this year."

In a presentation last week, CoreLogic head of research Eliza Owen said during Perth's most recent market downturn, property prices declined 20% and arrears doubled to 3.0% - "still at very low levels".

Houses are less affordable than apartments

Moody’s data also revealed house buyers needed 30.2% of household income to meet their mortgage repayments in May while apartment buyers needed 21.4%.

Sydney had the highest disparity between house and apartment affordability with house buyers needing 47.1% of income to meet mortgage repayments compared to 26.6% for apartments.

Rising household incomes not enough to combat affordability

Although it is expected that household incomes will rise this year due to the strong Australian economy, low unemployment rates, and a 5.2% minimum wage increase, this may not be enough to improve housing affordability.

Moody’s expects that the rising interest rates will overshadow higher incomes and restrict potential homebuyers’ borrowing capacity.

Despite falling property prices and increasing household incomes, housing affordability will continue to worsen for borrowers over the coming year and into 2023.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

Lender Home Loan Interest Rate Comparison Rate* Monthly Repayment Repayment type Rate Type Offset Redraw Ongoing Fees Upfront Fees Max LVR Lump Sum Repayment Extra Repayments Split Loan Option Tags Features Link Compare Promoted Product Disclosure

Promoted

Disclosure

Promoted

Disclosure

Promoted

Disclosure

Disclosure

Image by Dhyamis Kleber via Pexels

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Alex Brewster

Alex Brewster

Emma Duffy

Emma Duffy