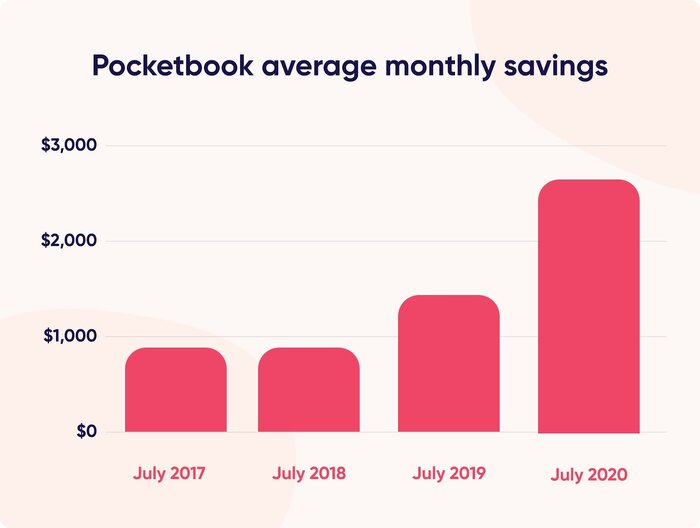

According to data from 800,000 users of personal finance app Pocketbook, Aussie savings have tripled in the past three years, and is up 116% in the last six months alone.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

Pocketbook's data shows Australians' monthly savings sat at $941 in July 2017.

In subsequent years, monthly savings:

- Averaged $948 in July 2018

- Averaged $1,516 in July 2019

- Averaged $2,645 in July 2020

Image source: Pocketbook

The biggest jump came in 2020, between January and July, where monthly savings increased from $1,200 per month to $2,600 per month.

Savings spiked the most in April 2020, jumping 120% from a year earlier, when the full effects of COVID-19 shutdowns were felt by many Australians.

These figures are supported by the Australian Bureau of Statistics (ABS) data, which shows the household savings ratio skyrocketed from 2.5% to 19.8% over the June quarter.

Government support payments such as JobSeeker significantly contributed to this rise in Aussies saving money over spending, according to the ABS.

The rise in savings is despite the current unemployment rate is 6.9% (and a higher effective unemployment rate), with Australians stashing money away out of caution as a result of the pandemic's economic fallout.

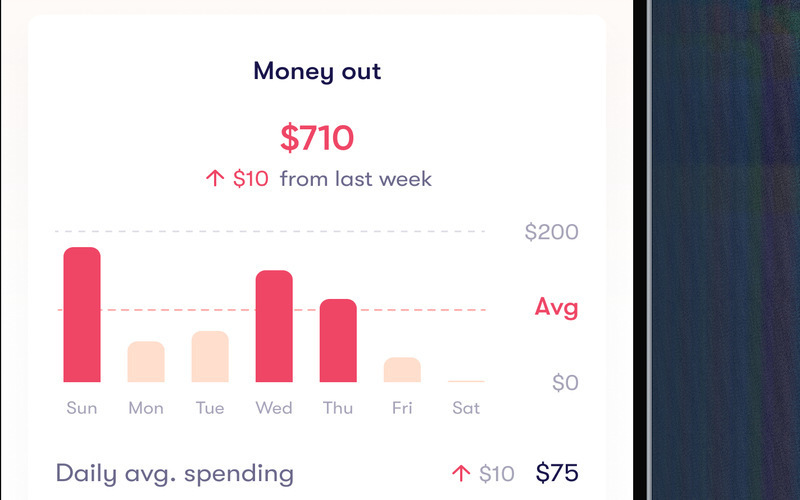

Pocketbook Director Serdar Nurmammedov said the pandemic has created "never before seen" spending habits.

"Preserved outgoings, coupled with ingoings reliant on government stimuli, mean it’s understandable that consumers are being extra cautious with their spending so they have enough money put away should the worst happen," Mr Nurmammedov said.

According to Pocketbook data, this increase in savings has occurred despite a 25% increase in 'bank spend' between June and July 2020 and 2019, indicating consumers are relying more on credit and overdrafts to get by.

"It’s a positive sign that Aussies are being savvy with their finances and creating a buffer should they need to rely on this in the future," Mr Nurmammedov said.

"Our data indicates that these trends are set to continue post-pandemic as Aussies work to curb spending and preserve their savings.

"As the government introduces more spending incentives and the job market picks back up we’re likely to see this frugalness lessen.

"For now though, Aussies are understandably remaining cautious."

[Read: Household deposits are up during the pandemic - are there any good interest rates?]

What is Pocketbook?

Available on both iOS and Google Play, Pocketbook syncs with your bank account (as long as you give it permission to do so), listing every spend you make and sorting it into categories.

Compare some of the other top-rated budgeting and savings apps in Australia.

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly