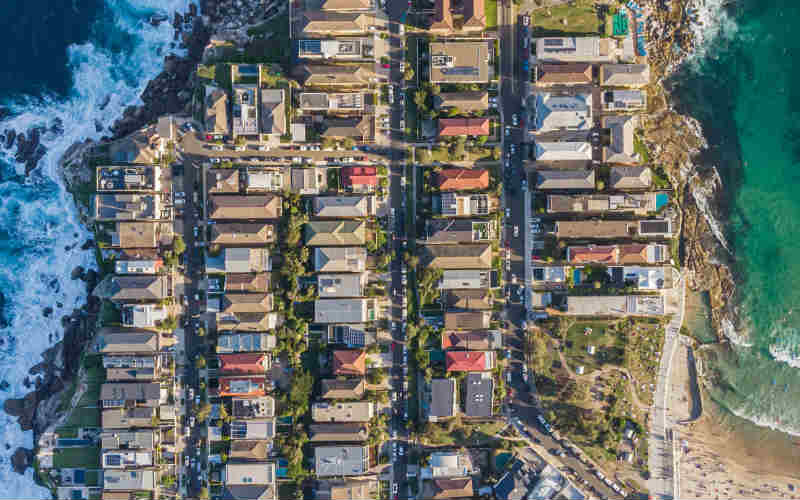

According to CoreLogic data, Sydney dwellings have risen in value by more than 25% in the last year.

Domain’s House Price Report indicates house prices rose by roughly $6,700 a week over the past 12 months, a total rise of just over $349,000.

Australia’s most expensive capital city now sits with a daunting median house price of almost $1.5 million.

This is on the back of the fastest annual rate of house price growth on record, at 30.4%.

Despite this rapid rise, some economists are anticipating possible interest rate rises in late-2022, which could mean trickier lending conditions for borrowers.

So what locations could see some of the biggest spikes in prices? We asked the experts to discover their top picks of major growth suburbs in 2022.

- Parramatta, Pyrmont, Rozelle

- Darling Square

- Bexley and Belmore

- St Leonards and North Sydney

- Blue Haven, Cessnock, Dubbo

Parramatta, Pyrmont, Rozelle

Rob Trovato, Head of Network at Better Homes and Gardens Real Estate, told Savings.com.au new infrastructure and the widespread shift towards a hybrid working lifestyle have created great growth potential in Sydney’s west.

“There's infrastructure going into areas west of Sydney, like Parramatta, Concord, Pyrmont, Rozelle, are all going to benefit from the high speed, high frequency metro line that’s going to connect them to the CBD," Mr Trovato said.

“Those suburbs are already seeing growth, and will continue to see growth because of that.

“I don’t see the same growth as this year, I see it slowing down a bit, but there still will be growth next year.”

-

Median price - Parramatta: $1,300,000 for houses, $605,000 for units

-

Median rent - Parramatta: $478 p/w for houses, $420 p/w for units

-

Median price - Pyrmont: $1,420,000 for houses, $1,205,000 for units.

-

Median rent - Pyrmont: $700 p/w for houses, $610 p/w for units.

-

Median price - Rozelle: $1,870,000 for houses, $1,305,000 for units

-

Median rent - Rozelle: $813 p/w for houses, $525 per week for units

Darling Square

Director of Ayre Real Estate Craig Donohue told Savings.com.au that newly developed Darling Square in the suburb of Haymarket is a market still with plenty of growth to come.

“The interesting thing we're finding is that there's already a lot of demand for people to come back into the city, now that we are out of lockdowns,” he said.

“So the area I think is going to be a good one to watch is probably the Darling Square and Haymarket area.

“It's an area that's been underperforming probably for the last couple of years. But we're starting to see a lot of good results, and especially some of the new developments.”

Mr Donohue said he thinks there’s still a lot of gains to be had.

“We're seeing a lot more owner occupiers move into the area, and really love it," he said.

“A lot of people looking at the area haven't really considered living there in the past. And now they're seeing all the development come together, and all the amazing retail and shops and cafes and parks that have come with it. And it's becoming a really popular lifestyle choice.”

-

Median price - Haymarket: $925,500 for units (Houses n/a)

-

Median rent - Haymarket: $660 p/w for units (Houses n/a)

Bexley and Belmore

Independent Buyers Agent Michelle May told Savings.com.au that south of Sydney CBD, Bexley and Belmore are set to benefit from the upgraded metro line.

“You know, I think people have realised that there's actually more value for money down south and further west,” Ms May said.

“Local council and the government have been injecting a lot of money into public transport, upgrading the metro line.

“Some stations now going into the CBD, their actual journey is going to be 20 minutes less which is fantastic.

“So combined with the option to work at home, now they've actually become a proper option, because people are no longer forced to work in the CBD and that makes a big difference.”

-

Median price - Bexley: $1,506,000 for houses, $724,545 for units.

-

Median price - Belmore: $1,383,000 for houses, $535,000 for units.

-

Median rent - Bexley: $635 p/w for houses, $400 p/w for units.

-

Median rent - Belmore: $580 p/w for houses, $350 p/w for units.

St Leonards and North Sydney

According to Director of The Investors Agency, Darren Venter, Sydney’s recent boom is likely to turn into a steady build over the next 12 months.

“Inner city suburbs are all slow burners, slow risers and constant growth markets, generally speaking,” he told Savings.com.au

“Incentive behind those markets growing will be the introduction or opening of borders, especially to Asian markets, such as what we've got going on with Singapore at the moment.

“As borders begin to reopen the major metropolitan markets will also start to strengthen and suburbs that have dipped during the start of the pandemic or not grown as much as the neighbouring ones have, will also become more desirable as international interests surge the values in the low vacancy towers.

“In the short-term, with the Australian government campaigning for interest from Singapore - who has easy access considering COVID restrictions - Sydney inner-city markets can expect support to continue.”

-

Median price - North Sydney: $2,805,000 for houses, $1,055,500 for units

-

Median price - St Leonards: $1,050,000 for units (houses n/a).

-

Median rent - North Sydney: $1,023 p/w for houses, $530 p/w for units

-

Median rent - St Leonards: $775 p/w for houses, $580 p/w for units.

Blue Haven, Cessnock, Dubbo

Outside of the Sydney, Mr Trovato also shared regional suburbs he tips for growth in 2022.

North of Sydney, Mr Trovato identified Blue Haven as an entry level suburb with growth potential in the next twelve months, as well as regional suburbs Cessnock and Dubbo.

“People are looking for that sea change to work from home now that COVID has given all businesses new ways of working. People are moving out of Sydney because of that,” he said.

-

Median price - Blue Haven: $627,500 for houses.

-

Median Rent - Blue Haven: $480 p/w for houses.

-

Median price - Dubbo: $435,000 for houses, $309,500 for units.

-

Median rent - Dubbo: $400 p/w for houses, $290 p/w for units.

-

Median price - Cessnock: $456,000 for houses, $355,000 for units.

-

Median rent - Cessnock: $400 p/w for houses, $320 p/w for units.

Also read: Brisbane suburbs to watch in 2022

Image by Leigh via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Jacob Cocciolone

Jacob Cocciolone