With the hope that your dream becomes a reality one day in the future, you may be curious as to how buying a property overseas works and whether it’s as complicated as it seems.

While buying a property overseas is certainly not the same as buying one locally, it can be possible (to an extent) to own your own slice of heaven on the other side of the world. As long as you’re aware of the country’s property laws that you’re buying in.

The 6 things you need to consider when buying overseas

Buying property overseas can be a high risk, difficult thing to do.

Not only can there be language barriers to navigate, but laws regarding foreign investment can vary in every country, making the process much more of a hassle than usual.

Before you go out and decide to buy a property on the other side of the world, there are many details to research and consider. So, to make life just that little bit easier for you, we spoke to Ray White chief economist Nerida Conisbee to find out the six things Australians need to understand before purchasing offshore.

1. Location

“The first thing people need to consider is if you can actually buy in the country you’re looking at,” Ms Conisbee told Savings.com.au.

“There can be very complicated restrictions depending on where you look. For example, some countries ban people from buying such as Canada and Iceland, while the likes of the UK and US have very relaxed rules on foreign purchases.”

Ms Conisbee recommends conducting online research to get an idea of where it’s possible to buy.

2. Finance options

Accessing finance is key in any property purchase.

“Australian banks are hesitant to lend to people who are wanting to buy property overseas as there are higher risk elements,” she said.

“As a result, you may need to look at getting finance from the country you’re buying in. The challenge with that is someone looking to get finance in a foreign country is often charged a higher interest rate, or can also be restricted in terms of the amount they’re able to borrow.”

Because foreign mortgage requirements differ from country to country, it’s best to receive professional advice from mortgage brokers, real estate agents, and/or lawyers to uncover your finance options.

3. Taxation

Before you buy an overseas property, you need to consider the tax implications. As an overseas investor, you will need to declare all your income, including rental income and/or capital gains from the property to the ATO.

You may also be required to pay tax on your rental income in the country where you own the property.

“Taxes on foreign buyers can be quite significant and can make the purchase far less worthwhile than it otherwise would be,” she said.

Consult a professional tax advisor to determine your situation, or head to the ATO website to find out more.

4. Stability

Understanding how stable the country is economically and politically is another big thing to consider before purchasing an overseas property. You don’t want to get yourself into a situation where you’ve bought a property but can’t sell it, or, you sell the property but have trouble getting the money out of the bank.

5. Get a feel for the place

Before making any final decisions, Ms Conisbee recommends visiting the property to get a feel for the place.

“Buying property overseas unseen can be a risky strategy,” she said.

“You may be buying somewhere that isn’t desirable, or may be subject to major infrastructure in the near future. You need to make sure that where you’re planning to buy is exactly what you’re after.”

6. Rental options

If you’re investing, you need to find out whether there are any restrictions for renting the property out.

“A lot of countries do have rental caps on foreign investment properties. For example, although the property could potentially get $500 a week in rent, you may be restricted to only charging $200 a week due to the rental caps,” she said.

“Another thing you may need to do is find someone to manage the property. You want to conduct a lot of research for this because you’ll be placing a high element of trust into this person.”

See Also: Moving overseas finance checklist

How to finance an overseas property

If you’re looking at purchasing a property overseas, you may be wondering how to finance your venture.

Below are the three ways you can finance an overseas property. But be mindful that some countries may not offer all the choices to foreigners e.g. bank financing.

-

Apply for a mortgage from an overseas lender: Although possible in some countries, obtaining a loan from a local lender in the country you’re buying can be difficult. If you do manage to get one, the interest rates could be higher than if you were a local and your payments are likely to be in a foreign currency.

-

Apply for a mortgage from an Australian bank: Some banks and building societies may offer international banking services e.g. HSBC. Check with your bank to see if they support the country you’re looking to buy in.

-

Pay in cash and buy the property outright: With cash in hand, you won’t have to deal with the challenges of borrowing money. If you have the available funds, you can own the home outright, save on interest, and also speed up the entire buying process.

Which countries are the easiest to buy a property in?

Now that you’re equipped with all the relevant information that comes with purchasing a property overseas, the fun part can begin - finding the right country for you.

To help you, we’ve compiled a list of countries that have relatively easy processes for Australians buying a property across the pond.

But before you go through the list, it’s important to note that buying, with the intention of obtaining a loan, can be difficult and complicated even in these countries. The reason these countries are easier to buy in compared to others is because of their relaxed laws, limited restrictions on foreign investment and fewer language barriers.

New Zealand

Australia’s next door neighbour New Zealand can be a great place for people to buy an investment property or holiday home.

Besides the fact that their mortgage system is fairly similar to that of Australia’s, New Zealand’s taxation laws include no capital gains tax, no land tax, and no stamp duty. Score!

Aussies are also exempt from the Overseas Investment Amendment Act due to the existing free trade agreements.

If you’re buying in NZ, check if your Australian bank or lender has a presence in the country. This will help down the line when you apply for a mortgage as most lenders in NZ require borrowers to have some local credit history.

Plus, you can’t forget that New Zealand is a short flight away if you ever need to wind down and relax in your holiday home or visit the investment property for any reasons.

UK

The first thing to point out is there are no legal restrictions on foreigners buying property in the UK, even if you aren’t a resident. You don’t even need a visa (cue the hoorahs!).

While buying a property in the UK is easier than other European countries, there are still some things to be mindful of.

Obtaining a mortgage in the UK for a non-resident can be very difficult, however there are some lenders that are willing to offer mortgage options to foreigners at a price i.e. put down a larger deposit, pay higher interest rates. In that case, it is often better to purchase a property outright.

For Scott Aggett, an Australian property investor, buying a property in the UK through a local bank was pretty simple.

“I left Australia when I was 21 and went to the UK, spending five years over there working in real estate,” Mr Aggett told Savings.com.au.

“While I was there, I bought two properties in London which were funded with a local bank. As I was on a working holiday visa, this enabled me to open a bank account and eventually qualify for a loan.

“Buying in the UK with a mortgage was pretty straightforward and was a very similar process to Australia in terms of the consumer's perspective, the financial checks, the approval process, and the timeframes.

“However, the exchange and settlement processes were very different to Australia which was a big learning curve.”

As always, it’s recommended to use a mortgage broker or specialist lender to help you secure a mortgage in the UK.

The tax implications for non-residents include stamp duty land tax, income tax, and capital gains tax.

US

Thinking about pursuing the American dream, literally?

Buying a property in the US as a foreigner can be relatively easy, as long as you’re aware of the processes involved and the tax implications.

Foreigners are free to buy properties and own land in the US. Australian citizens will need to apply for an Individual Taxpayer Identification Number (ITIN), which is a tax processing number assigned to foreigners, to proceed with their purchase. They will also be required to complete and file a tax return annually in Australia and the US. Typically, US property held by a foreign investor will be subject to additional requirements as stipulated by the Foreign Investment in Real Property Tax Act.

In terms of finance, US banks impose stricter lending criteria for foreigners. For example, most banks require a large deposit, usually about a third of the home price. US banks will also examine your credit score, so if possible, open a US bank and credit card account and start paying off balances.

Again, Australian banks generally do not provide funds for offshore purchases as they’re seen as high risk.

Although you can receive a loan from some US banks, the process can be much easier for a cash-only buyer.

France

Australians are able to buy French property with limited restrictions, and that includes getting a mortgage.

Because foreign property purchases are quite popular in France, there are a few banks who will provide non-EU nationals with a loan, although there maybe some limitations. For example, the product ranges may be more restricted such as the maximum loan-to-value ratio e.g. some lenders may allow you to borrow between 70-80% of a property’s value, while others will limit their loans to up to 50%.

Many lenders in France employ English-speaking representatives to make the process easier.

You will be required to use a notaire to buy or sell your property and will also be entitled to pay notary fees along with estate agent fees and mortgage fees.

As always, it’s best to hire an English-speaking advisor (who specialises in foreign purchases) to guide you through the entire journey.

Japan

If you’re a cash buyer, Japan can be relatively easy to buy in, as long as you follow a couple of simple rules.

Along with his properties in the UK (which he has now sold), Mr Aggett has three investment properties currently in Japan.

“At the end of 2015, I bought a five storey ski lodge with two friends from Sydney all in cash as Australian citizens,” Mr Aggett said.

“Although I did physically fly over to inspect the properties myself, I did have the help of a local Japanese estate agent who handled the transactions, and also had local trades people on the ground conduct building and pest reports before transacting the purchases.

“As we didn’t require the help of a bank, all we needed to do was set up international transfers to get the money across to the estate agent's trust account and the conveyancer which was a relatively easy process.”

However, if you’re looking to take out a loan to buy a property in Japan, it can be impossible to make the dream a reality.

“It’s almost impossible to buy a property through a local bank, unless you’re seen to be in the community. It’s all very relationship-driven based on trust, longevity, and respect,” Mr Aggett explained.

“Although I have bank accounts and a business set up in Japan, I have yet to be approved for a mortgage. Because the difficulty to get a loan is high, most international buyers opt to purchase investment properties in cash.”

For Scott, although buying in Japan was a completely different process to Australia, it was beneficial in the long run.

“While there is definitely an element of risk, the opportunity to invest was huge,” he said.

“If you can fund your purchase in cash, you can build rental portfolios with 15-20% returns which is a big deal.”

So to sum up, foreigners have almost the same rights as Japanese citizens when it comes to purchasing property or land in Japan. However, obtaining a loan is almost out of the question.

Which countries are difficult to buy a property in?

On the other side of the coin, there are some countries out there where buying a property can be just that little bit harder. If you have considered purchasing a property in one of the countries below, make sure to conduct some extra research and receive some professional guidance to determine whether it’s the right path to go down.

“In some countries, there’s not always a lot of transparency in the sales process. It’s important to make sure you do your own due-diligence in terms of what restrictions there are on buying property as you don’t want to get caught out down the line,” Ms Conisbee said.

Canada

If your dream was to buy a property in the picturesque slopes of Canada, this dream will have to be popped on the backburner.

As of January 2023, Canada will ban foreigners from buying homes for two years.

According to Canadian Finance Minister Chrystia Freeland, the ban on foreign ownership of homes is needed to curb house prices in Canada and prevent them from rising further.

Thailand

To put it simply, foreigners are not permitted to purchase land in Thailand. Thai laws prohibit foreigners from owning land in their own name.

Another major reason buying a property in Thailand is difficult is that local banks do not provide loans to foreigners.

However, this is not to say that you can’t own a property in the country. As a non-citizen, you are able to buy apartments and condominiums. As such, the condo can be fully and legally titled in your name. Under Thai law, up to 49% of the unit area of any condominium may be owned by foreigners.

Another option for foreigners wanting to buy land or a house in Thailand is to set up their own private limited company. For this, the company must be a legitimate business and must have Thai and foreign ownership. A foreigner may not own more than 49% of the shares.

The last option is to enter into a long term leasehold with the landowner. In this case, the foreigner is effectively renting a property (30 years) from the actual owner and is given exclusive possession of the property for the duration of the lease.

If you’re planning on purchasing a property in Thailand, you need to have the cash to do so, and must also hire a reputable and independent real estate lawyer. The realty industry in the country is unregulated, so a lawyer will be needed to help you navigate paperwork, legal requirements, and due diligence checks.

Bali

Although it’s not impossible to buy in Bali, it can be a difficult process.

The Indonesian constitution prohibits foreigners from owning land, similarly to Thailand. Only Indonesian citizens can require Hak Milik (right of ownership) for a building and the land it stands on.

Meanwhile, foreigners are able to obtain a Hak Pakai (right of use) certificate to buy property in Bali. Think of it like a very long leasehold.

While foreigners can buy condominiums, buying a freehold property can be risky. In this instance, you would have to use a nominee (local representative) to own the property for you. Although this method is used widely, it can be fraught with danger because if the relationship turns sour between the nominee and foreigner, many problems can arise e.g. you could lose your property.

It’s also important to note that you’re unlikely to get a mortgage in Indonesia as a foreigner.

When buying in Bali as a foreigner, make sure to get professional advice and also find a local you can trust.

Savings.com.au’s two cents

Unless you’re a cash buyer, purchasing a property overseas can be tough to say the least. Though not impossible - research will be your friend.

One thing we know is clear. No one country is the same - they each have various laws and regulations that must be followed for foreign investment.

So, if you’re still eager to take the plunge, you’ll need to take some time in front of the computer conducting research and also speaking to professionals who specialise in overseas property purchases.

“The biggest tip I can give to Australians wanting to buy overseas is to understand the fundamentals of the market,” Mr Aggett said.

“Find out what the supply and demand is like and what prices are actually achieving. If you really understand that and also physically inspect the properties yourself then you’re going to lower the risk of the whole project.”

Advertisement

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

| Bank | Savings Account | Base Interest Rate | Max Interest Rate | Total Interest Earned | Introductory Term | Minimum Amount | Maximum Amount | Linked Account Required | Minimum Monthly Deposit | Minimum Opening Deposit | Account Keeping Fee | ATM Access | Joint Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

3.70% p.a. | 5.15% p.a. Intro rate for 4 months then 3.70% p.a. | $844 | 4 months | $0 | $249,999 | $0 | $1 | $0 |

| Promoted | Disclosure | ||||||||

4.50% p.a. | 4.85% p.a. Intro rate for 4 months then 4.50% p.a. | $933 | 4 months | $0 | $99,999,999 | $0 | $0 | $0 |

| Promoted | Disclosure | ||||||||

4.20% p.a. | 4.95% p.a. Intro rate for 4 months then 4.20% p.a. | $899 | 4 months | $250,000 | $99,999,999 | $0 | $0 | – |

| Disclosure | |||||||||

3.05% p.a. | 4.85% p.a. Intro rate for 4 months then 3.05% p.a. | $736 | 4 months | $0 | $99,999,999 | $0 | $0 | – |

| ||||||||||

0.00% p.a. Bonus rate of 4.85% Rate varies on savings amount. | 4.85% p.a. | $992 | – | $0 | $99,999 | $0 | $0 | $0 |

| Promoted | Disclosure |

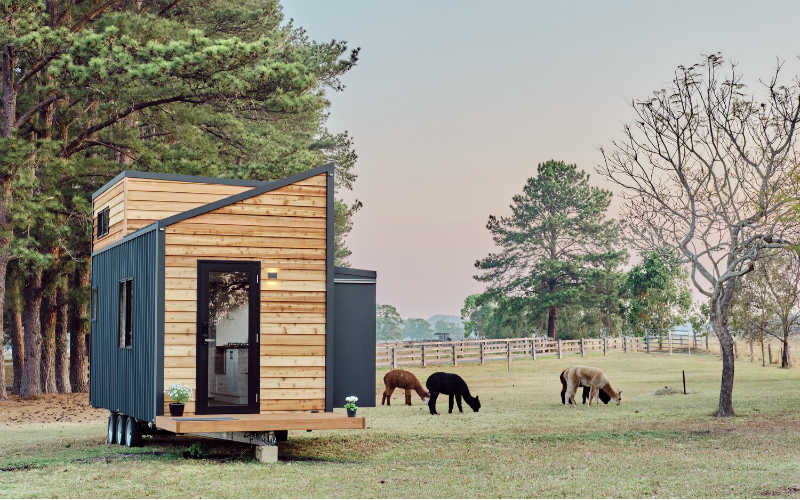

Image by Dennis P via Pixabay

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harrison Astbury

Harrison Astbury

Hanan Dervisevic

Hanan Dervisevic