The figures from the Australian Bureau of Statistics (ABS) painted a more positive picture of the Australian job market, as employment increased by 114,700 people and hours worked increased by 1.3%.

However, with the marginal increase to unemployment, there are now more than one million people out of work and searching for a job.

The figures come in shy of the market consensus of the unemployment rate increasing to 7.8%, while forecasting was split between 125,000 jobs being lost and 150,000 being added, a reflection of how volatile the economy currently is.

Head of Labour Statistics at the ABS Bjorn Jarvis said while the results were encouraging, there was a significant difference between the current and pre-COVID-19 job market.

"The July figures indicate that employment had recovered by 343,000 people and hours worked had also recovered 5.5% since May," Mr Jarvis said.

"Employment remained over half a million people lower than seen in March, while hours worked remained 5.5% lower."

Need somewhere to store cash and earn interest? The table below features introductory savings accounts with some of the highest interest rates on the market.

Provider | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Savings Accelerator

| |||||||||||||

Disclosure | |||||||||||||

Savings Accelerator

Disclosure

| |||||||||||||

| 4 | 0 | 0 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

| FEATURED | High Interest Savings Account (<$250k)

| ||||||||||||

Disclosure | |||||||||||||

High Interest Savings Account (<$250k)

Disclosure

| |||||||||||||

| 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

| FEATURED | Save Account

| ||||||||||||

Disclosure | |||||||||||||

Save Account

Disclosure

| |||||||||||||

| 0 | 1000 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

| FEATURED | Savings Maximiser

| ||||||||||||

Disclosure | |||||||||||||

Savings Maximiser

Disclosure

| |||||||||||||

| 4 | 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Hi Saver | |||||||||||||

| 4 | 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Bonus Saver | |||||||||||||

| 4 | 0 | 0 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Online Saver | |||||||||||||

| 0 | 0 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Up Saver Account | |||||||||||||

| 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||||

Qsaver | |||||||||||||

| 0 | 100 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Bonus Saver Account | |||||||||||||

| 0 | 100 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Bonus Saver | |||||||||||||

| 3 | 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Maxi Saver | |||||||||||||

| 0 | 100 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Bonus Saver Account | |||||||||||||

| 4 | 0 | 0 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Netsave Account | |||||||||||||

| 0 | 200 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Growth Saver | |||||||||||||

| 4 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Simple Saver | |||||||||||||

| 0 | 1000 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||||

Virgin Money Boost Saver | |||||||||||||

| 0 | 2000 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

HomeME Savings Account (<$100k) | |||||||||||||

| 0 | 200 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Online Savings - Premium Saver | |||||||||||||

| 0 | 10 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

mySaver | |||||||||||||

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

The increase to employment was largely driven by part-time employment, which added 71,200 jobs, while full-time employment saw 43,500 jobs added.

Hours worked for females was up 2.3%, compared to just 0.6% for males, with hours down for each down 4.9% and 5.9% respectively since the start of the pandemic.

Mr Jarvis said the figures didn't yet show the damage to the job market done by stage 4 restrictions in Victoria.

"The July data provides insight into the Australian labour market during Stage 3 restrictions in Victoria," he said.

"The August Labour Force data will provide the first indication of the impact of Stage 4 restrictions."

New South Wales saw the largest increase in employment in July, adding almost 60,000 jobs, followed by Victoria and Western Australia.

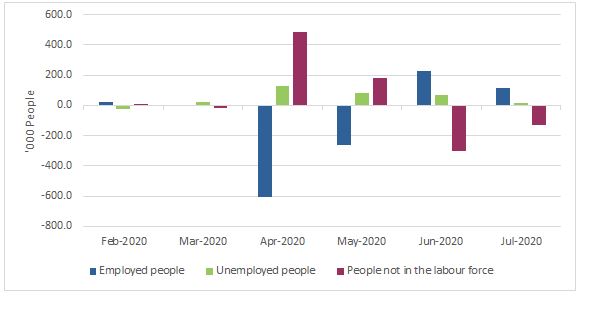

Monthly changes in labour force populations

Source: ABS

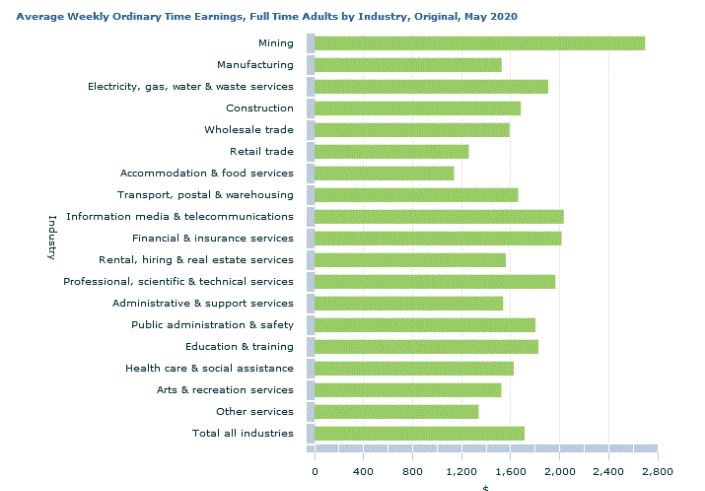

Average earnings rise as low paid jobs lost

The ABS found the average ordinary time earnings for full-time adults in May was $1,714, seasonally adjusted, up 3.3% from November of last year.

Mr Jarvis said lower-paid jobs and industries were particularly impacted by COVID-19 restrictions, accounting for a high share of jobs lost.

“This fall in lower-paid jobs led to an increase in average earnings for all employees because the remaining jobs had a higher earnings profile," he said.

“In recent years, the six-monthly increase in average earnings for all employees has been around 1%.

"The 3.8% increase to mid-May highlights the extent of the major compositional change in jobs and earnings during this difficult period.”

Employees in the mining industry had the highest full-time weekly earnings at $2,697.50, while those in the accommodation and food services industry had the lowest at $1,139.30.

Source: ABS

More to come..

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly

Rachel Horan

Rachel Horan