Nearly 90% of Australians have unwanted or unused items sitting in their home that could be earning them up to $5,800.

At a time when COVID-19 has left thousands of Australians out of work or with reduced incomes, more people are turning to the second-hand economy to make a quick buck.

See also: 8 ways to make extra cash online during COVID-19

According to the report, over half of the 1,000 Australians surveyed (56%) expect the COVID-19 pandemic will cause the second-hand economy to grow, with the rising unemployment rate fuelling people to be savvier with their money.

In fact, 42% of Australians said they are more likely to sell unwanted items due to COVID, with millennials - one of the hardest hit demographics of the pandemic - the most likely to do so (52%).

Key findings from Gumtree's report include:

- 85% of Aussies reported having pre-loved or unused items in their home;

- 42% are now more likely to sell items on the online marketplaces due to COVID-19;

- Aussies have approximately 19 unused items ready to sell; and

- Millennials ($8,940) have generated more from the sale of their items than Gen X ($4,602) and Baby Boomers ($1,965).

Almost a quarter (23%) of Australians said selling items they no longer needed helped them feel more in control of their finances, with 41% utilising the extra cash to pay for household expenses.

Head of Marketing for Gumtree Australia Amanda Behre said it's hard to argue with making extra cash during these hard economic times.

“It’s our mission to empower people and create economic opportunity and with potentially thousands of dollars worth of unwanted items sitting around homes across Australia, we believe the second hand economy is the perfect way to relieve financial pressure during this time," Ms Behre said.

“We’re encouraging Aussies to find the $5,800 worth of pre-loved items lying around the house as a way to supplement income or help pay for necessary expenses.”

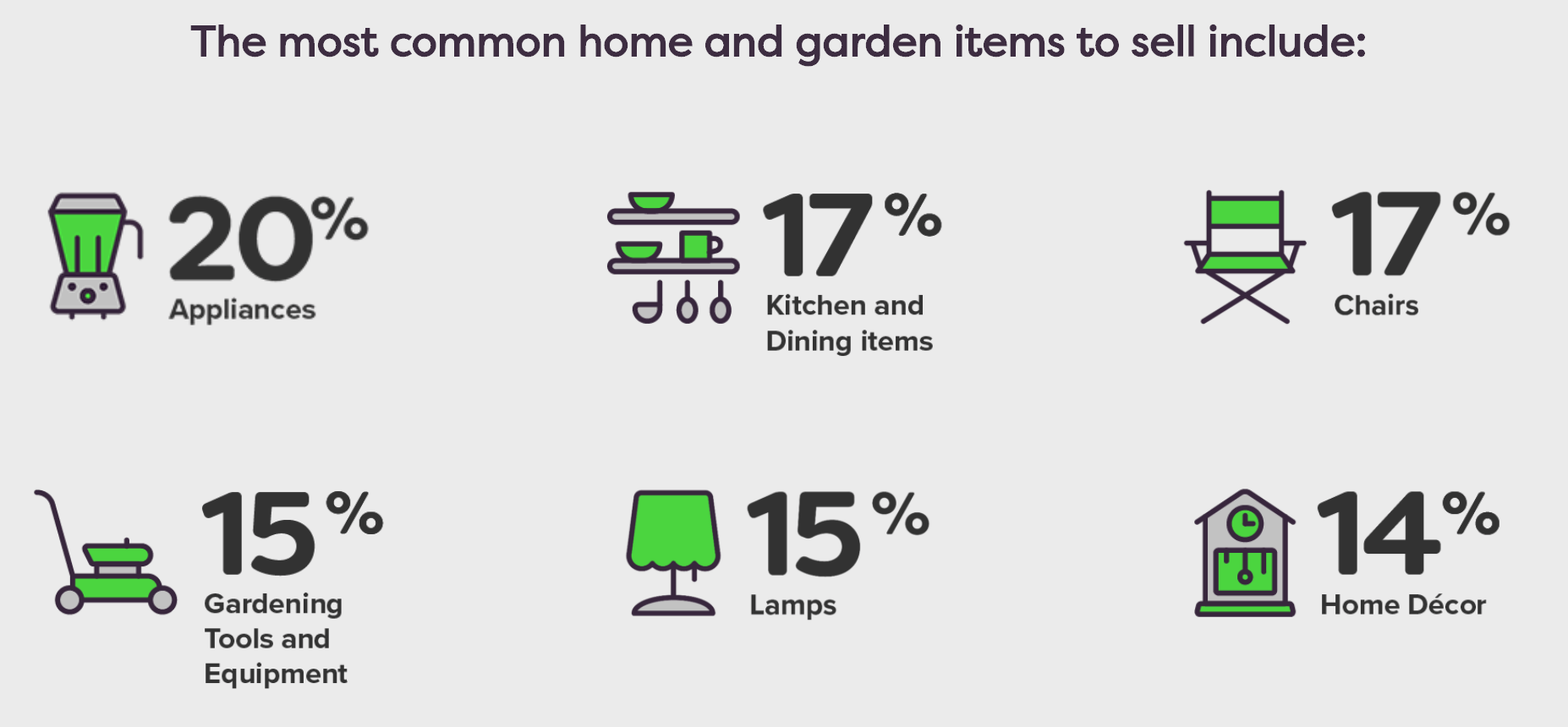

What are the most popular items to sell?

The items that sold the quickest and made the most money according to Gumtree include home decor and furniture.

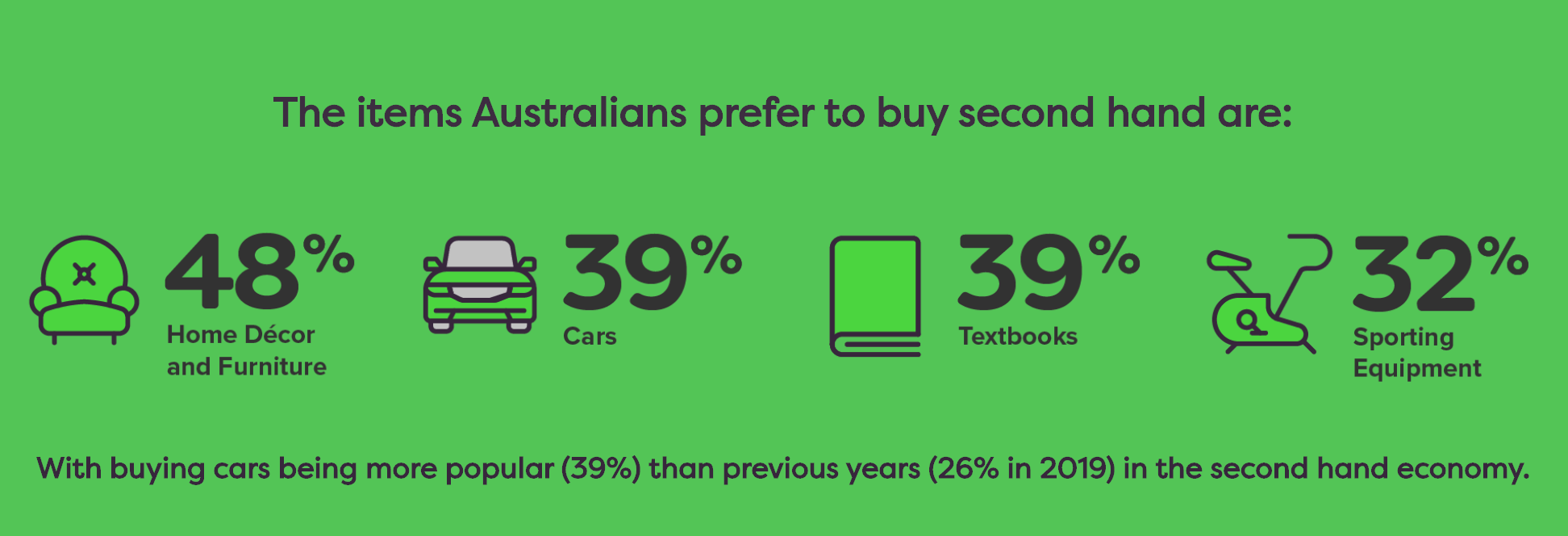

With people spending more time at home, it's probably not that surprising that people are turning to pre-loved items to furnish their homes.

Source: Gumtree

The report also found the most common items Australians would consider buying secondhand include home decor/furniture (48%), textbooks (39%), cars (39%) and sporting equipment (32%).

So if you have an overpriced lamp or an old textbook from university gathering dust at the back of your cupboard, it might be time to dust it off and make yourself some sweet, sweet cash.

Source: Gumtree

Tips for buying and selling online

Personal finance guru, Glen James from My Millennial Money, has the following tips for effectively buying and selling your unwanted items online.

1. BEFORE PAY: I’m all about before pay. So if you are looking to buy something or saving for a big ticket item, set yourself a financial goal, so you’re not going into debt with every little purchase. An easy way to set a ‘before pay’ goal is to create a list of items you can sell to meet the value of the new item you’re looking to buy.

2. PACKAGE DEALS: To sell big, think like a retailer. If you’re selling a gaming console, throw in some games, and accessories to seal the deal. It also helps if you’re trying to declutter your home of unused items and make room for some new things.

3. NEGOTIATE ON YOUR TERMS: It’s important to remember that you are selling the item and ultimately have the power at the end of the day to decide on the final price. Don’t offer the lowest price first- control the speed of the negotiation. A good way to do that is to explain why it is the value you have listed before going down. If you aren’t happy with the price someone is offering, it is okay to say no. You can always pause or edit your listing to make the description more detailed and wait for another offer.

4. MARKET RESEARCH: Whether you’re selling or buying, make sure you dedicate time to research what’s out there to help you understand the average price of similar items. There are a few rules to it: search by brand, search by style and search by similar age - both new and used.

5. MONEY DOES GROW ON TREES: Forget what your parents told you, money does grow on trees - think about some of the highly sought after items people are in the market for, such as plants. If you have some plants at home, you could divide and propagate to sell them separately. These are big sellers on Gumtree, so think like a business expert - low cost, high margin and money will grow on trees.

6. PROVIDE SHIPPING OPTION: Consider utilising contactless delivery via Sendle to expand your offering. This might also help to get a buyer across the line with a sale.

7. INTERACT WITH YOUR BUYERS: If you want to increase your chances of selling an item, make sure you respond promptly to messages from potential buyers and offer some personality. Make sure you turn your notifications on through the Gumtree app to avoid missing any messages.

8. UPCYCLE AND THEN RECYCLE: Pre-loved furniture, cabinetry, fittings and fixtures can get you some extra coin. Often a wooden table or chairs just needs a good wash and a polish with any wood oil or polish you have around the house.

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Aaron Bell

Aaron Bell

Rachel Horan

Rachel Horan