Savers storing their money away in safer options such as these are now facing interest rates barely above the rate of inflation at below 2%.

Such interest rates would be welcomed by home buyers and investors, and these recent rate cuts have led to some home loan interest rates in the sub-3% region.

But these kinds of rates are not good for savers, who now have to look harder than ever for a good interest rate to earn a decent return on their cash.

After June’s cash rate cut – the first in nearly three years – a host of savings accounts that had previously offered rates of around 3% slashed rates by the full 25 basis points, sometimes by even more.

UBank, for example, cut the base interest rate on its USaver accounts by 27 basis points, but cut home loan rates by 25.

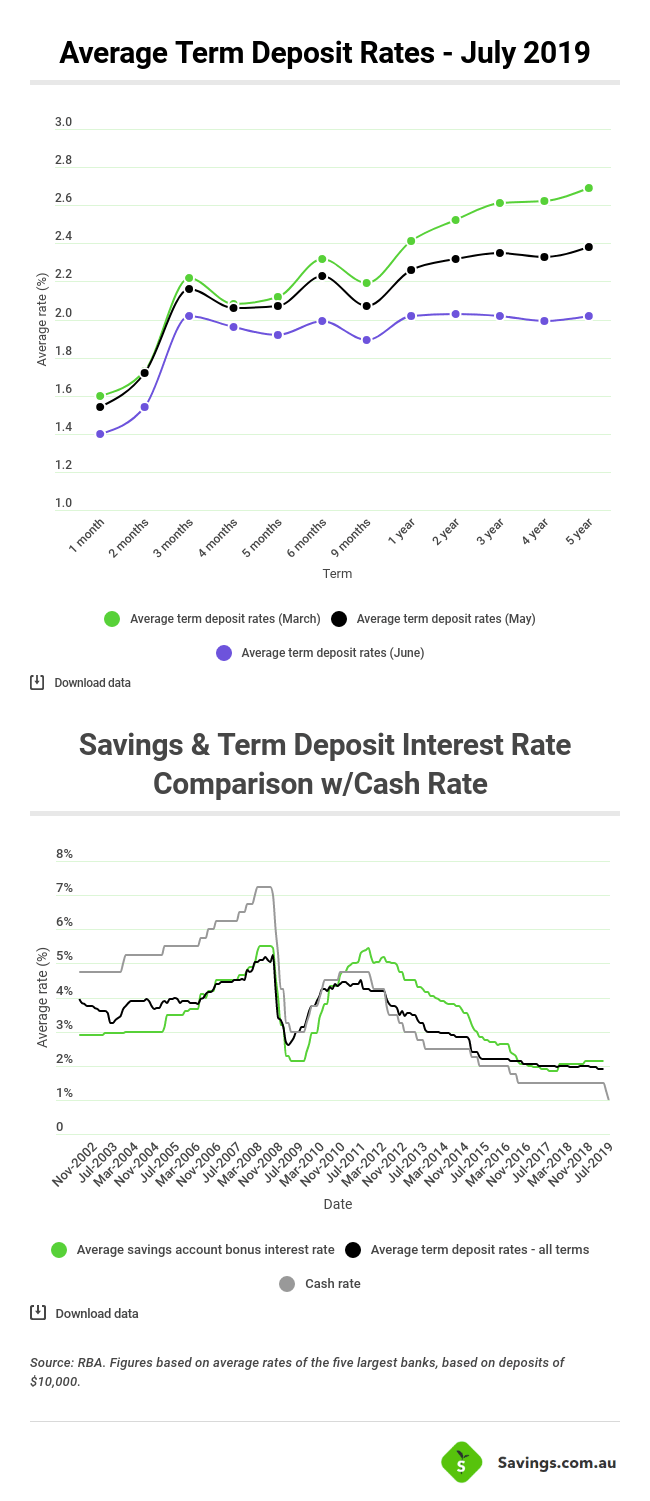

Term deposits have been hit by even bigger rate reductions, with the average term deposit rate across the majority of products in the market slipping to around 1.90% p.a..

This average was more than 2.30% p.a. just a few months ago.

Compared to their home loan rate cuts – often announced through emails to customers, media releases, and social media posts – many banks have been discreet about cutting savings account and term deposit rates.

Some even resorted to only publicising their cuts in the notices section of a print newspaper.

However, two of the big four banks – Commonwealth Bank and NAB – publicly announced they won’t be passing on the full 25 basis point rate cut to deposits and savings accounts in July.

“We have carefully considered how to respond to this latest official interest rate cut, given that it is not possible to pass on the full rate reduction to over $160 billion of our deposits, including deposits where interest rates are at or already near zero,” Angus Sullivan, Group Executive Retail Banking Services at Commbank said.

“We have made a deliberate choice to limit the interest rate reduction to 0.15% p.a. on our most popular savings account, NetBank Saver. We have also introduced a 5-month term deposit special of 2.20% p.a. together with an additional 0.10% p.a. bonus on this rate for existing CBA pensioner customers.”

NAB Chief Customer Office for Consumer Banking Mike Baird said NAB had considered customers who rely on deposits, such as farmers, retirees and those wanting to build their savings.

“For any changes to interest rates on savings accounts following today’s RBA cash rate announcement, NAB will not decrease rates by more than 19 basis points,” Mr Baird said.

“Decisions like these are difficult and reflect the current unique circumstances, with home loan rates at record lows at the same time as deposit and savings rates also being at record lows.”

Following the June and July rate cuts, these are some of the highest savings account rates available on the market at the moment.

One-year depositors meanwhile can find rates as high as 2.50%.

“Stop screwing our senior citizens”

The people most affected by the rate cuts to deposits and savings accounts are usually retirees and pensioners, as this demographic tends to be more risk-averse with their investments and reliant on interest for income.

Since 2015, the cash rate has been reduced from 2.50% to 1%, yet there has been no change to the Government’s deeming rate over this time.

The deeming rate is an assessment rate used by the Government to calculate a person’s aged pension. Instead of assessing their actual income, the government assumes the retiree is earning a set rate of return (the deeming rate) on financial assets including bank accounts, term deposits, shares and managed funds.

The current deeming rates and thresholds are as follows:

| 1.75% | 3.25% | |

|---|---|---|

| Single | Assets up to $51,800 | Assets above $51,800 |

| Couple | Assets up to $86,200 | Assets above $86,200 |

When a single person is deemed to be earning more than $52,686 per year, they are ineligible for the pension.

In fact, for each fortnightly dollar of income “earned” above $174 per fortnight ($4,524 per year – the maximum you can earn to get the full pension), the pension reduces by 50 cents per fortnight.

According to Paul Rickard, Director of Switzer Financial Group, the lack of a change in the deeming rate is hurting the real incomes of thousands, if not hundreds of thousands of aged pensioners.

“Because the deeming rate hasn’t kept pace with actual investment returns – that is, lowered in line with reductions in the cash rate – thousands of aged pensioners have suffered a decline in real incomes,” Mr Rickard wrote for Switzer Daily.

“Some may be wondering why the Government hasn’t changed the deeming rate and here’s why…. from a Treasury perspective, changing the deeming rate costs money. Lots of money.

“Hundreds of thousands of aged pensioners would become eligible for higher pensions, and thousands of others, who are currently ineligible, would become eligible for a part pension.”

Mr Rickard urged the Government to “stop screwing our senior citizens”.

“Age pension eligibility, and deeming in particular, are complex, and with a generous superannuation scheme and comfortable remuneration arrangements, something that most politicians are unlikely to personally experience,” he said.

He also called for an immediate 0.5% point cut to the deeming rate and for the Government to tie the level of future deeming rates to the cash rate.

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy

Brooke Cooper

Brooke Cooper